503.31

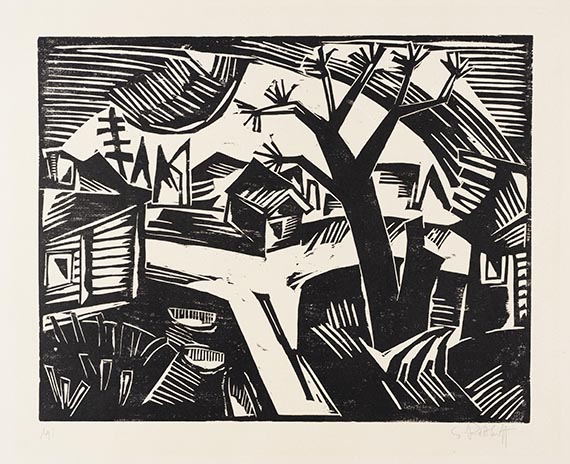

Karl Schmidt-Rottluff

Russische Landschaft, 1919.

Woodcut

Post auction sale: € 6,000 / $ 6,300

Russische Landschaft. 1919.

Woodcut.

Signed and inscribed with the work number "191". 39 x 49.7 cm (15.3 x 19.5 in). Sheet: 53 x 69,7 cm (20,9 x 27,4 in).

Printed by Fritz Voigt, Berlin.

The work is registered in the Hermann Gerlinger Collection under the number SHG 175 a. [CH].

• Schmidt-Rottluff's graphic depictions of Russian landscapes were only created in Berlin after impressions of the Russian countryside gained during the First World War.

• Large sheet in an expressive formal language.

• With characteristically clear contours, angular shapes and dynamic lines, Schmidt-Rottluff created a composition in an almost ornamental style.

• Rare: only two other copies have been offered on the international auction market in the past 30 years (source: artprice.com).

PROVENANCE: Hermann Gerlinger Collection, Würzburg (with the collector's stamp, Lugt 6032, acquired in 2010).

EXHIBITION: Kunstmuseum Moritzburg, Halle an der Saale (permanent loan from the Hermann Gerlinger Collection, 2001-2017).

Buchheim Museum, Bernried (permanent loan from the Hermann Gerlinger Collection, 2017-2022).

LITERATURE: Rosa Schapire, Karl Schmidt-Rottluff. Graphisches Werk bis 1923, Berlin 1924, p. 47, no. H 236 (illu., plate vol.).

Woodcut.

Signed and inscribed with the work number "191". 39 x 49.7 cm (15.3 x 19.5 in). Sheet: 53 x 69,7 cm (20,9 x 27,4 in).

Printed by Fritz Voigt, Berlin.

The work is registered in the Hermann Gerlinger Collection under the number SHG 175 a. [CH].

• Schmidt-Rottluff's graphic depictions of Russian landscapes were only created in Berlin after impressions of the Russian countryside gained during the First World War.

• Large sheet in an expressive formal language.

• With characteristically clear contours, angular shapes and dynamic lines, Schmidt-Rottluff created a composition in an almost ornamental style.

• Rare: only two other copies have been offered on the international auction market in the past 30 years (source: artprice.com).

PROVENANCE: Hermann Gerlinger Collection, Würzburg (with the collector's stamp, Lugt 6032, acquired in 2010).

EXHIBITION: Kunstmuseum Moritzburg, Halle an der Saale (permanent loan from the Hermann Gerlinger Collection, 2001-2017).

Buchheim Museum, Bernried (permanent loan from the Hermann Gerlinger Collection, 2017-2022).

LITERATURE: Rosa Schapire, Karl Schmidt-Rottluff. Graphisches Werk bis 1923, Berlin 1924, p. 47, no. H 236 (illu., plate vol.).

503.31

Karl Schmidt-Rottluff

Russische Landschaft, 1919.

Woodcut

Post auction sale: € 6,000 / $ 6,300

Buyer's premium, taxation and resale right compensation for Karl Schmidt-Rottluff "Russische Landschaft"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 503.31

Lot 503.31