190

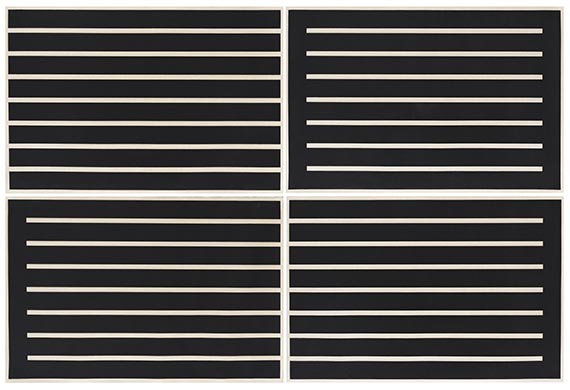

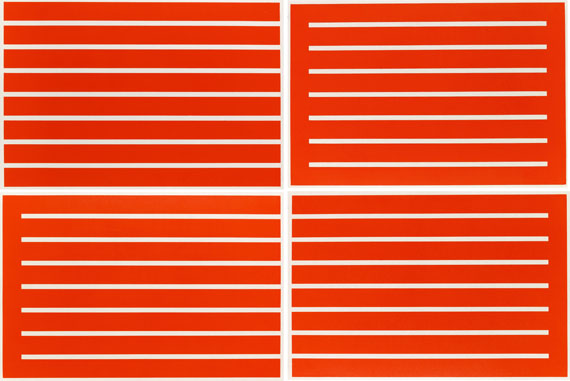

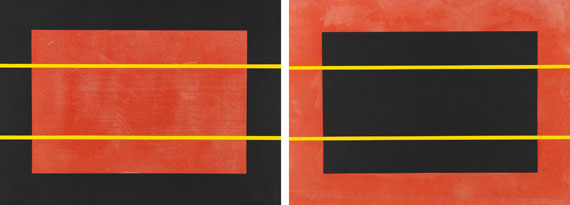

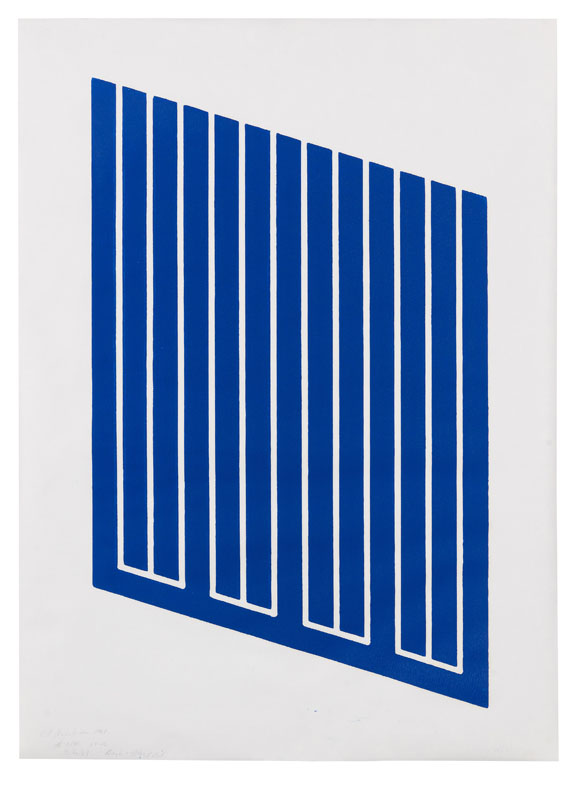

Donald Judd

Untitled, 1991/1994.

Set of 4 Woodcuts in Ivory Black

Estimate:

€ 30,000 - 40,000

$ 32,100 - 42,800

Untitled. 1991/1994.

Set of 4 Woodcuts in Ivory Black.

With the estate stamp and the number on the reverse. From an edition of 15 copies. On Japan paper (Mitsumata). 63 x 95.5 cm (24.8 x 37.5 in). Sheet: 67 x 99,5 cm (26,3 x 39,1 in).

Printed by J. Miller, M. Sanches at Derrière l'Etoile Studio, New York, and published by Brook Alexander Editions, New York. [EH].

• Woodcut series by the main representative of American Minimal Art.

• The nuanced structure of the print image shakes up the rigid composition.

• Donald Judd finds a concentrated form of expression without any representational associations.

• Alongside his three-dimensional works, Judd's woodcuts are regarded completely independent and fascinating expressions of his very own conception of form, symmetry and color.

PROVENANCE: Galerie Sabine Knust, Munich.

Private collection Rhineland-Palatinate (acquired from the above in 1996).

LITERATURE: Mariette Josephus Jitta, Jörg Schellmann, Donald Judd. Prints and works in editions. A catalogue raisonné, Munich/New York 1996 (arspublicata.com), no. 243-246.

Called up: June 7, 2024 - ca. 15.32 h +/- 20 min.

Set of 4 Woodcuts in Ivory Black.

With the estate stamp and the number on the reverse. From an edition of 15 copies. On Japan paper (Mitsumata). 63 x 95.5 cm (24.8 x 37.5 in). Sheet: 67 x 99,5 cm (26,3 x 39,1 in).

Printed by J. Miller, M. Sanches at Derrière l'Etoile Studio, New York, and published by Brook Alexander Editions, New York. [EH].

• Woodcut series by the main representative of American Minimal Art.

• The nuanced structure of the print image shakes up the rigid composition.

• Donald Judd finds a concentrated form of expression without any representational associations.

• Alongside his three-dimensional works, Judd's woodcuts are regarded completely independent and fascinating expressions of his very own conception of form, symmetry and color.

PROVENANCE: Galerie Sabine Knust, Munich.

Private collection Rhineland-Palatinate (acquired from the above in 1996).

LITERATURE: Mariette Josephus Jitta, Jörg Schellmann, Donald Judd. Prints and works in editions. A catalogue raisonné, Munich/New York 1996 (arspublicata.com), no. 243-246.

Called up: June 7, 2024 - ca. 15.32 h +/- 20 min.

190

Donald Judd

Untitled, 1991/1994.

Set of 4 Woodcuts in Ivory Black

Estimate:

€ 30,000 - 40,000

$ 32,100 - 42,800

Buyer's premium, taxation and resale right compensation for Donald Judd "Untitled"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 190

Lot 190