487

Ernst Ludwig Kirchner

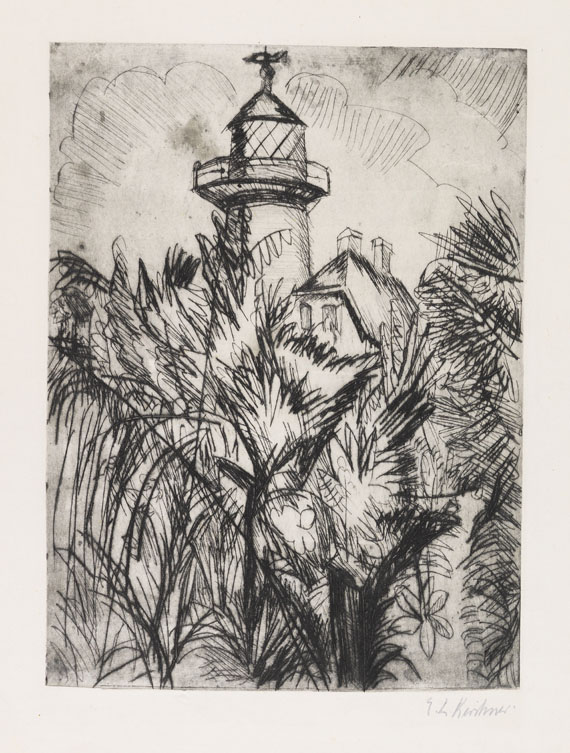

Leuchtturm im Grünen, Fehmarn, 1913.

Drypoint

Estimate:

€ 8,000 / $ 9,440 Sold:

€ 9,000 / $ 10,620 (incl. surcharge)

Leuchtturm im Grünen, Fehmarn. 1913.

Drypoint.

Gercken 610/ II (of II). Dube R. 152. Schiefler R. 149. Signed by Erna Schilling on behalf of E. L. Kirchner. Verso with the barely legible stamp "Unverkäuflich EL Kirchner". On copper plate printing paper. 33.5 x 24.8 cm (13.1 x 9.7 in). Sheet: 49,5 x 36,5 cm (19,4 x 14,3 in).

This is a copy from the artist's archive. Kirchner always marked one proof of his prints as unsellable and kept it for documentation purposes. [EH].

• One of just two known copies.

• In the artist's posession up until his death.

• Burred, strong print of this very rare etching.

PROVENANCE: From the artist's estate.

Christian Anton Laely, Davos (taken from aforementioned estate in 1946 and ascribed to the fictitious "Collection Gervais", verso with hand-written inventory number "KR 80").

Private collection Southern Germany (acquired from Hauswedell & Nolte in 2009).

LITERATURE: Hauswedell & Nolte, Hamburg, December 4, 2009, 420th auction, lot no. 33.

Drypoint.

Gercken 610/ II (of II). Dube R. 152. Schiefler R. 149. Signed by Erna Schilling on behalf of E. L. Kirchner. Verso with the barely legible stamp "Unverkäuflich EL Kirchner". On copper plate printing paper. 33.5 x 24.8 cm (13.1 x 9.7 in). Sheet: 49,5 x 36,5 cm (19,4 x 14,3 in).

This is a copy from the artist's archive. Kirchner always marked one proof of his prints as unsellable and kept it for documentation purposes. [EH].

• One of just two known copies.

• In the artist's posession up until his death.

• Burred, strong print of this very rare etching.

PROVENANCE: From the artist's estate.

Christian Anton Laely, Davos (taken from aforementioned estate in 1946 and ascribed to the fictitious "Collection Gervais", verso with hand-written inventory number "KR 80").

Private collection Southern Germany (acquired from Hauswedell & Nolte in 2009).

LITERATURE: Hauswedell & Nolte, Hamburg, December 4, 2009, 420th auction, lot no. 33.

487

Ernst Ludwig Kirchner

Leuchtturm im Grünen, Fehmarn, 1913.

Drypoint

Estimate:

€ 8,000 / $ 9,440 Sold:

€ 9,000 / $ 10,620 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 487

Lot 487