175

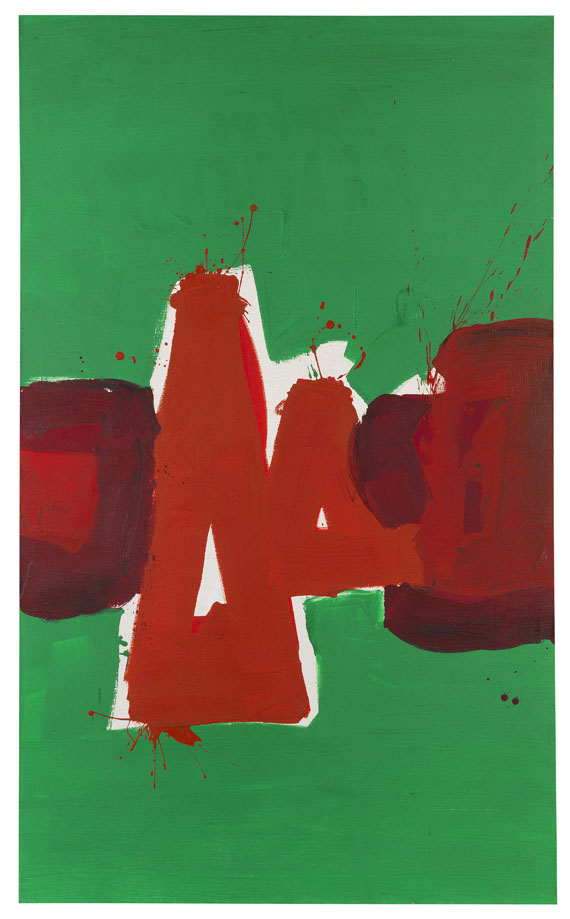

Markus Prachensky

Rot und grüne Flächen – Solitude II, 1964.

Oil on canvas

Estimate:

€ 40,000 / $ 47,200 Sold:

€ 55,000 / $ 64,900 (incl. surcharge)

Rot und grüne Flächen – Solitude II. 1964.

Oil on canvas.

Signed, dated, titled and inscribed with the dimensions and a direction arrow on the reverse. 165 x 100 cm (64.9 x 39.3 in).

[AR].

• High-contrast work from the group of the "Solitude" pictures, which the artist created in his Stuttgart studio as of 1964.

• The red forms sprawl across the canvas like charcters and collide with the green background.

• Shown at the "Große Kunstausstellung" at the Haus der Kunst in Munich a year after it was made, and was show again in the grand retrospective exhibition at the Kunstverein Hanover in 1970.

• Family-owned for more than 50 years.

PROVENANCE: Private collection Southern Germany (acquired directly from the artist, ever since family-owned).

EXHIBITION: Große Kunstausstellung, Haus der Kunst, Munich, June 24 - October 3, 1965, cat. no. 272 (with the exhibition label on the reverse).

Markus Prachensky, Kunstverein Hanover, August 29 - September 27, 1970 (with illu. on p. 73).

"These pictures emanate a strange intimacy. They vibrate as if they were energized. [..] Colors and forms evoke contrasts so strong that the voltage ratio should be measurable."

Heinz Ohff about the Markus-Prachensky exhibition at Galerie Schüler, 1965, in: Tagesspiegel, Berlin, March 11, 1965.

Oil on canvas.

Signed, dated, titled and inscribed with the dimensions and a direction arrow on the reverse. 165 x 100 cm (64.9 x 39.3 in).

[AR].

• High-contrast work from the group of the "Solitude" pictures, which the artist created in his Stuttgart studio as of 1964.

• The red forms sprawl across the canvas like charcters and collide with the green background.

• Shown at the "Große Kunstausstellung" at the Haus der Kunst in Munich a year after it was made, and was show again in the grand retrospective exhibition at the Kunstverein Hanover in 1970.

• Family-owned for more than 50 years.

PROVENANCE: Private collection Southern Germany (acquired directly from the artist, ever since family-owned).

EXHIBITION: Große Kunstausstellung, Haus der Kunst, Munich, June 24 - October 3, 1965, cat. no. 272 (with the exhibition label on the reverse).

Markus Prachensky, Kunstverein Hanover, August 29 - September 27, 1970 (with illu. on p. 73).

"These pictures emanate a strange intimacy. They vibrate as if they were energized. [..] Colors and forms evoke contrasts so strong that the voltage ratio should be measurable."

Heinz Ohff about the Markus-Prachensky exhibition at Galerie Schüler, 1965, in: Tagesspiegel, Berlin, March 11, 1965.

175

Markus Prachensky

Rot und grüne Flächen – Solitude II, 1964.

Oil on canvas

Estimate:

€ 40,000 / $ 47,200 Sold:

€ 55,000 / $ 64,900 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 175

Lot 175