254

Beatus von Liebana

Beatus von Liébana, 2011.

Estimate:

€ 1,000 / $ 1,180 Sold:

€ 1,500 / $ 1,770 (incl. surcharge)

Beatus von Liébana

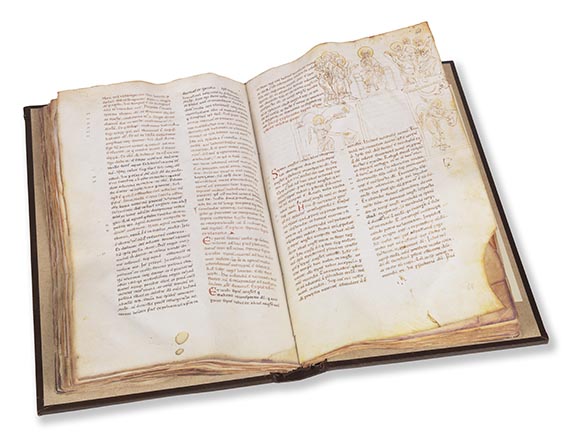

Berliner Codex. Faksimile der Handschrift Ms. Theol. lat. Fol. 561 der Berliner Staatsbibliothek. Madrid, Millennium liber 2011.

Faksimile eines der außergewöhnlichsten Beatus-Manuskripte des 12. Jahrhunderts, das nicht wie gewöhnlich aus Spanien, sondern aus Mittelitalien stammt. Zudem mit ungewöhnlichem Buchschmuck, der in jeder der wunderschönen Federzeichnungen Johannes als Autor der Apokalypse zeigt.

1 von 995 Exemplaren. Mit dem Kommentarband von Peter K. Klein in Spanisch und Englisch.

EINBAND: Blindgeprägter Orig.-Lederband über Holzdeckeln in Orig.-Lederkassette mit Leinen-Kanten und goldgeprägtem Deckeltitel. 31 : 20 cm. - ZUSTAND: Der Faksimileband tls. mit leichten Quetschfalten und etw. feuchtigkeitswellig.

Facsimile of one of the most extraordinary Beatus manuscripts of the 12th century, which does not come from Spain, as usual, but from central Italy. Also with unusual book decorations, which show Johannes as the author of the Apocalypse in each of the beautiful pen and ink drawings. Blind-stamped orig. calf over wooden boards in orig. calf case with linen edges and gilt title on front cover. 31 : 20 cm. - The facsimile vol. here and there with publisher‘s creases and slightly waved with moisture.

Berliner Codex. Faksimile der Handschrift Ms. Theol. lat. Fol. 561 der Berliner Staatsbibliothek. Madrid, Millennium liber 2011.

Faksimile eines der außergewöhnlichsten Beatus-Manuskripte des 12. Jahrhunderts, das nicht wie gewöhnlich aus Spanien, sondern aus Mittelitalien stammt. Zudem mit ungewöhnlichem Buchschmuck, der in jeder der wunderschönen Federzeichnungen Johannes als Autor der Apokalypse zeigt.

1 von 995 Exemplaren. Mit dem Kommentarband von Peter K. Klein in Spanisch und Englisch.

EINBAND: Blindgeprägter Orig.-Lederband über Holzdeckeln in Orig.-Lederkassette mit Leinen-Kanten und goldgeprägtem Deckeltitel. 31 : 20 cm. - ZUSTAND: Der Faksimileband tls. mit leichten Quetschfalten und etw. feuchtigkeitswellig.

Facsimile of one of the most extraordinary Beatus manuscripts of the 12th century, which does not come from Spain, as usual, but from central Italy. Also with unusual book decorations, which show Johannes as the author of the Apocalypse in each of the beautiful pen and ink drawings. Blind-stamped orig. calf over wooden boards in orig. calf case with linen edges and gilt title on front cover. 31 : 20 cm. - The facsimile vol. here and there with publisher‘s creases and slightly waved with moisture.

254

Beatus von Liebana

Beatus von Liébana, 2011.

Estimate:

€ 1,000 / $ 1,180 Sold:

€ 1,500 / $ 1,770 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 254

Lot 254