110

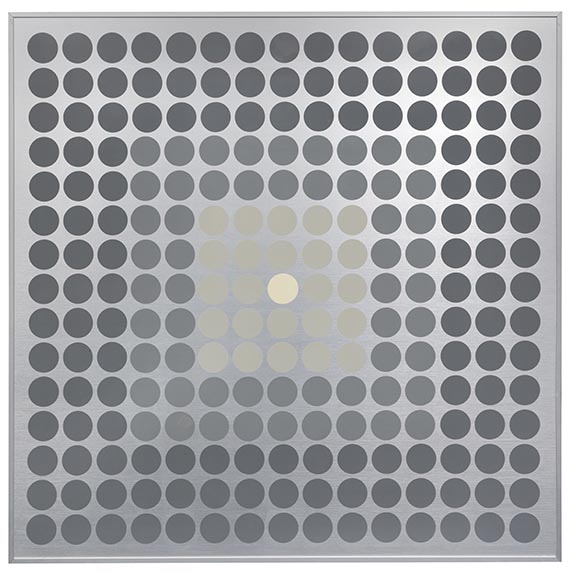

Victor Vasarely

Ohne Titel, ca. 1970.

Mixed media. Lacquer on aluminum

Estimate:

€ 30,000 - 40,000

$ 32,100 - 42,800

Ohne Titel. ca. 1970.

Mixed media. Lacquer on aluminum.

Lower right signed and inscribed "Ais [für Aix-en-Provence] #73 ES 126". 100 x 100 cm (39.3 x 39.3 in). [AW].

• Energetic and reduced aluminum work of special radiance depending on the incidence of light.

• In his own canon of constructive-geometric abstraction, Victor Vasarely created optical phenomena and kinetic effects.

• Co-founder and key representative of Op Art.

• Participated in the documenta in Kassel four times between 1955 and 1968.

Accompanied by a photo certificate (copy) by Pierre Vasarely, Fondation Vasarely, Aix-en-Provence, universal legatee and holder of Victor Vasarely's moral rights, issued in July 2007.

PROVENANCE: Private collection Southern Germany.

Terra Antiqua Fine Asian Art & Antiques, Basel.

Private collection Switzerland.

LITERATURE: Hampel Kunstauktionen, Munich, auction 68, December 7/8, 2007, lot 361 (illu. on p. 97).

Called up: June 7, 2024 - ca. 13.44 h +/- 20 min.

Mixed media. Lacquer on aluminum.

Lower right signed and inscribed "Ais [für Aix-en-Provence] #73 ES 126". 100 x 100 cm (39.3 x 39.3 in). [AW].

• Energetic and reduced aluminum work of special radiance depending on the incidence of light.

• In his own canon of constructive-geometric abstraction, Victor Vasarely created optical phenomena and kinetic effects.

• Co-founder and key representative of Op Art.

• Participated in the documenta in Kassel four times between 1955 and 1968.

Accompanied by a photo certificate (copy) by Pierre Vasarely, Fondation Vasarely, Aix-en-Provence, universal legatee and holder of Victor Vasarely's moral rights, issued in July 2007.

PROVENANCE: Private collection Southern Germany.

Terra Antiqua Fine Asian Art & Antiques, Basel.

Private collection Switzerland.

LITERATURE: Hampel Kunstauktionen, Munich, auction 68, December 7/8, 2007, lot 361 (illu. on p. 97).

Called up: June 7, 2024 - ca. 13.44 h +/- 20 min.

110

Victor Vasarely

Ohne Titel, ca. 1970.

Mixed media. Lacquer on aluminum

Estimate:

€ 30,000 - 40,000

$ 32,100 - 42,800

Buyer's premium, taxation and resale right compensation for Victor Vasarely "Ohne Titel"

This lot can be subjected to differential taxation plus a 7% import tax levy (saving approx. 5 % compared to regular taxation) or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 110

Lot 110