113

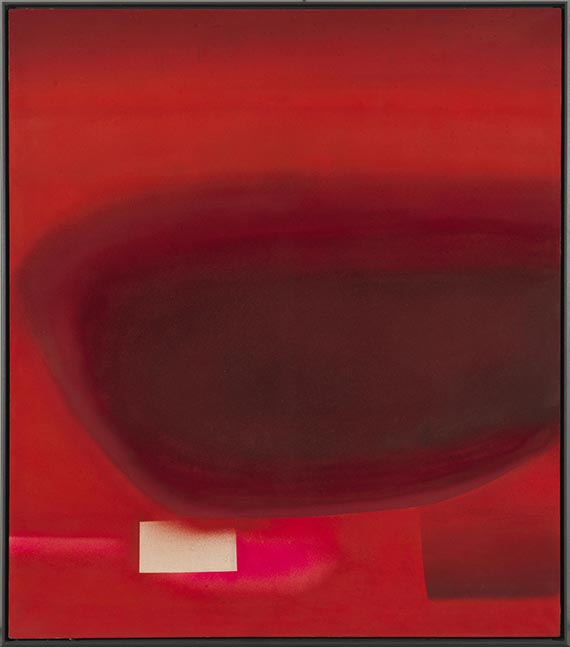

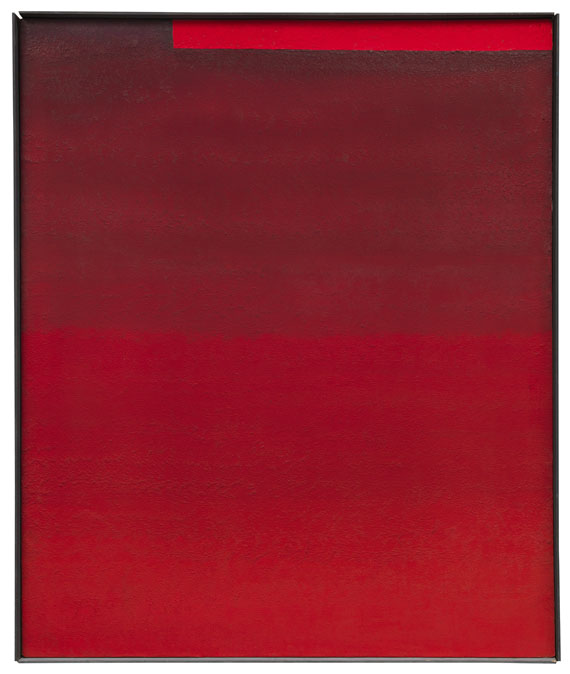

Rupprecht Geiger

OE 264, 1957.

Oil on canvas

Estimate:

€ 70,000 - 90,000

$ 74,900 - 96,300

OE 264. 1957.

Oil on canvas.

Signed on the reverse of the strether, signed, dated, titled and inscribed with the dimensions on the stretcher. 175 x 145 cm (68.8 x 57 in). [AW].

• Red is the most important color in Geiger's oeuvre.

• Powerful modulation in an early painting by Rupprecht Geiger that is captivating for its gentle oscillation between different color values.

• Paintings from the late 1950s and early 1960s are among the artist's most sought-after works on the international auction market (source: artprice.com).

PROVENANCE: Galerie Schurr, Stuttgart.

Private collection Southern Germany (acquired from the above).

EXHIBITION: Rupprecht Geiger. Retrospektive, Akademie der Künste, Berlin, February 10 - March 17, 1985; Wilhelm-Hack-Museum, Ludwigshafen a. Rh., April 14 - June 2, 1985; Städtische Kunsthalle Düsseldorf, June 21 - July 21, 1985, cat. no. 67.

LITERATURE: Rupprecht Geiger Gesellschaft, Städtische Galerie im Lenbachhaus, Munich (ed.), edited by Pia Dornacher and Julia Geiger, Rupprecht Geiger. Catalogue raisonné 1942-2002. Gemälde und Objekte, architekturbezogene Kunst, Munich 2003, no. 211 (illu. in color on p. 94).

Called up: June 7, 2024 - ca. 13.48 h +/- 20 min.

Oil on canvas.

Signed on the reverse of the strether, signed, dated, titled and inscribed with the dimensions on the stretcher. 175 x 145 cm (68.8 x 57 in). [AW].

• Red is the most important color in Geiger's oeuvre.

• Powerful modulation in an early painting by Rupprecht Geiger that is captivating for its gentle oscillation between different color values.

• Paintings from the late 1950s and early 1960s are among the artist's most sought-after works on the international auction market (source: artprice.com).

PROVENANCE: Galerie Schurr, Stuttgart.

Private collection Southern Germany (acquired from the above).

EXHIBITION: Rupprecht Geiger. Retrospektive, Akademie der Künste, Berlin, February 10 - March 17, 1985; Wilhelm-Hack-Museum, Ludwigshafen a. Rh., April 14 - June 2, 1985; Städtische Kunsthalle Düsseldorf, June 21 - July 21, 1985, cat. no. 67.

LITERATURE: Rupprecht Geiger Gesellschaft, Städtische Galerie im Lenbachhaus, Munich (ed.), edited by Pia Dornacher and Julia Geiger, Rupprecht Geiger. Catalogue raisonné 1942-2002. Gemälde und Objekte, architekturbezogene Kunst, Munich 2003, no. 211 (illu. in color on p. 94).

Called up: June 7, 2024 - ca. 13.48 h +/- 20 min.

113

Rupprecht Geiger

OE 264, 1957.

Oil on canvas

Estimate:

€ 70,000 - 90,000

$ 74,900 - 96,300

Buyer's premium, taxation and resale right compensation for Rupprecht Geiger "OE 264"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 113

Lot 113