11

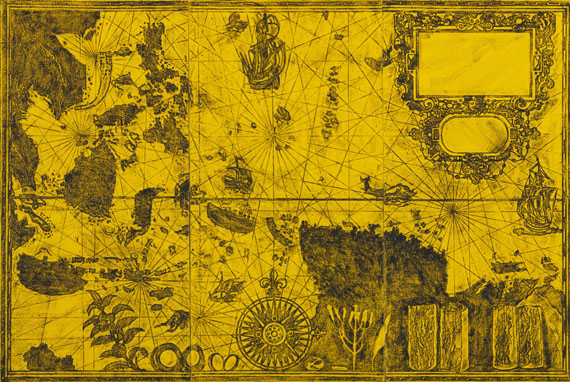

Matt Mullican

Untitled (3-tlg.), 1991.

Frottage. Acrylic and oil crayon on canvas

Estimate:

€ 12,000 / $ 14,160 Sold:

€ 27,500 / $ 32,450 (incl. surcharge)

Untitled (3-tlg.). 1991.

Frottage. Acrylic and oil crayon on canvas.

Three panels, each 305 x 153 cm (120 x 60.2 in). Total dimensions ca. 305 x 460 cm (120 x 181 in).

Attached: Matt Mullican, "Map of the East Indies from 1965", etching, 35 x 25 cm (13,8 x 9,8 in) as preliminary draft for this work. [CH].

• Large-size work in three parts

• Works by the artist are part of many acclaimed public collections like the London Tate Modern, the Haus der Kunst in Munich or the Museum of Modern Art and the Metropolitan Museum of Art in New York.

• The GAK regards Matt Mullican one of the internationally most important artists of his generation

• Until October 18, 2020 the Belgian Musée des Arts Contemporains in Boussu shows some of his works in the solo show "Representing the Work".

PROVENANCE: Company collection Thomas Cook Touristik GmbH (acquired from the artist).

Frottage. Acrylic and oil crayon on canvas.

Three panels, each 305 x 153 cm (120 x 60.2 in). Total dimensions ca. 305 x 460 cm (120 x 181 in).

Attached: Matt Mullican, "Map of the East Indies from 1965", etching, 35 x 25 cm (13,8 x 9,8 in) as preliminary draft for this work. [CH].

• Large-size work in three parts

• Works by the artist are part of many acclaimed public collections like the London Tate Modern, the Haus der Kunst in Munich or the Museum of Modern Art and the Metropolitan Museum of Art in New York.

• The GAK regards Matt Mullican one of the internationally most important artists of his generation

• Until October 18, 2020 the Belgian Musée des Arts Contemporains in Boussu shows some of his works in the solo show "Representing the Work".

PROVENANCE: Company collection Thomas Cook Touristik GmbH (acquired from the artist).

11

Matt Mullican

Untitled (3-tlg.), 1991.

Frottage. Acrylic and oil crayon on canvas

Estimate:

€ 12,000 / $ 14,160 Sold:

€ 27,500 / $ 32,450 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 11

Lot 11