136

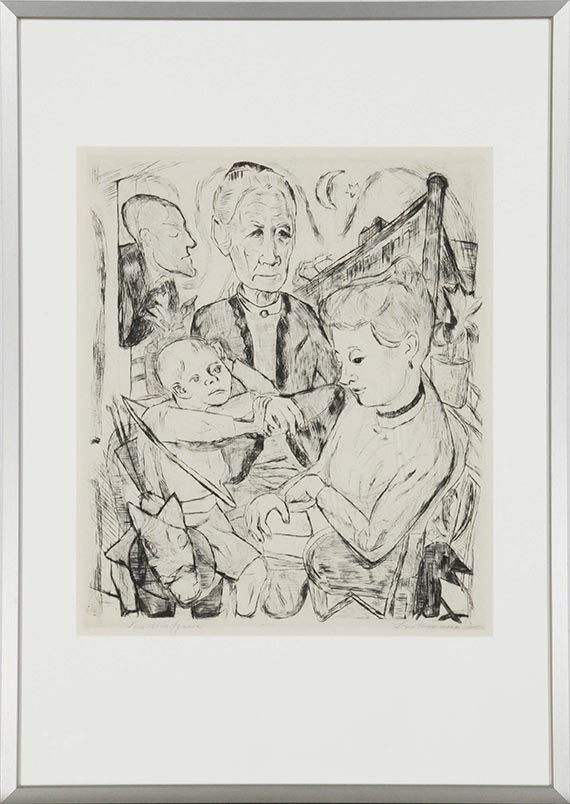

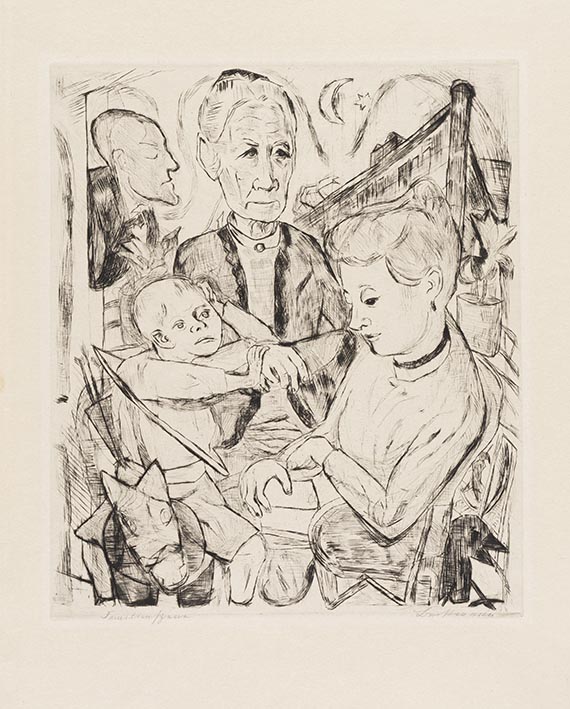

Max Beckmann

Familienszene (Familie Beckmann), 1918.

Drypoint

Post auction sale: € 4,500 / $ 5,310

Familienszene (Familie Beckmann). 1918.

Drypoint.

Signed and titled. One of 40 copies. On firm, creme Japan paper. 30.6 x 25.9 cm (12 x 10.1 in). Sheet: 47,5 x 33,3 cm (18,50 x 12,99 in).

Sheet 2 from the portfolio “Gesichter” (Faces). Printed by Franz Hanfstaengel, Munich. Published as the thirteenth print of the Marées Gesellschaft (with blind stamp), by R. Piper & Co., Munich, 1919. [MH].

• Max Beckmann's intimate view of family life.

• Extremely detailed and elaborate composition.

• The extraordinary artist Max Beckmann is internationally regarded as one of the most important protagonists of European Modernism.

PROVENANCE: Karin & Rüdiger Volhard Collection, Bad Homburg.

In family ownership ever since.

LITERATURE: James Hofmaier, Max Beckmann. Catalogue raisonné of his prints, vol. 1, Bern 1990, no. 127 B a (of B b).

Klaus Gallwitz, Max Beckmann. Die Druckgraphik, Karlsruhe 1962, no. 98.

Drypoint.

Signed and titled. One of 40 copies. On firm, creme Japan paper. 30.6 x 25.9 cm (12 x 10.1 in). Sheet: 47,5 x 33,3 cm (18,50 x 12,99 in).

Sheet 2 from the portfolio “Gesichter” (Faces). Printed by Franz Hanfstaengel, Munich. Published as the thirteenth print of the Marées Gesellschaft (with blind stamp), by R. Piper & Co., Munich, 1919. [MH].

• Max Beckmann's intimate view of family life.

• Extremely detailed and elaborate composition.

• The extraordinary artist Max Beckmann is internationally regarded as one of the most important protagonists of European Modernism.

PROVENANCE: Karin & Rüdiger Volhard Collection, Bad Homburg.

In family ownership ever since.

LITERATURE: James Hofmaier, Max Beckmann. Catalogue raisonné of his prints, vol. 1, Bern 1990, no. 127 B a (of B b).

Klaus Gallwitz, Max Beckmann. Die Druckgraphik, Karlsruhe 1962, no. 98.

136

Max Beckmann

Familienszene (Familie Beckmann), 1918.

Drypoint

Post auction sale: € 4,500 / $ 5,310

Buyer's premium and taxation for Max Beckmann "Familienszene (Familie Beckmann)"

This lot can be purchased subject to differential or regular taxation.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 7 % is levied to the sum of hammer price and premium.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 7 % is levied to the sum of hammer price and premium.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 136

Lot 136