501

Pablo Picasso

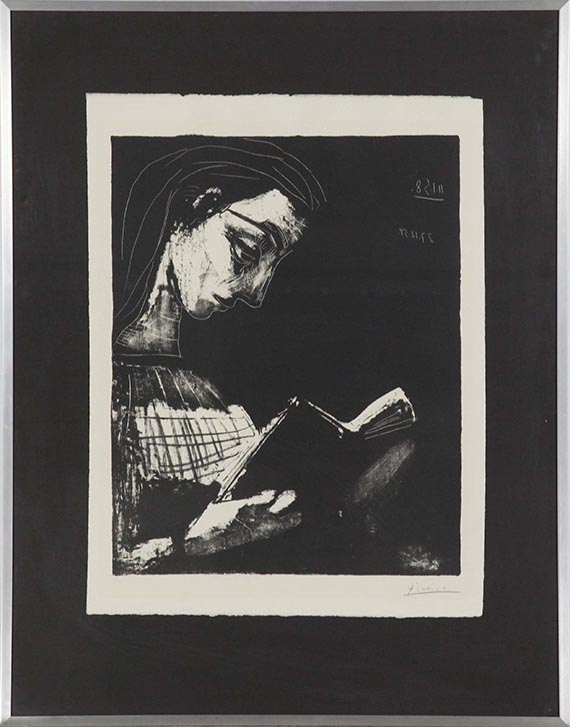

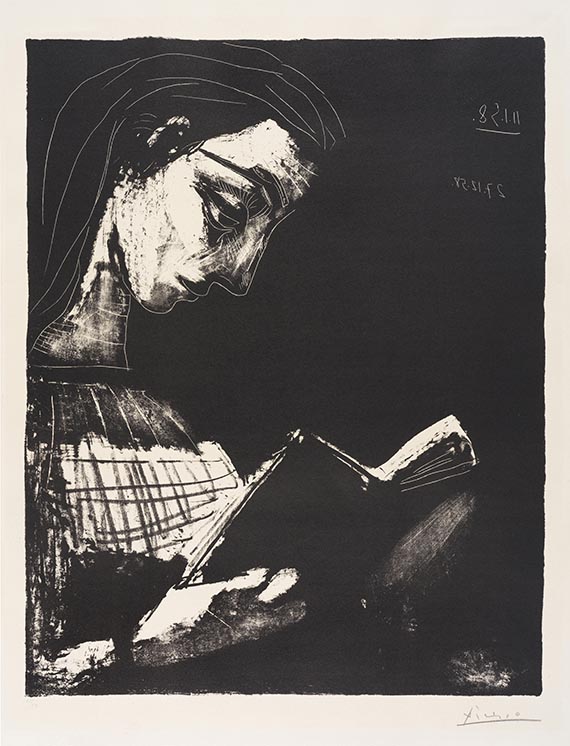

Jacqueline lisant, 1954/1958.

Lithograph

Estimate:

€ 15,000 - 20,000

$ 16,050 - 21,400

Jacqueline lisant. 1954/1958.

Lithograph.

Signed and numbered. Twice dated "11.1.58" and "27.12.58" in printing substrate. From an edition of 50 copies. On wove paper. 55.5 x 44 cm (21.8 x 17.3 in). Sheet. 65,7 x 50 cm (25,8 x 19,6 in).

Further works from the Dr. Maier-Mohr Collection will be offered in our Evening Sale and Contemporary Art Day Sale on Friday, June 7, 2024 – see collection catalog "A Private Collection - Dr. Theo Maier-Mohr".

• Portrait of Picasso's last muse and partner, Jacqueline Roque.

• Picasso's prints represent a significant part of his oeuvre in terms of their extent, technical variety and expressiveness.

PROVENANCE: Galerie Iris Eckert, Kampen a. Sylt

Collection of Dr. Theo Maier-Mohr (acquired from the above in 1978, ever since family-owned).

