353

Almut Heise

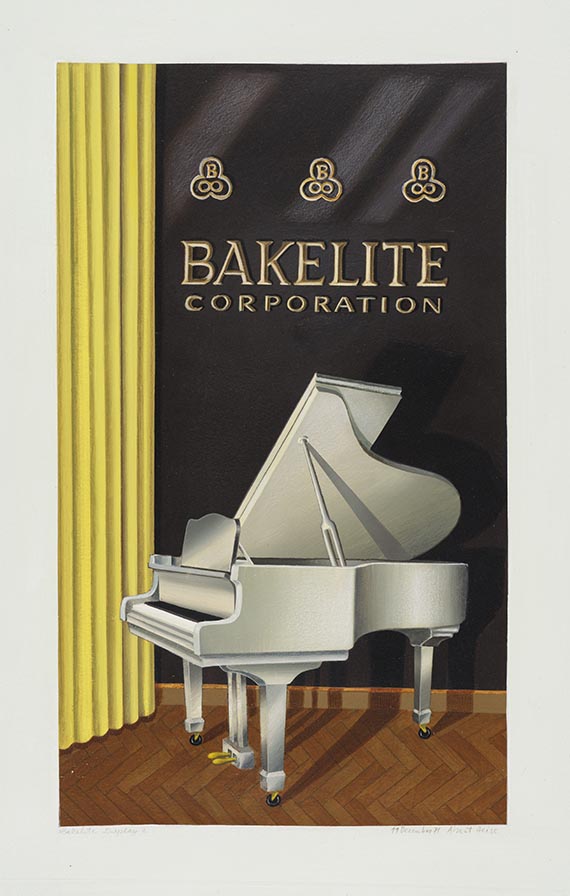

Bakelite Display, 1971.

Watercolor, color pencil, gouache and Acrylic o...

Estimate:

€ 6,000 - 8,000

$ 6,540 - 8,720

Bakelite Display. 1971.

Watercolor, color pencil, gouache and Acrylic on paper.

Signed and dated “11 December 1971” lower right, titled lower left (each scratched into the wet paint). On light board. Actual depiction: 45.3 x 26.5 cm (17.8 x 10.4 in). Sheet (also painted): 59,6 x 40 cm (23,4 x 15,7 in).

[CH].

• With six decades of creative work, Almut Heise has established a unique and consistent position in figurative contemporary art.

Between 1967 and 1970, Heise studied at the University of Fine Arts of Hamburg, where Gotthard Graubner and Paul Wunderlich were among her teachers. During her DAAD scholarship at the Royal College of Art in London, she studied under Allen Jones, David Hockney, and Peter Blake, among others.

• In her early works, Heise focused on interiors from the post-war period and the time of the German Wirtschaftswunder (Economic Miracle).

• Today, the artist's works are part of important museum collections, including the Hamburger Kunsthalle, the Städel Museum in Frankfurt am Main, and the Museum Frieder Burda in Baden-Baden.

• The Staatliche Graphische Sammlung München (Pinakothek der Moderne) presents an extensive solo exhibition of her drawings until January 4, 2025.

PROVENANCE: Michael Becher Collection, Istanbul.

From a Swiss collection.

EXHIBITION: Almut Heise. Gemälde, Gouachen, Zeichnungen, Radierungen, Staatliche Kunsthalle, Baden-Baden, May 17 - June 30, 1974, Württembergischer Kunstverein, Stuttgart, August 7 - September 15, 1974, p. 87, cat. no. 92 (with full-page illu.).

LITERATURE: Marie-Catherine Vogt, Almut Heise. Catalogue raisonné II (drawings, etchings), Berlin 2024, p. 94, cat. no. Z 69 (with full-page color ill., on p. 192).

Called up: December 7, 2024 - ca. 16.55 h +/- 20 min.

Watercolor, color pencil, gouache and Acrylic on paper.

Signed and dated “11 December 1971” lower right, titled lower left (each scratched into the wet paint). On light board. Actual depiction: 45.3 x 26.5 cm (17.8 x 10.4 in). Sheet (also painted): 59,6 x 40 cm (23,4 x 15,7 in).

[CH].

• With six decades of creative work, Almut Heise has established a unique and consistent position in figurative contemporary art.

Between 1967 and 1970, Heise studied at the University of Fine Arts of Hamburg, where Gotthard Graubner and Paul Wunderlich were among her teachers. During her DAAD scholarship at the Royal College of Art in London, she studied under Allen Jones, David Hockney, and Peter Blake, among others.

• In her early works, Heise focused on interiors from the post-war period and the time of the German Wirtschaftswunder (Economic Miracle).

• Today, the artist's works are part of important museum collections, including the Hamburger Kunsthalle, the Städel Museum in Frankfurt am Main, and the Museum Frieder Burda in Baden-Baden.

• The Staatliche Graphische Sammlung München (Pinakothek der Moderne) presents an extensive solo exhibition of her drawings until January 4, 2025.

PROVENANCE: Michael Becher Collection, Istanbul.

From a Swiss collection.

EXHIBITION: Almut Heise. Gemälde, Gouachen, Zeichnungen, Radierungen, Staatliche Kunsthalle, Baden-Baden, May 17 - June 30, 1974, Württembergischer Kunstverein, Stuttgart, August 7 - September 15, 1974, p. 87, cat. no. 92 (with full-page illu.).

LITERATURE: Marie-Catherine Vogt, Almut Heise. Catalogue raisonné II (drawings, etchings), Berlin 2024, p. 94, cat. no. Z 69 (with full-page color ill., on p. 192).

Called up: December 7, 2024 - ca. 16.55 h +/- 20 min.

353

Almut Heise

Bakelite Display, 1971.

Watercolor, color pencil, gouache and Acrylic o...

Estimate:

€ 6,000 - 8,000

$ 6,540 - 8,720

Buyer's premium, taxation and resale right compensation for Almut Heise "Bakelite Display"

This lot can be subjected to differential taxation plus a 7% import tax levy (saving approx. 5 % compared to regular taxation) or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 353

Lot 353