368

Otto Dill

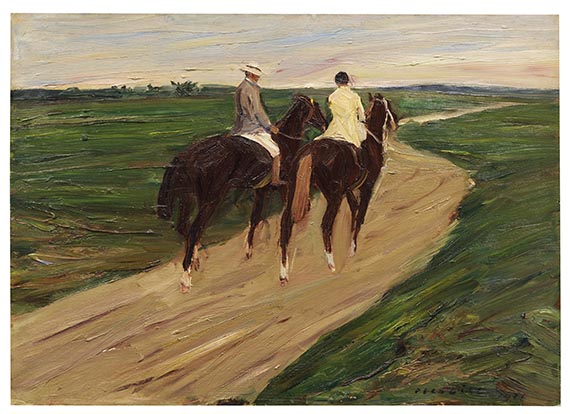

Spazierritt, 1921.

Oil on cardboard, laid on fiberboard

Estimate:

€ 3,000 - 4,000

$ 3,210 - 4,280

Spazierritt. 1921.

Oil on cardboard, laid on fiberboard.

Lower right signed and dated. With a label on the reverse, there titled and dated, as well as with a hand-written note of ownership in the lower margin. 50 x 70 cm (19.6 x 27.5 in).

PROVENANCE: Private collection Northern Germany

Private collection Lower Saxony.

Called up: June 8, 2024 - ca. 15.32 h +/- 20 min.

Oil on cardboard, laid on fiberboard.

Lower right signed and dated. With a label on the reverse, there titled and dated, as well as with a hand-written note of ownership in the lower margin. 50 x 70 cm (19.6 x 27.5 in).

PROVENANCE: Private collection Northern Germany

Private collection Lower Saxony.

Called up: June 8, 2024 - ca. 15.32 h +/- 20 min.

In addition to quickly capturing what he sees using a technique inspired by the airiness of Impressionism, Otto Dill is also a particularly talented illustrator of movement. The fleeting character of the application of paint supports the impression of movement without challenging the composition's unity. From 1908 to 1914, Dill studied painting at the Munich Academy and became a master student of Heinrich von Zügel, who taught him to paint exotic animals. In the summer of 1917, the artist exhibited his horse racing scenes in the Munich Glaspalast. As a member of the Munich Secession, he took part in many its in 1922, and was appointed professor in 1924. In a composition reduced to clearly juxtaposed color fields, which nevertheless appears animated by the loose style, he uses the two riders in lilac-grey and lemon-yellow costumes as pastel highlights. The path that stretches far into the landscape suggests speed and velocity, which they are sure to resume after their brief chat. [KT]

368

Otto Dill

Spazierritt, 1921.

Oil on cardboard, laid on fiberboard

Estimate:

€ 3,000 - 4,000

$ 3,210 - 4,280

Buyer's premium, taxation and resale right compensation for Otto Dill "Spazierritt"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 368

Lot 368