179

Russell Young

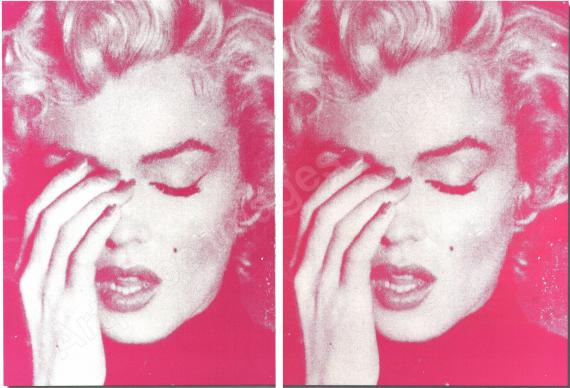

Crying Marilyn x 2 (gold and black diamond dust), 2011.

Mixed media on canvas. Acrylic, silkscreen and ...

Estimate:

€ 40,000 - 60,000

$ 42,800 - 64,200

Crying Marilyn x 2 (gold and black diamond dust). 2011.

Mixed media on canvas. Acrylic, silkscreen and "diamond dust".

Signed, dated and titled as well as inscribed with the work number "EV2011" and information on the colors and the technique "gold + black + diamond dust". 158 x 240 cm (62.2 x 94.4 in). [EH].

• Oversized portrait of the Hollywood icon who plays the leading role in many of Russell Young's works.

• His paintings with sparkling “diamond dust” lend the stars of the past a shimmering timelessness.

• A comparable work from the “Marilyn Crying” series is art of the Albertina collection in Vienna.

PROVENANCE: Private collection Great Britain.

EXHIBITION: Kreszler Gallery, New York, 2011.

"They're all women that have really inspired me growing up [..]. Growing up in Northern England is a fairly bleak, dour, gritty, horrible place. And this was my escapism. My father would take me to see all the movies, we would listen to all the music. [..] All the women I've chosen, they're all fairly strong women. [..] Even Marilyn set up her own studio because she hated the role she was being given. So they're all a nod to the modern-day woman."

Russell Young in an interview for Heather James Gallery, YouTube, May 2020, quoted from: www.youtu.be/EsVHYhV_uP8.

Called up: June 7, 2024 - ca. 15.18 h +/- 20 min.

Mixed media on canvas. Acrylic, silkscreen and "diamond dust".

Signed, dated and titled as well as inscribed with the work number "EV2011" and information on the colors and the technique "gold + black + diamond dust". 158 x 240 cm (62.2 x 94.4 in). [EH].

• Oversized portrait of the Hollywood icon who plays the leading role in many of Russell Young's works.

• His paintings with sparkling “diamond dust” lend the stars of the past a shimmering timelessness.

• A comparable work from the “Marilyn Crying” series is art of the Albertina collection in Vienna.

PROVENANCE: Private collection Great Britain.

EXHIBITION: Kreszler Gallery, New York, 2011.

"They're all women that have really inspired me growing up [..]. Growing up in Northern England is a fairly bleak, dour, gritty, horrible place. And this was my escapism. My father would take me to see all the movies, we would listen to all the music. [..] All the women I've chosen, they're all fairly strong women. [..] Even Marilyn set up her own studio because she hated the role she was being given. So they're all a nod to the modern-day woman."

Russell Young in an interview for Heather James Gallery, YouTube, May 2020, quoted from: www.youtu.be/EsVHYhV_uP8.

Called up: June 7, 2024 - ca. 15.18 h +/- 20 min.

179

Russell Young

Crying Marilyn x 2 (gold and black diamond dust), 2011.

Mixed media on canvas. Acrylic, silkscreen and ...

Estimate:

€ 40,000 - 60,000

$ 42,800 - 64,200

Buyer's premium, taxation and resale right compensation for Russell Young "Crying Marilyn x 2 (gold and black diamond dust)"

This lot can be subjected to differential taxation plus a 7% import tax levy (saving approx. 5 % compared to regular taxation) or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 179

Lot 179