169

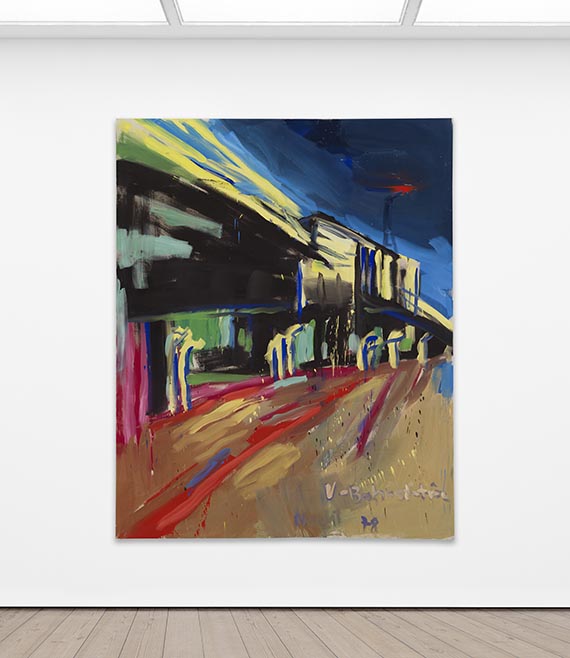

Rainer Fetting

The New York Painter, 1983.

Oil on canvas

Estimate:

€ 50,000 - 70,000

$ 53,500 - 74,900

The New York Painter. 1983.

Oil on canvas.

Titled in bottom center. Signed, dated and inscribed “N. Y. Painter” on the reverse of the canvas. 254 x 198 cm (100 x 77.9 in).

[AR].

• Rainer Fetting staged himself with great confidence and expressiveness as “The New York Painter”.

• Hat and palette, but also the flow and the jittery colors are reminiscent of Van Gogh, a much-cited role model in the artist's work.

• In 2022, the Vincent van GoghHuis in Zundert dedicated a special exhibition to the German painter entitled “Rainer Fetting ziet van Gogh”.

• Part of the same private collection for more than 35 years and offered on the international auction market for the first time.

The authenticity of the present work has been confirmed by the artist. We are grateful for the kind support in cataloging this lot.

PROVENANCE: Galleri Dobloug, Oslo.

Private collection Switzerland (acquired from the above in 1987).

“The artist, who had celebrated great success on the international auction market as a ‘Young Wild One’ from Berlin within just a few years, had moved to the epicenter of the art market and presented himself with great self-confidence, half-naked wearing a cowboy hat and with palette and brush.”

Arie Hartog about a similar self-portrait, quoted from: Hier ist der Maler. Beobachtungen zu Rainer Fetting, in: Fetting, Cologne 2009, pp. 17-19.

Called up: June 7, 2024 - ca. 15.04 h +/- 20 min.

Oil on canvas.

Titled in bottom center. Signed, dated and inscribed “N. Y. Painter” on the reverse of the canvas. 254 x 198 cm (100 x 77.9 in).

[AR].

• Rainer Fetting staged himself with great confidence and expressiveness as “The New York Painter”.

• Hat and palette, but also the flow and the jittery colors are reminiscent of Van Gogh, a much-cited role model in the artist's work.

• In 2022, the Vincent van GoghHuis in Zundert dedicated a special exhibition to the German painter entitled “Rainer Fetting ziet van Gogh”.

• Part of the same private collection for more than 35 years and offered on the international auction market for the first time.

The authenticity of the present work has been confirmed by the artist. We are grateful for the kind support in cataloging this lot.

PROVENANCE: Galleri Dobloug, Oslo.

Private collection Switzerland (acquired from the above in 1987).

“The artist, who had celebrated great success on the international auction market as a ‘Young Wild One’ from Berlin within just a few years, had moved to the epicenter of the art market and presented himself with great self-confidence, half-naked wearing a cowboy hat and with palette and brush.”

Arie Hartog about a similar self-portrait, quoted from: Hier ist der Maler. Beobachtungen zu Rainer Fetting, in: Fetting, Cologne 2009, pp. 17-19.

Called up: June 7, 2024 - ca. 15.04 h +/- 20 min.

169

Rainer Fetting

The New York Painter, 1983.

Oil on canvas

Estimate:

€ 50,000 - 70,000

$ 53,500 - 74,900

Buyer's premium, taxation and resale right compensation for Rainer Fetting "The New York Painter"

This lot can be subjected to differential taxation plus a 7% import tax levy (saving approx. 5 % compared to regular taxation) or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 169

Lot 169