481

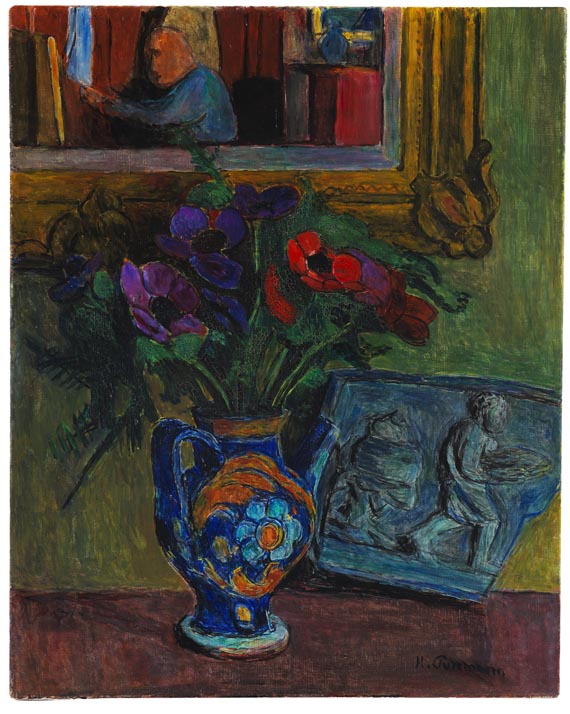

Hans Purrmann

Früchtestillleben, 1935/36.

Oil on canvas

Estimate:

€ 20,000 - 30,000

$ 21,400 - 32,100

Früchtestillleben. 1935/36.

Oil on canvas.

Signed in lower right. 60 x 73 cm (23.6 x 28.7 in).

The work is documented in the Hans Purrmann Archive under the numbers 33 and 787. [AR].

• Alongside landscapes and portraits, still lifes were among Hans Purrmann's preferred genres.

• Powerful work with a composition dominated by the ripe splendor of the fruit.

• In 1935, around the time the work was made, the artist left Germany and took over the administration of the German Artists' Foundation Villa Romana in Florence.

• His still lifes can be found in important museum collections like the Museum Ludwig, Cologne, the Neue Nationalgalerie, Berlin, and the Pinakothek der Moderne, Munich.

PROVENANCE: Monastery Raitenhaslach, Bavaria (stored by Dr. Robert Purrmann, the artist's son, for safekeeping during the war).

Central Collecting Point, Munich (December 11, 1945 - April 28, 1948, no. 16455).

Dr. Robert Purrmann (reobtained from the above on April 28, 1948).

Dr. Hugo Max Collection (inscribed on the reverse).

Private collection North Rhine-Westphalia.

EXHIBITION: Hans Purrmann zum 100. Geburtstag, Mittelrheinisches Landesmuseum, Mainz 1980, cat. no. 48.

LITERATURE: Christian Lenz, Felix Billeter, Hans Purrmann. Die Gemälde II 1935-1966. Catalogue raisonné, Munich 2004, no. 1936/06 (illu. in color).

Called up: June 8, 2024 - ca. 18.47 h +/- 20 min.

Oil on canvas.

Signed in lower right. 60 x 73 cm (23.6 x 28.7 in).

The work is documented in the Hans Purrmann Archive under the numbers 33 and 787. [AR].

• Alongside landscapes and portraits, still lifes were among Hans Purrmann's preferred genres.

• Powerful work with a composition dominated by the ripe splendor of the fruit.

• In 1935, around the time the work was made, the artist left Germany and took over the administration of the German Artists' Foundation Villa Romana in Florence.

• His still lifes can be found in important museum collections like the Museum Ludwig, Cologne, the Neue Nationalgalerie, Berlin, and the Pinakothek der Moderne, Munich.

PROVENANCE: Monastery Raitenhaslach, Bavaria (stored by Dr. Robert Purrmann, the artist's son, for safekeeping during the war).

Central Collecting Point, Munich (December 11, 1945 - April 28, 1948, no. 16455).

Dr. Robert Purrmann (reobtained from the above on April 28, 1948).

Dr. Hugo Max Collection (inscribed on the reverse).

Private collection North Rhine-Westphalia.

EXHIBITION: Hans Purrmann zum 100. Geburtstag, Mittelrheinisches Landesmuseum, Mainz 1980, cat. no. 48.

LITERATURE: Christian Lenz, Felix Billeter, Hans Purrmann. Die Gemälde II 1935-1966. Catalogue raisonné, Munich 2004, no. 1936/06 (illu. in color).

Called up: June 8, 2024 - ca. 18.47 h +/- 20 min.

481

Hans Purrmann

Früchtestillleben, 1935/36.

Oil on canvas

Estimate:

€ 20,000 - 30,000

$ 21,400 - 32,100

Buyer's premium, taxation and resale right compensation for Hans Purrmann "Früchtestillleben"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 481

Lot 481