Frame image

336

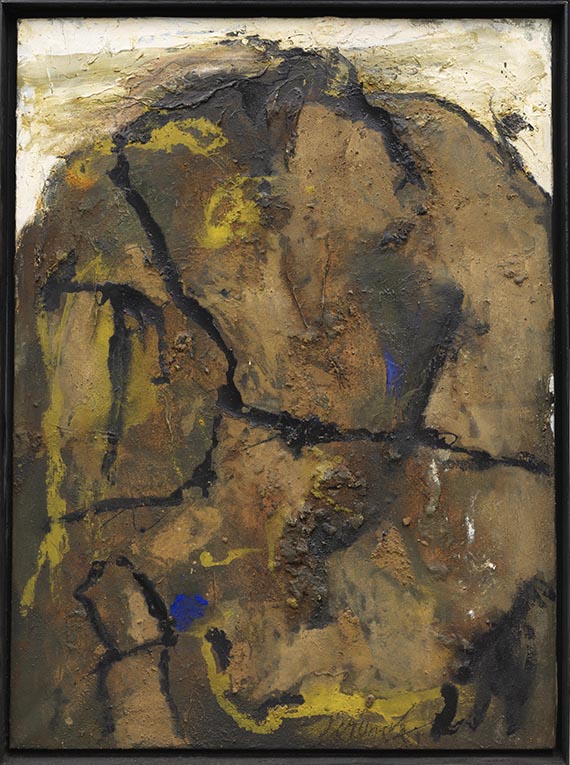

Emil Schumacher

Albia, 1977.

Oil on canvas

Estimate:

€ 60,000 - 80,000

$ 66,000 - 88,000

Albia. 1977.

Oil on canvas.

Signed lower right. Titled, dated and inscribed with the dimensions verso on the stretcher. 130.5 x 96 cm (51.3 x 37.7 in). [AW].

• An outstanding, powerful work in the typical style of Art Informel.

• Schumacher liberated color from form, and line from figurative motifs.

• He participated in documenta II, III and 6 in Kassel in 1959, 1964 and 1977.

• Emil Schumacher's works are in the collections of the Kunsthalle Hamburg, the Staatsgalerie Stuttgart, the Metropolitan Museum of Art, New York, as well as in the Vatican Museums, Rome.

The work is registered at the Emil Schumacher Archive, Emil Schumacher Museum, Hagen, under the inventory number “0/21”.

PROVENANCE: Galerie Hans Strelow, Düsseldorf (seit ca. 1984).

Private collection, Berlin (from the above).

EXHIBITION: Fritz Winter House, Ahlen, April 28 - May 31, 1979, cat. no. 5 (with an exhibition label on the reverse of the stretcher).

Emil Schumacher. Bilder, Gouaches, Zeichnungen, Galerie Merten Slominsky, Mühlheim, February 28 - April 18, 1980; Galerie Alice Pauli, Lausanne, May 13 - June 28, 1980; Galerie István Schlégl, Zurich, November 21, 1980 - January 10, 1981, cat. no. 8.

Emil Schumacher, quoted from: Emil Schumacher. Farben sind Feste für die Augen. zum 100. Geburtstag, Ernst Barlach Haus, Hamburg 2012/13, p. 91.

Called up: December 7, 2024 - ca. 16.33 h +/- 20 min.

Oil on canvas.

Signed lower right. Titled, dated and inscribed with the dimensions verso on the stretcher. 130.5 x 96 cm (51.3 x 37.7 in). [AW].

• An outstanding, powerful work in the typical style of Art Informel.

• Schumacher liberated color from form, and line from figurative motifs.

• He participated in documenta II, III and 6 in Kassel in 1959, 1964 and 1977.

• Emil Schumacher's works are in the collections of the Kunsthalle Hamburg, the Staatsgalerie Stuttgart, the Metropolitan Museum of Art, New York, as well as in the Vatican Museums, Rome.

The work is registered at the Emil Schumacher Archive, Emil Schumacher Museum, Hagen, under the inventory number “0/21”.

PROVENANCE: Galerie Hans Strelow, Düsseldorf (seit ca. 1984).

Private collection, Berlin (from the above).

EXHIBITION: Fritz Winter House, Ahlen, April 28 - May 31, 1979, cat. no. 5 (with an exhibition label on the reverse of the stretcher).

Emil Schumacher. Bilder, Gouaches, Zeichnungen, Galerie Merten Slominsky, Mühlheim, February 28 - April 18, 1980; Galerie Alice Pauli, Lausanne, May 13 - June 28, 1980; Galerie István Schlégl, Zurich, November 21, 1980 - January 10, 1981, cat. no. 8.

Emil Schumacher, quoted from: Emil Schumacher. Farben sind Feste für die Augen. zum 100. Geburtstag, Ernst Barlach Haus, Hamburg 2012/13, p. 91.

Called up: December 7, 2024 - ca. 16.33 h +/- 20 min.

336

Emil Schumacher

Albia, 1977.

Oil on canvas

Estimate:

€ 60,000 - 80,000

$ 66,000 - 88,000

Buyer's premium, taxation and resale right compensation for Emil Schumacher "Albia"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 336

Lot 336