197

Paul McCarthy

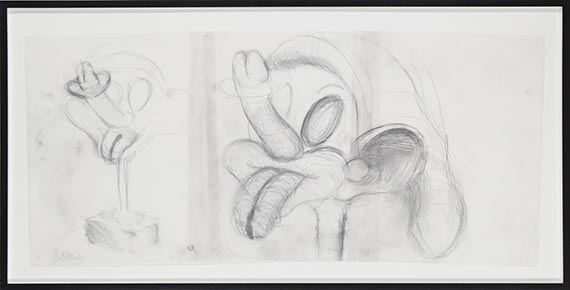

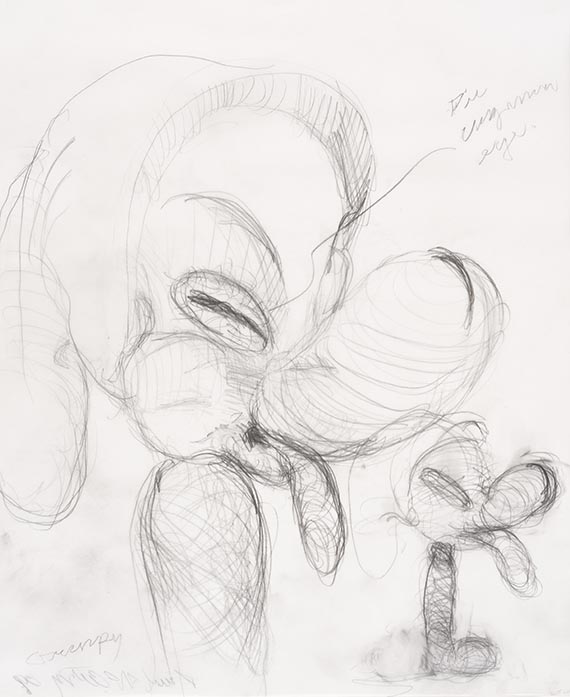

2 Bll.: Dwarf Heads, 2009.

Pencil drawing

Estimate:

€ 30,000 - 40,000

$ 32,100 - 42,800

2 Bll.: Dwarf Heads. 2009.

Pencil drawing.

Sheet I inscribed “Grumpy” in lower left and illegibly inscribed in upper right. Sheet II inscribed “Dopey” in bottom center. Each signed, dated and numbered on the reverse. Each on transparent paper, each firmly mounted on a backing cardboard. Sheet I: 43 x 35.4 cm (16.9 x 13.9 in). Sheet II: 43 x 96 cm (16,9 x 37,7 in).

• Paul McCarthy - his controversial installations make him an agent provocateur of contemporary art.

• McCarthy's playful figures criticize their origins: Hollywood, politics, philosophy, science, art, literature and television.

• Uncanny and expressive alienation of Snow White's seven dwarfs.

• In 2009, Hauser & Wirth in New York hosted “White Snow” an exhibition of mixed-media works centered on Disney's “Snow White and the Seven Dwarfs”.

PROVENANCE: Hauser & Wirth, Zurich/London (each with a gallery label on the reverse).

Private collection Southern Germany (acquired from the above).

Called up: June 7, 2024 - ca. 15.42 h +/- 20 min.

Pencil drawing.

Sheet I inscribed “Grumpy” in lower left and illegibly inscribed in upper right. Sheet II inscribed “Dopey” in bottom center. Each signed, dated and numbered on the reverse. Each on transparent paper, each firmly mounted on a backing cardboard. Sheet I: 43 x 35.4 cm (16.9 x 13.9 in). Sheet II: 43 x 96 cm (16,9 x 37,7 in).

• Paul McCarthy - his controversial installations make him an agent provocateur of contemporary art.

• McCarthy's playful figures criticize their origins: Hollywood, politics, philosophy, science, art, literature and television.

• Uncanny and expressive alienation of Snow White's seven dwarfs.

• In 2009, Hauser & Wirth in New York hosted “White Snow” an exhibition of mixed-media works centered on Disney's “Snow White and the Seven Dwarfs”.

PROVENANCE: Hauser & Wirth, Zurich/London (each with a gallery label on the reverse).

Private collection Southern Germany (acquired from the above).

Called up: June 7, 2024 - ca. 15.42 h +/- 20 min.

197

Paul McCarthy

2 Bll.: Dwarf Heads, 2009.

Pencil drawing

Estimate:

€ 30,000 - 40,000

$ 32,100 - 42,800

Buyer's premium, taxation and resale right compensation for Paul McCarthy "2 Bll.: Dwarf Heads"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 197

Lot 197