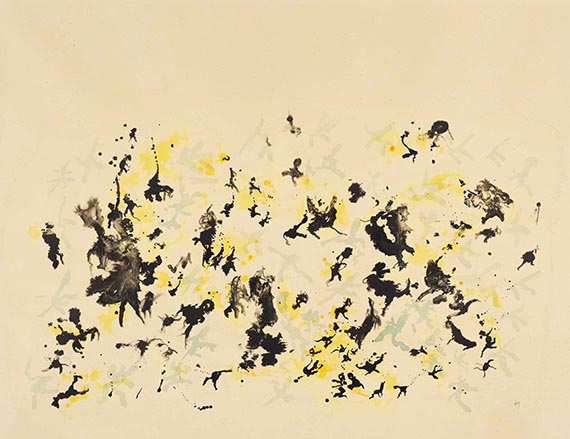

Ohne Titel. Um 1950/1957.

Watercolor.

Monogrammed in the lower right. On firm BFK Rives wove paper (with watermark). 32 x 52 cm (12.5 x 20.4 in). Sheet: 50 x 65,3 cm (19,68 x 25,59 in).

[MH].

• Henri Michaux is considered a pioneer in the field of literature and visual arts.

• For Michaux, painting is a means of expressing what cannot be put into words.

• The interplay of deep black, bright yellow, and delicate blue creates a tense balance between dynamism and tranquility.

PROVENANCE: Max Niedermayer Collection (1905–1968), Wiesbaden.

Estate of Dr. Max Niedermayer, Wiesbaden.

Private collection, Rhineland-Palatinate (acquired from the above in 1979).

In family ownership since.

EXHIBITION: Henri Michaux, Studio Paul Facchetti, Paris, 1957, cat. no. 773 (with the label on the reverse).

Good overall impression. Overall foxing and with mount staining. Due to the technique used, there is a faint water stain around the image. Tiny pinholes in the corners of the sheet, probably due to mounting. The edges of the sheet are slightly irregular, with some tiny losses of paper, small tears, and slight bumping. Mounting tape around the reverse, partially visible on the recto.

Watercolor.

Monogrammed in the lower right. On firm BFK Rives wove paper (with watermark). 32 x 52 cm (12.5 x 20.4 in). Sheet: 50 x 65,3 cm (19,68 x 25,59 in).

[MH].

• Henri Michaux is considered a pioneer in the field of literature and visual arts.

• For Michaux, painting is a means of expressing what cannot be put into words.

• The interplay of deep black, bright yellow, and delicate blue creates a tense balance between dynamism and tranquility.

PROVENANCE: Max Niedermayer Collection (1905–1968), Wiesbaden.

Estate of Dr. Max Niedermayer, Wiesbaden.

Private collection, Rhineland-Palatinate (acquired from the above in 1979).

In family ownership since.

EXHIBITION: Henri Michaux, Studio Paul Facchetti, Paris, 1957, cat. no. 773 (with the label on the reverse).

Good overall impression. Overall foxing and with mount staining. Due to the technique used, there is a faint water stain around the image. Tiny pinholes in the corners of the sheet, probably due to mounting. The edges of the sheet are slightly irregular, with some tiny losses of paper, small tears, and slight bumping. Mounting tape around the reverse, partially visible on the recto.

64

Henri Michaux

Ohne Titel, 1950.

Watercolor

Starting bid: € 5,400 / $ 6,372

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 64

Lot 64