225

Gabriele Münter

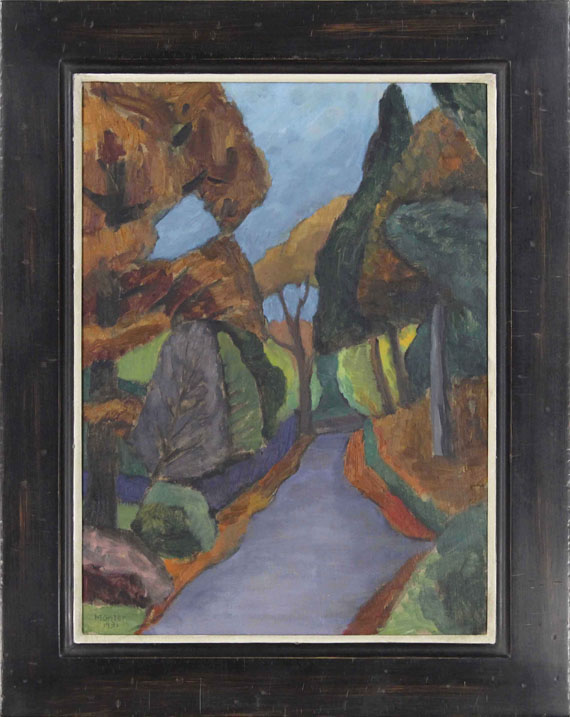

Herbstallee, 1931.

Oil on cardboard

Estimate:

€ 100,000 / $ 118,000 Sold:

€ 250,000 / $ 295,000 (incl. surcharge)

Herbstallee. 1931.

Oil on cardboard.

Lower left signed and dated. Verso signed, dated and titled, inscribed "97/31" as well as with a hand-written inscription. Verso with the estate stamp. Verso with a label with the partly stamped and partly hand-written number "L 173" and a label with the stamped number "558" and the hand-written inscription "18268". 45 x 33 cm (17.7 x 12.9 in).

The following entry can be found in Gabriele Münter's work books under 97/31: "5.XII vm. Herbstallee P. 45 x 33, nach Studie 72". She noted on the mentioned study: "Herbstlicher Weg. n.nat. (unten beim See die Anlagen)".

• Atmospheric autumnal view characterized by strong and brilliant colors.

• Clearly contoured forms in bright colors.

• For the first time offered on the international auction market.

Accompanied by a written expertise issued by the Gabriele Münter- and Johannes Eichner-Foundation, Munich, from November 2, 2020. The work will be included into the catalog raisonné of paintings.

PROVENANCE: From the artist's estate.

Private collection Rhineland.

Private collection Rhineland (inherited from aforementioned).

EXHIBITION: Westdeutsche Kunstmesse, Galerie Gunzenhauser, 1967

Gunzenhauser, September 10 - November 1999.

Oil on cardboard.

Lower left signed and dated. Verso signed, dated and titled, inscribed "97/31" as well as with a hand-written inscription. Verso with the estate stamp. Verso with a label with the partly stamped and partly hand-written number "L 173" and a label with the stamped number "558" and the hand-written inscription "18268". 45 x 33 cm (17.7 x 12.9 in).

The following entry can be found in Gabriele Münter's work books under 97/31: "5.XII vm. Herbstallee P. 45 x 33, nach Studie 72". She noted on the mentioned study: "Herbstlicher Weg. n.nat. (unten beim See die Anlagen)".

• Atmospheric autumnal view characterized by strong and brilliant colors.

• Clearly contoured forms in bright colors.

• For the first time offered on the international auction market.

Accompanied by a written expertise issued by the Gabriele Münter- and Johannes Eichner-Foundation, Munich, from November 2, 2020. The work will be included into the catalog raisonné of paintings.

PROVENANCE: From the artist's estate.

Private collection Rhineland.

Private collection Rhineland (inherited from aforementioned).

EXHIBITION: Westdeutsche Kunstmesse, Galerie Gunzenhauser, 1967

Gunzenhauser, September 10 - November 1999.

Landscape and nature are Gabriele Münter’s preferred theme. Her views of the "Blue Land" with the mountains and the seasonal views of the Staffelsee are well known. With great diversity, she captured the rich coloring of the changing seasons, which is particularly spectacular in the pre-Alpine landscape around Murnau, in her pictures. Whether its the pure winter light, the soft colors of an early spring, the rich and strong summer hues or the autumn’s color blaze. Münter worked a lot plein-air, something she became acquainted with and learned to appreciate in the class of her future partner Kandinsky at the Phalanx painting school. First sketches were often created in front of nature and fully executed in oil. This is also the case with our painting "Herbstallee", as Münter recorded in her journal, according to which Gabriele Münter made the oil painting on December 5, 1931. It also mentions that this almost abstract painting was painted after study 72 and that Gabriele Münter found the motif in her direct surroundings down by the lake. Few of her landscapes show such a narrow image section without any wider scope than it is the case with our "Herbstallee". The bright and colorful trees condense into an almost abstract two-dimensional color pattern, while the interlocked bushes and trees form a dense pattern. This must have been the only way for Münter to work out the autumn colors in such a tremendous clarity. [EH]

225

Gabriele Münter

Herbstallee, 1931.

Oil on cardboard

Estimate:

€ 100,000 / $ 118,000 Sold:

€ 250,000 / $ 295,000 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 225

Lot 225