352

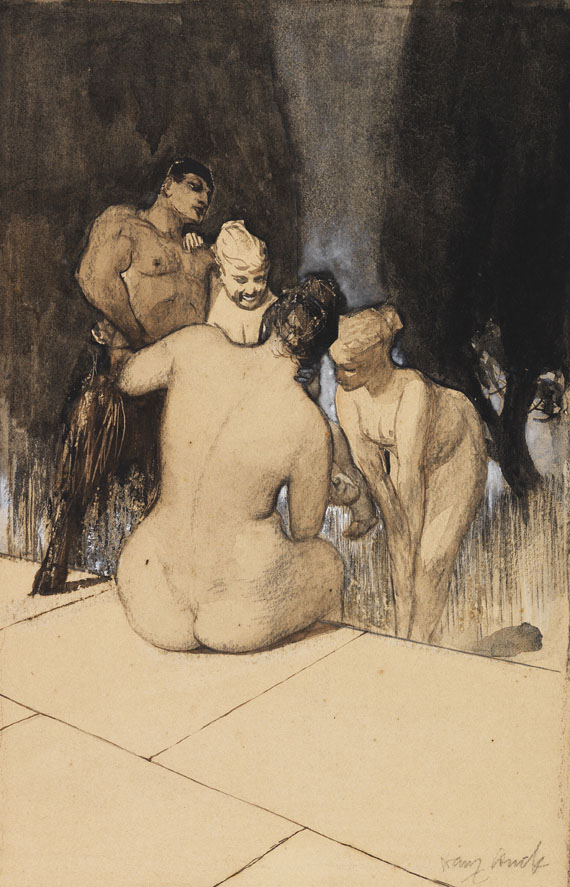

Satyr mit Nymphen und Kind, Ca. 1889.

Watercolor, India ink, gouache, pencil and blac...

Estimate:

€ 12,000 / $ 14,160 Sold:

€ 15,000 / $ 17,700 (incl. surcharge)

Satyr mit Nymphen und Kind. Ca. 1889.

Watercolor, India ink, gouache, pencil and black chalks on light board.

Signed in lower right. Verso of backing with several old labels, among them from the Dörner Institute Munich, and with several hand-written numbers. 33.5 x 22.5 cm (13.1 x 8.8 in). Board: 45 x 33 cm (17,7 x 13 in).

• Very rare watercolor from Stuck's early period of creation, a document of the transition from graphic artist to painter.

• Technically fascinating sheet.

• Early examination of the amorous-erotic motif of faun and nymph.

PROVENANCE: Moderne Galerie Heinrich Thannhauser, Munich, no. 2474 (with the label).

Galerie de 3 Gratiën, Amsterdam (with the label).

Christie's, Amsterdam, auction on July 8, 1998, lot 162.

Private collection Netherlands (acquired at aforementioned auction).

Watercolor, India ink, gouache, pencil and black chalks on light board.

Signed in lower right. Verso of backing with several old labels, among them from the Dörner Institute Munich, and with several hand-written numbers. 33.5 x 22.5 cm (13.1 x 8.8 in). Board: 45 x 33 cm (17,7 x 13 in).

• Very rare watercolor from Stuck's early period of creation, a document of the transition from graphic artist to painter.

• Technically fascinating sheet.

• Early examination of the amorous-erotic motif of faun and nymph.

PROVENANCE: Moderne Galerie Heinrich Thannhauser, Munich, no. 2474 (with the label).

Galerie de 3 Gratiën, Amsterdam (with the label).

Christie's, Amsterdam, auction on July 8, 1998, lot 162.

Private collection Netherlands (acquired at aforementioned auction).

More Information

Share

+Share link

+Share link

+Share link

+Share link

352

Satyr mit Nymphen und Kind, Ca. 1889.

Watercolor, India ink, gouache, pencil and blac...

Estimate:

€ 12,000 / $ 14,160 Sold:

€ 15,000 / $ 17,700 (incl. surcharge)

More Information

Share

+Share link

+Share link

+Share link

+Share link

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 352

Lot 352