350

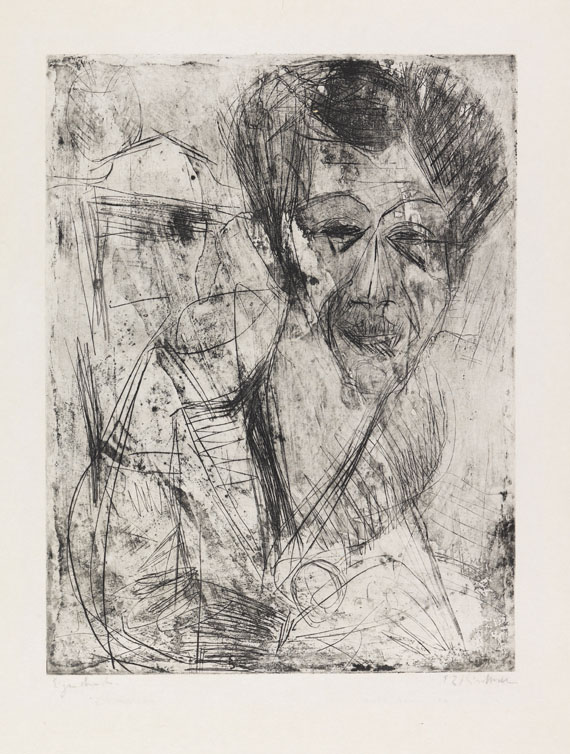

Ernst Ludwig Kirchner

Selbstbildnis (zeichnend), 1916.

Etching with surface etching

Estimate:

€ 40,000 / $ 47,200 Sold:

€ 231,250 / $ 272,875 (incl. surcharge)

Selbstbildnis (zeichnend). 1916.

Etching with surface etching.

Gercken 780 (II of III). Signed and inscribed "Eigendruck". On blotting paper by Huber Frères Wintherthur (with embosing print). 40.5 x 30.7 cm (15.9 x 12 in). Sheet: 85 x 42,8 cm (33,4 x 16,8 in).

• This is the first time in 25 years that a copy of this etching is offered on the international auction market.

• The only self portrait made in 1916

• Other copies are in the Brücke Museum, Berlin and the Städel Museum, Frankfurt.

PROVENANCE: Private collection Germany (family-owned since 1972).

LITERATURE: Kornfeld und Klipstein, Bern, 145th auction, June 15 - 17, 1972, lot 524.

From a letter by Ernst Ludwig Kirchner to Gustav Schiefler about this etching:

Dear director,

I hereby send you the self portrait for your daughter. I made in a night during which I nearly lost consciousness, and i am not sure if she'll like it, so I added 2 other sheets. I will come back to Königstein to continue my treatment around mid May. Outside my studio and my accustomed work it is dififcult for me to exist the way the doctor wants me to. But it's okay, and I hope to get back on my feet.

Quote after: Wolfgang Henze, Ernst Ludwig Kirchner - Gustav Schiefler. Briefwechsel, p. 78

Etching with surface etching.

Gercken 780 (II of III). Signed and inscribed "Eigendruck". On blotting paper by Huber Frères Wintherthur (with embosing print). 40.5 x 30.7 cm (15.9 x 12 in). Sheet: 85 x 42,8 cm (33,4 x 16,8 in).

• This is the first time in 25 years that a copy of this etching is offered on the international auction market.

• The only self portrait made in 1916

• Other copies are in the Brücke Museum, Berlin and the Städel Museum, Frankfurt.

PROVENANCE: Private collection Germany (family-owned since 1972).

LITERATURE: Kornfeld und Klipstein, Bern, 145th auction, June 15 - 17, 1972, lot 524.

From a letter by Ernst Ludwig Kirchner to Gustav Schiefler about this etching:

Dear director,

I hereby send you the self portrait for your daughter. I made in a night during which I nearly lost consciousness, and i am not sure if she'll like it, so I added 2 other sheets. I will come back to Königstein to continue my treatment around mid May. Outside my studio and my accustomed work it is dififcult for me to exist the way the doctor wants me to. But it's okay, and I hope to get back on my feet.

Quote after: Wolfgang Henze, Ernst Ludwig Kirchner - Gustav Schiefler. Briefwechsel, p. 78

350

Ernst Ludwig Kirchner

Selbstbildnis (zeichnend), 1916.

Etching with surface etching

Estimate:

€ 40,000 / $ 47,200 Sold:

€ 231,250 / $ 272,875 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 350

Lot 350