357

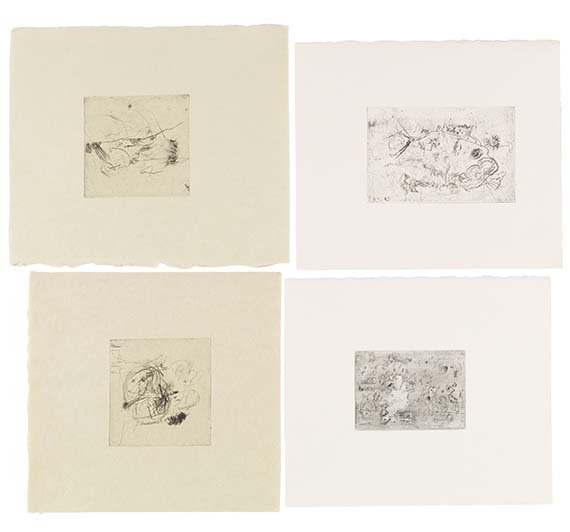

Wols (d. i. Wolfgang Schulz)

9 Radierungen, 2000-2001.

Etching

Estimate:

€ 1,000 / $ 1,180 Sold:

€ 1,000 / $ 1,180 (incl. surcharge)

Wols (d. i. Wolfgang Schulz)

9 Orig.-Kaltnadelradierungen aus dem Nachlaß. Rückseitig typographisch mit "Hors commerce. Oeuvre posthume, Collection Marc Johannes" bezeichnet. 3 der Radierungen auf leicht getöntem Japan, 6 auf Büttenkarton. Versch. Formate (ca. 9,5 : 10cm, 10,5 : 7 cm bis 20 : 15 cm). Hamburg, Griffelkunst 2000-2001.

Neun Nachlaßradierungen, die in der Collection Marc Johannes posthum durch die Griffelkunst veröffentlicht wurden.

Je 1 von 250 bis 350 Exemplaren der ersten Auflagen. - 26 unveröffentlichte Radierungen fanden sich im Nachlaß des Künstlers, 11 davon wurden von der Griffelkunst-Vereinigung Hamburg 2000 und 2001 erstmals ediert.

- PROVENIENZ: Aus dem Nachlaß Rolf Niederkrome.

LITERATUR: Griffelkunst E 338-342, 358 und 360-362.

9 drypoint etchings from the Wols estate. Typographically inscribed on the reverse with "Hors commerce. Oeuvre posthume, Collection Marc Johannes.". 3 of the etchings on slightly tinted Japan, 6 on laid paper. Different sizes (approx. 9.5 : 10 cm, 10.5 : 7 cm to 20 : 15 cm). - 1 of 250 to 350 numb. copies of the first editions. 26 unpublished etchings were found in the artist's estate, 11 of which were first edited by the Griffelkunst-Vereinigung Hamburg in 2000 and 2001.(R)

9 Orig.-Kaltnadelradierungen aus dem Nachlaß. Rückseitig typographisch mit "Hors commerce. Oeuvre posthume, Collection Marc Johannes" bezeichnet. 3 der Radierungen auf leicht getöntem Japan, 6 auf Büttenkarton. Versch. Formate (ca. 9,5 : 10cm, 10,5 : 7 cm bis 20 : 15 cm). Hamburg, Griffelkunst 2000-2001.

Neun Nachlaßradierungen, die in der Collection Marc Johannes posthum durch die Griffelkunst veröffentlicht wurden.

Je 1 von 250 bis 350 Exemplaren der ersten Auflagen. - 26 unveröffentlichte Radierungen fanden sich im Nachlaß des Künstlers, 11 davon wurden von der Griffelkunst-Vereinigung Hamburg 2000 und 2001 erstmals ediert.

- PROVENIENZ: Aus dem Nachlaß Rolf Niederkrome.

LITERATUR: Griffelkunst E 338-342, 358 und 360-362.

9 drypoint etchings from the Wols estate. Typographically inscribed on the reverse with "Hors commerce. Oeuvre posthume, Collection Marc Johannes.". 3 of the etchings on slightly tinted Japan, 6 on laid paper. Different sizes (approx. 9.5 : 10 cm, 10.5 : 7 cm to 20 : 15 cm). - 1 of 250 to 350 numb. copies of the first editions. 26 unpublished etchings were found in the artist's estate, 11 of which were first edited by the Griffelkunst-Vereinigung Hamburg in 2000 and 2001.(R)

357

Wols (d. i. Wolfgang Schulz)

9 Radierungen, 2000-2001.

Etching

Estimate:

€ 1,000 / $ 1,180 Sold:

€ 1,000 / $ 1,180 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 357

Lot 357