487

Lyonel Feininger

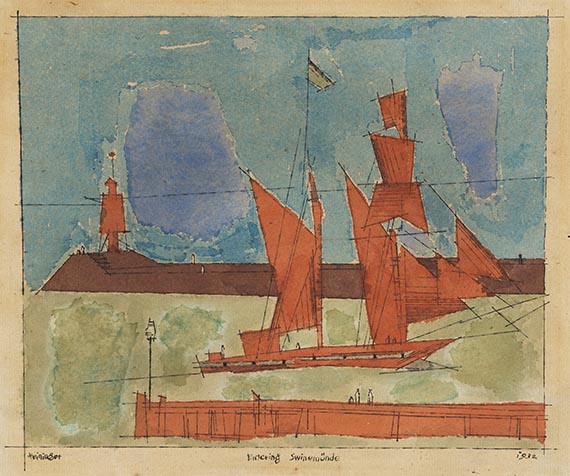

Entering Swinemünde, 1932.

Watercolor and pen and ink drawing

Estimate:

€ 20,000 - 30,000

$ 21,400 - 32,100

Entering Swinemünde. 1932.

Watercolor and pen and ink drawing.

Lower left signed, lower right dated and titled in bottom center. On laid paper. 24.5 x 28.5 cm (9.6 x 11.2 in), size of sheet.

[AR].

• A seascape in rarely seen vibrant colors with the characteristic, subtle ink lines.

• Feininger had a great passion for this subject: ships, the sea, clouds and figures are combined in varying constellations to create ever new pictorial compositions.

• From the last year of the Dessau Bauhaus, which the National Socialist local council decided to close in September 1932.

• For the first time offered on the international auction market (source: artprice.com).

Achim Moeller, director of the Lyonel Feininger Project LLC, New York - Berlin, has confirmed the authenticity of this work, which is registered in the archive of the Lyonel Feininger Project under the number 1923-05-03-24. The work comes with a certificate.

Additional information was provided by Achim Moeller, The Lyonel Feininger Project LLC, New York - Berlin.

PROVENANCE: Galerie Thomas, Munich.

Private collection Düsseldorf (acquired from the above).

Private collection Northern Germany.

Called up: June 8, 2024 - ca. 18.57 h +/- 20 min.

Watercolor and pen and ink drawing.

Lower left signed, lower right dated and titled in bottom center. On laid paper. 24.5 x 28.5 cm (9.6 x 11.2 in), size of sheet.

[AR].

• A seascape in rarely seen vibrant colors with the characteristic, subtle ink lines.

• Feininger had a great passion for this subject: ships, the sea, clouds and figures are combined in varying constellations to create ever new pictorial compositions.

• From the last year of the Dessau Bauhaus, which the National Socialist local council decided to close in September 1932.

• For the first time offered on the international auction market (source: artprice.com).

Achim Moeller, director of the Lyonel Feininger Project LLC, New York - Berlin, has confirmed the authenticity of this work, which is registered in the archive of the Lyonel Feininger Project under the number 1923-05-03-24. The work comes with a certificate.

Additional information was provided by Achim Moeller, The Lyonel Feininger Project LLC, New York - Berlin.

PROVENANCE: Galerie Thomas, Munich.

Private collection Düsseldorf (acquired from the above).

Private collection Northern Germany.

Called up: June 8, 2024 - ca. 18.57 h +/- 20 min.

487

Lyonel Feininger

Entering Swinemünde, 1932.

Watercolor and pen and ink drawing

Estimate:

€ 20,000 - 30,000

$ 21,400 - 32,100

Buyer's premium, taxation and resale right compensation for Lyonel Feininger "Entering Swinemünde"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 487

Lot 487