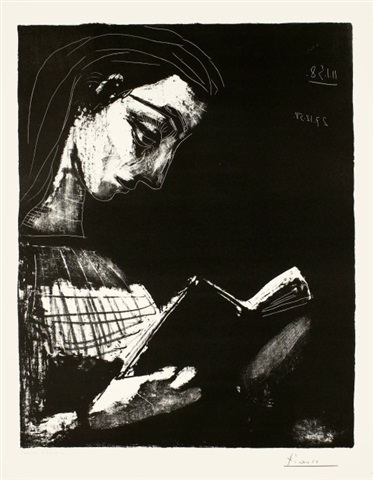

LITERATURE: Georges Bloch, Pablo Picasso. Catalogue de l’œuvre gravé et lithograpié 1904-1967, Bern 1984, no. 852 (illu.).

- -

Fernand Mourlot, Picasso. Lithograph, no. 310/3 (of 3), Paris 1970.

Called up: June 8, 2024 - ca. 19.16 h +/- 20 min.

Lithograph.

Signed and numbered. Twice dated "11.1.58" and "27.12.58" in printing substrate. From an edition of 50 copies. On wove paper. 55.5 x 44 cm (21.8 x 17.3 in). Sheet. 65,7 x 50 cm (25,8 x 19,6 in).

Further works from the Dr. Maier-Mohr Collection will be offered in our Evening Sale and Contemporary Art Day Sale on Friday, June 7, 2024 – see collection catalog "A Private Collection - Dr. Theo Maier-Mohr".

• Portrait of Picasso's last muse and partner, Jacqueline Roque.

• Picasso's prints represent a significant part of his oeuvre in terms of their extent, technical variety and expressiveness.

PROVENANCE: Galerie Iris Eckert, Kampen a. Sylt

Collection of Dr. Theo Maier-Mohr (acquired from the above in 1978, ever since family-owned).

LITERATURE: Georges Bloch, Pablo Picasso. Catalogue de l’œuvre gravé et lithograpié 1904-1967, Bern 1984, no. 852 (illu.).

- -

Fernand Mourlot, Picasso. Lithograph, no. 310/3 (of 3), Paris 1970.

Called up: June 8, 2024 - ca. 19.16 h +/- 20 min.

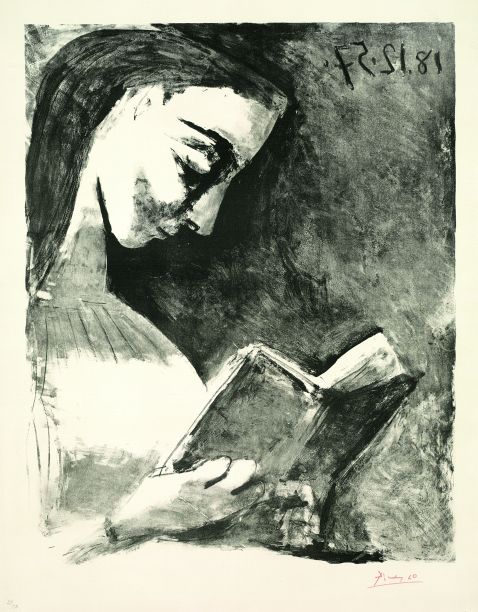

Picasso met Jacqueline, who he married in 1961, in Vallauris in the summer of 1953. The many variations of her portrait are an impressive testimony to his love for her. He began working on the lithograph stone for "Jacqueline lisant" on December 17, 1957, and reworked the stone on January 11, as the date at the top suggests, as no prints of this second state are known. Almost a year later, on December 27, 1958, he reworked the stone once again. By coloring the entire background in a deep black, except for a few shadings in the area of the book, there is a strong focus on the reader in this 3rd state. Pablo Picasso thus succeeds in showing how deeply immersed Jacqueline is in her read.

501

Pablo Picasso

Jacqueline lisant, 1954/1958.

Lithograph

Estimate:

€ 15,000 - 20,000

$ 16,050 - 21,400

Buyer's premium, taxation and resale right compensation for Pablo Picasso "Jacqueline lisant"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 501

Lot 501