244

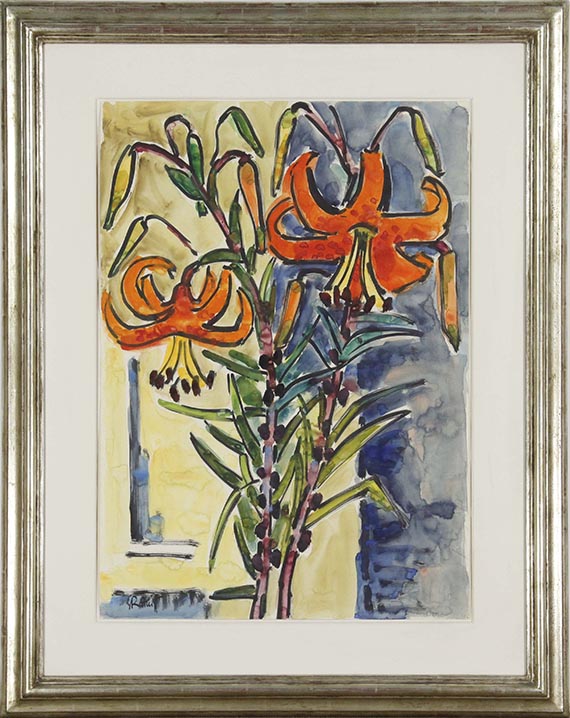

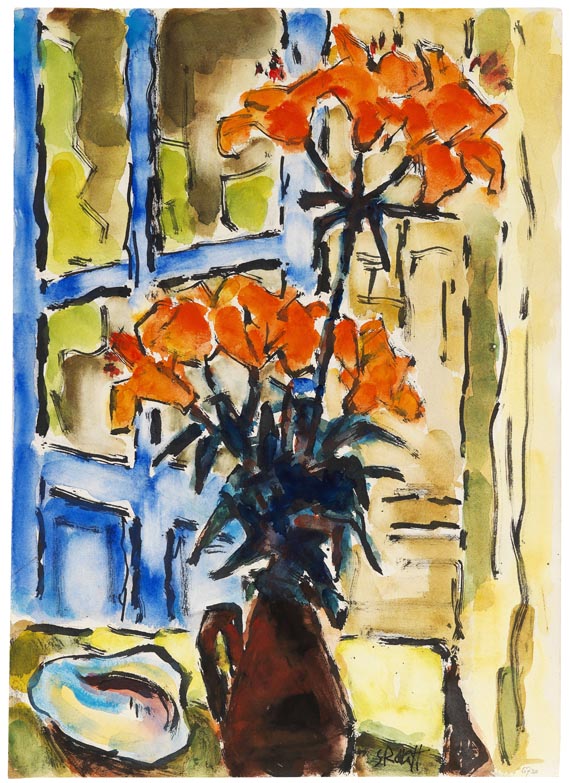

Karl Schmidt-Rottluff

Feuerlilien, 1962.

Watercolor

Estimate:

€ 20,000 - 30,000

$ 22,000 - 33,000

Feuerlilien. 1962.

Watercolor.

Signed lower left and inscribed “6250” lower right. Titled and inscribed “61”on the reverse. On Schoeller wove paper (with the truncated blindstamp). 69.7 x 49.8 cm (27.4 x 19.6 in), the full sheet. [AW].

• The radiant colors and black outlines make for a fascinating composition.

• Watercolors are predominant in Schmidt-Rottluff's oeuvre, from his years with the “Brücke” group to his final creative period in the 1970s.

The work is documented in the archive of the Karl and Emy Schmidt-Rottluff Foundation, Berlin.

PROVENANCE: Private collection, Berlin.

Called up: December 7, 2024 - ca. 15.18 h +/- 20 min.

Watercolor.

Signed lower left and inscribed “6250” lower right. Titled and inscribed “61”on the reverse. On Schoeller wove paper (with the truncated blindstamp). 69.7 x 49.8 cm (27.4 x 19.6 in), the full sheet. [AW].

• The radiant colors and black outlines make for a fascinating composition.

• Watercolors are predominant in Schmidt-Rottluff's oeuvre, from his years with the “Brücke” group to his final creative period in the 1970s.

The work is documented in the archive of the Karl and Emy Schmidt-Rottluff Foundation, Berlin.

PROVENANCE: Private collection, Berlin.

Called up: December 7, 2024 - ca. 15.18 h +/- 20 min.

244

Karl Schmidt-Rottluff

Feuerlilien, 1962.

Watercolor

Estimate:

€ 20,000 - 30,000

$ 22,000 - 33,000

Buyer's premium, taxation and resale right compensation for Karl Schmidt-Rottluff "Feuerlilien"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 244

Lot 244