132

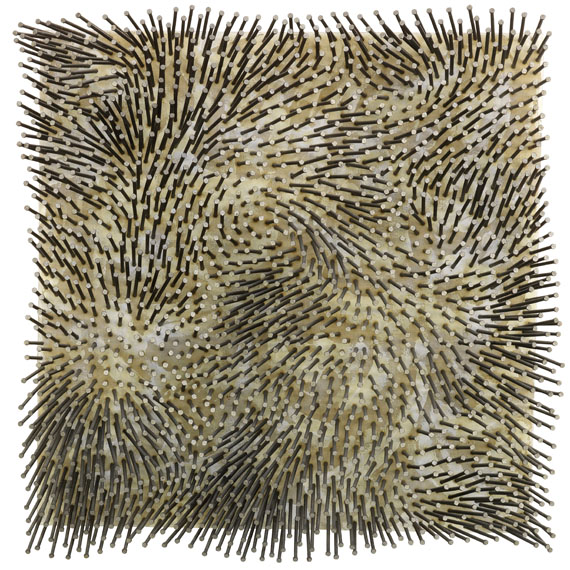

Günther Uecker

Bewegtes Feld, 1983.

Nails and white paint on canvas, on panel

Estimate:

€ 140,000 / $ 165,200 Sold:

€ 237,500 / $ 280,250 (incl. surcharge)

Bewegtes Feld. 1983.

Nails and white paint on canvas, on panel.

Verso signed, dated, titled, inscribed and with a direction arrow. 40 x 40 x 9 cm (15.7 x 15.7 x 3.5 in).

• Particularly harmonious example of the moved nail fields.

• In private possession for 35 years.

• The rhythmically arranged nails fully cover and expand the image carrier.

The work is registered at the Uecker archive under the number GU.83.013 and has been earmarked for inlcusion into the forthcoming catalog raisonné.

PROVENANCE: Erker Galerie, St. Gallen.

Private collection Baden-Württemberg (acquired directly from aforementioned).

"The nail fields, which the artist continues to make, appear a lot more dynamic and more eventful than ealier ones. […] These moved fields are made of heavier materials while the appear with a much lighter aesthetic and count among the most virtuoso accomplishments that Uecker attained in context of his operating principle."

Dieter Honisch, Günther Uecker, Stuttgart 1983, p. 93.

Nails and white paint on canvas, on panel.

Verso signed, dated, titled, inscribed and with a direction arrow. 40 x 40 x 9 cm (15.7 x 15.7 x 3.5 in).

• Particularly harmonious example of the moved nail fields.

• In private possession for 35 years.

• The rhythmically arranged nails fully cover and expand the image carrier.

The work is registered at the Uecker archive under the number GU.83.013 and has been earmarked for inlcusion into the forthcoming catalog raisonné.

PROVENANCE: Erker Galerie, St. Gallen.

Private collection Baden-Württemberg (acquired directly from aforementioned).

"The nail fields, which the artist continues to make, appear a lot more dynamic and more eventful than ealier ones. […] These moved fields are made of heavier materials while the appear with a much lighter aesthetic and count among the most virtuoso accomplishments that Uecker attained in context of his operating principle."

Dieter Honisch, Günther Uecker, Stuttgart 1983, p. 93.

132

Günther Uecker

Bewegtes Feld, 1983.

Nails and white paint on canvas, on panel

Estimate:

€ 140,000 / $ 165,200 Sold:

€ 237,500 / $ 280,250 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 132

Lot 132