310

Hermann Max Pechstein

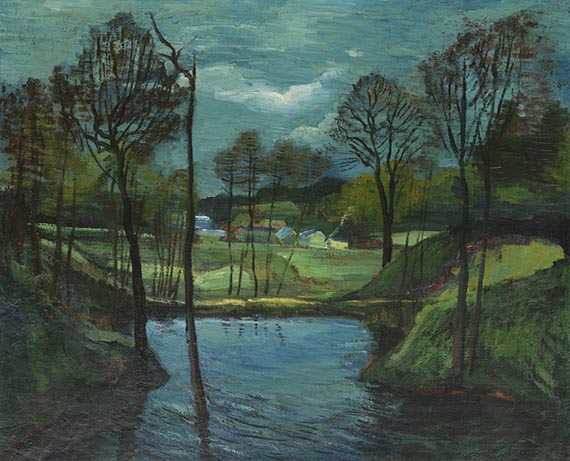

Forellenteich in Gliesnitz, Wohl 1944.

Oil on canvas

Estimate:

€ 40,000 / $ 47,200 Sold:

€ 60,960 / $ 71,932 (incl. surcharge)

Forellenteich in Gliesnitz. Wohl 1944.

Oil on canvas.

Soika 1944/1. 75 x 92 cm (29.5 x 36.2 in).

[AR].

• Trout pond on Gliesnitz manor in Western Pomerania, where Pechstein spent several weeks in May 1944.

• The balanced composition and the landscape's blue-green effects stand in a strong contrast to the difficult living conditions at the time of origin.

• Only very few paintings from around 1944/45 are known or preserved.

• Made in return for the hospitality of the property owner in Gliesnitz, ever since family-owned.

Accompanied by a written expertise (in copy) by Carl Georg Heise, former director of the Kunsthalle Hamburg from September 17, 1974.

PROVENANCE: Private collection Gliesnitz/Switzerland (gifted from the artist around 1944).

Private collection Switzerland (inherited from the above in 1988).

Oil on canvas.

Soika 1944/1. 75 x 92 cm (29.5 x 36.2 in).

[AR].

• Trout pond on Gliesnitz manor in Western Pomerania, where Pechstein spent several weeks in May 1944.

• The balanced composition and the landscape's blue-green effects stand in a strong contrast to the difficult living conditions at the time of origin.

• Only very few paintings from around 1944/45 are known or preserved.

• Made in return for the hospitality of the property owner in Gliesnitz, ever since family-owned.

Accompanied by a written expertise (in copy) by Carl Georg Heise, former director of the Kunsthalle Hamburg from September 17, 1974.

PROVENANCE: Private collection Gliesnitz/Switzerland (gifted from the artist around 1944).

Private collection Switzerland (inherited from the above in 1988).

Shortly after his friend, the painter Willy Jaeckel, was killed in an air raid in Berlin in January 1944, Hermann Max Pechstein wrote: "But now I've decided (..) to go to some other place where I can do my own work, otherwise I'll lose my courage. After all, I'm a painter!" (quoted from: Aya Soika, Max Pechstein. The catalog raisonné of oil paintings, Volume II, Munich 2011, p. 32). At the end of March he left Berlin behind and set out for Leba in Western Pomerania. Nevertheless, his life was still marked by great hardships and it becomes clear how difficult it was for the artist to find a way to paint and to get the necessary materials. Only a few paintings from this deprived period around 1944/45 are known or have been preserved. For 1944, Aya Soika's catalogue raisonné only mentions the present painting. In August the same year, Pechstein and his wife Marta were forced to work on the defense line "Pommernwall", employed under the most difficult conditions until the end of September, he had no opportunity to paint at all. It was not before March 1944 that he would find a retreat at Gut Gliesnitz for a short time, where he looked after the house of the owner friend for several weeks. A stay that inspired him to make his painting "Forellenteich in Gliesnitz" (Gliesnitz Trout Pond). Whether the work was created on site or at another point in time cannot be reconstructed with certainty. With the balanced composition and his preference for blue-green effects, Pechstein created a peaceful scenery that seems to stand in stark contrast to the difficult living conditions at the time of its creation. He left the painting as a gift to the family of the estate’s owner, where it has survived to this day and is now offered on the art market for the very first time. [AR]

310

Hermann Max Pechstein

Forellenteich in Gliesnitz, Wohl 1944.

Oil on canvas

Estimate:

€ 40,000 / $ 47,200 Sold:

€ 60,960 / $ 71,932 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 310

Lot 310