203

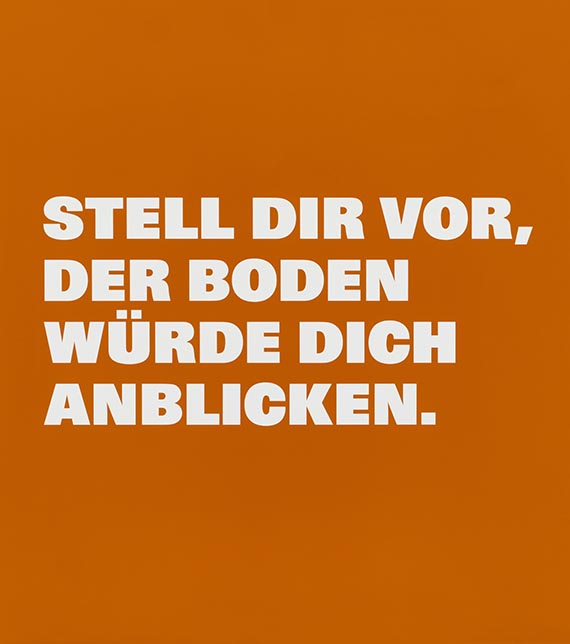

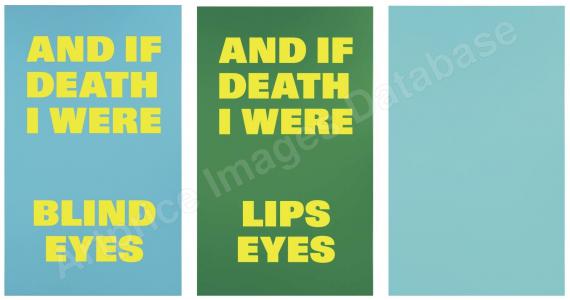

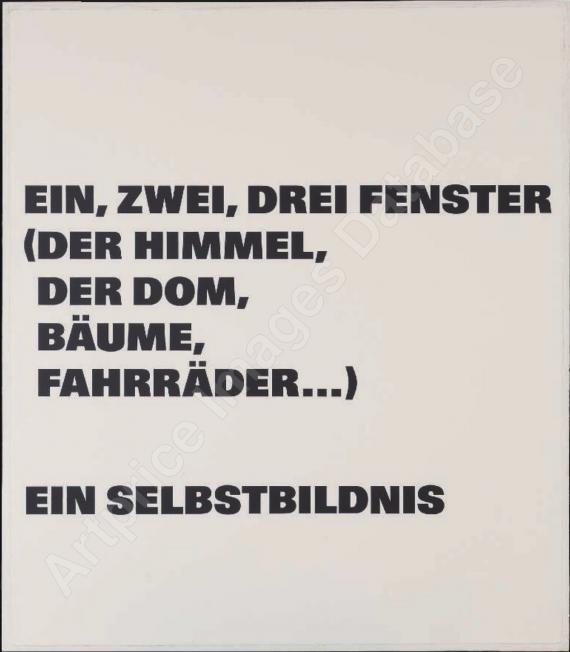

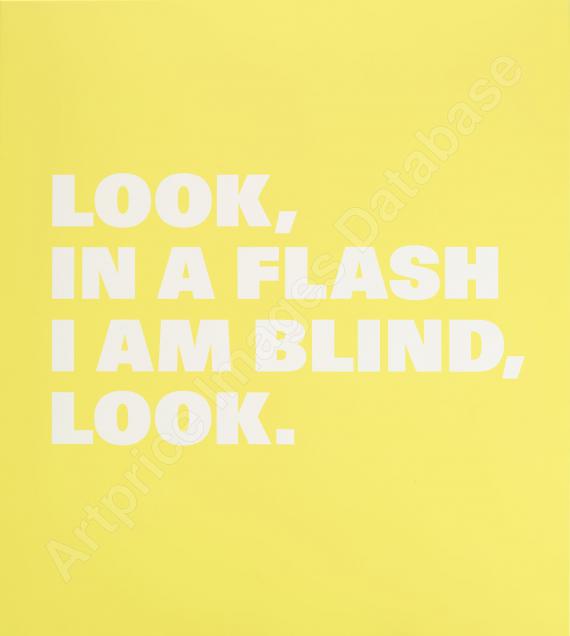

Rémy Zaugg

Neue Bilder 12a, 1996/1998.

Mixed media. Lacquer and silkscreen on aluminum

Estimate:

€ 20,000 - 30,000

$ 21,400 - 32,100

Neue Bilder 12a. 1996/1998.

Mixed media. Lacquer and silkscreen on aluminum.

Signed, dated, titled and inscribed on the reverse. 178 x 158 cm (70 x 62.2 in).

[SM].

• Rémy Zaugg is one of the most important Swiss artists of the 20th century.

• His works featured in the Biennale de Paris and documenta 7.

• Zaugg's art addresses profound reflections on our perception of the world.

• The typographic paintings, in which words become images, are among the key works in his oeuvre.

PROVENANCE: Private collection Switzerland (since 2013, directly from the estate).

"In the 20th century, I can no longer explain to people how to make a picture. I can, however, explain how to perceive a picture.“

Rémy Zaugg, quoted from: www.mgksiegen.de

Called up: June 7, 2024 - ca. 15.50 h +/- 20 min.

Mixed media. Lacquer and silkscreen on aluminum.

Signed, dated, titled and inscribed on the reverse. 178 x 158 cm (70 x 62.2 in).

[SM].

• Rémy Zaugg is one of the most important Swiss artists of the 20th century.

• His works featured in the Biennale de Paris and documenta 7.

• Zaugg's art addresses profound reflections on our perception of the world.

• The typographic paintings, in which words become images, are among the key works in his oeuvre.

PROVENANCE: Private collection Switzerland (since 2013, directly from the estate).

"In the 20th century, I can no longer explain to people how to make a picture. I can, however, explain how to perceive a picture.“

Rémy Zaugg, quoted from: www.mgksiegen.de

Called up: June 7, 2024 - ca. 15.50 h +/- 20 min.

203

Rémy Zaugg

Neue Bilder 12a, 1996/1998.

Mixed media. Lacquer and silkscreen on aluminum

Estimate:

€ 20,000 - 30,000

$ 21,400 - 32,100

Buyer's premium, taxation and resale right compensation for Rémy Zaugg "Neue Bilder 12a"

This lot can be subjected to differential taxation plus a 7% import tax levy (saving approx. 5 % compared to regular taxation) or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 203

Lot 203