303

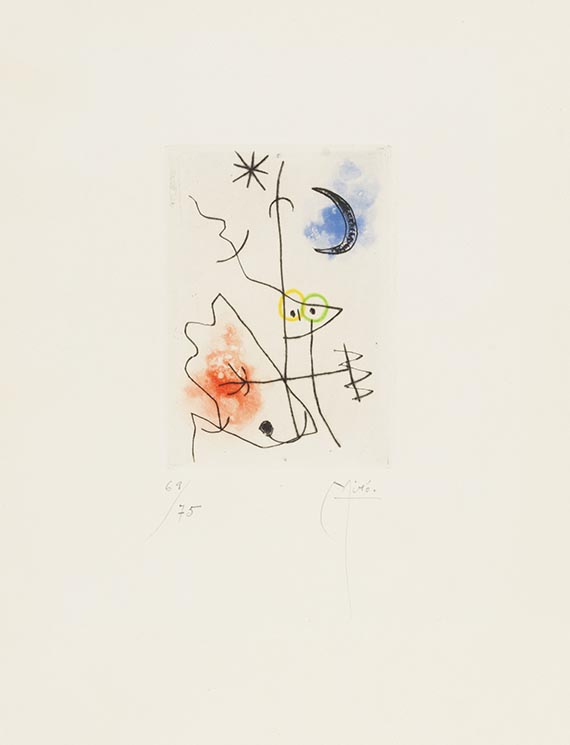

Joan Miró

Le Grillon, 1958.

Etching in colors

Estimate: € 2,000 / $ 2,140

Joan Miró

Le Grillon. Orig.-Kaltnadelradierung und Aquatinta, signiert und numeriert. 1958. Auf Vélin de Rives. 13,5 : 9,5 cm. Papierformat 38,3 : 28,4 cm.

1 von 75 numerierten Exemplaren auf Vélin de Rives.

In der vorliegenden Radierung verbindet Miró die himmlischen Symbole (Mond und Stern) mit dem irdischen Schlagballspiel. Farben werden durch Formen miteinander verbunden, das Irdische ist Rot, Gelb und Grün, während der Mond im dunklen Blau zu strahlen scheint, als hätte er Einfluß auf den getätigten Wurf.

- ZUSTAND: 2 Knickspuren im Druckbereich, verso numeriert und betitelt sowie mit Sammlerstempel (unbekannt, dreieckige Fahne in einem Kreis).

LITERATUR: Dupin 152.

1 of 75 numb. copies on Vélin de Rives. Orig. drypoint with aquatint in colors, signed and numbered. 13.5 : 9.5 cm. Paper size 38.3 : 28.4 cm. - 2 creases in the illustration, numb. and titled on the verso as well as with collector's stamp (unknown, triangular flag with a circle).

Le Grillon. Orig.-Kaltnadelradierung und Aquatinta, signiert und numeriert. 1958. Auf Vélin de Rives. 13,5 : 9,5 cm. Papierformat 38,3 : 28,4 cm.

1 von 75 numerierten Exemplaren auf Vélin de Rives.

In der vorliegenden Radierung verbindet Miró die himmlischen Symbole (Mond und Stern) mit dem irdischen Schlagballspiel. Farben werden durch Formen miteinander verbunden, das Irdische ist Rot, Gelb und Grün, während der Mond im dunklen Blau zu strahlen scheint, als hätte er Einfluß auf den getätigten Wurf.

- ZUSTAND: 2 Knickspuren im Druckbereich, verso numeriert und betitelt sowie mit Sammlerstempel (unbekannt, dreieckige Fahne in einem Kreis).

LITERATUR: Dupin 152.

1 of 75 numb. copies on Vélin de Rives. Orig. drypoint with aquatint in colors, signed and numbered. 13.5 : 9.5 cm. Paper size 38.3 : 28.4 cm. - 2 creases in the illustration, numb. and titled on the verso as well as with collector's stamp (unknown, triangular flag with a circle).

303

Joan Miró

Le Grillon, 1958.

Etching in colors

Estimate: € 2,000 / $ 2,140

Buyer's premium, taxation and resale right compensation for Joan Miró "Le Grillon"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer prices up to € 200,000: 32 % buyer's premium

Hammer prices above € 200,000: for the share up to € 200,000: 32%, for the share above € 200,000: 27% buyer's premium

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer prices up to € 200,000: 25 % buyer's premium plus statutory sales tax Hammer prices above € 200,000: for the share up to € 200,000: 25%, for the share above € 200.000: 20% buyer's premium, each plus statutory sales tax

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer prices up to € 200,000: 32 % buyer's premium

Hammer prices above € 200,000: for the share up to € 200,000: 32%, for the share above € 200,000: 27% buyer's premium

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer prices up to € 200,000: 25 % buyer's premium plus statutory sales tax Hammer prices above € 200,000: for the share up to € 200,000: 25%, for the share above € 200.000: 20% buyer's premium, each plus statutory sales tax

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 303

Lot 303