253

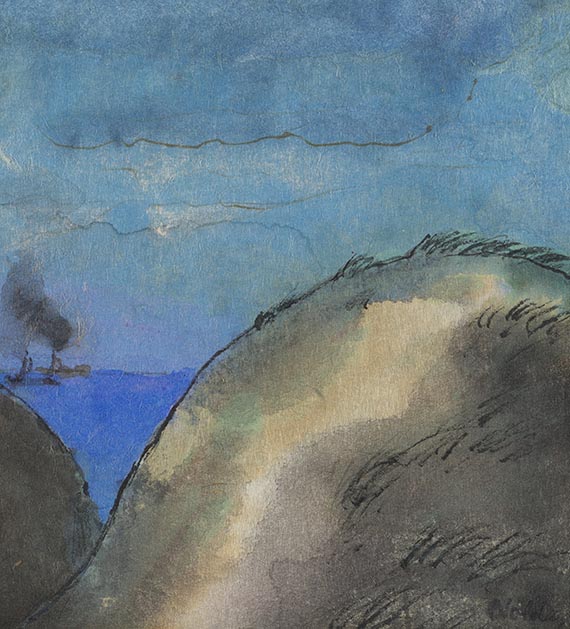

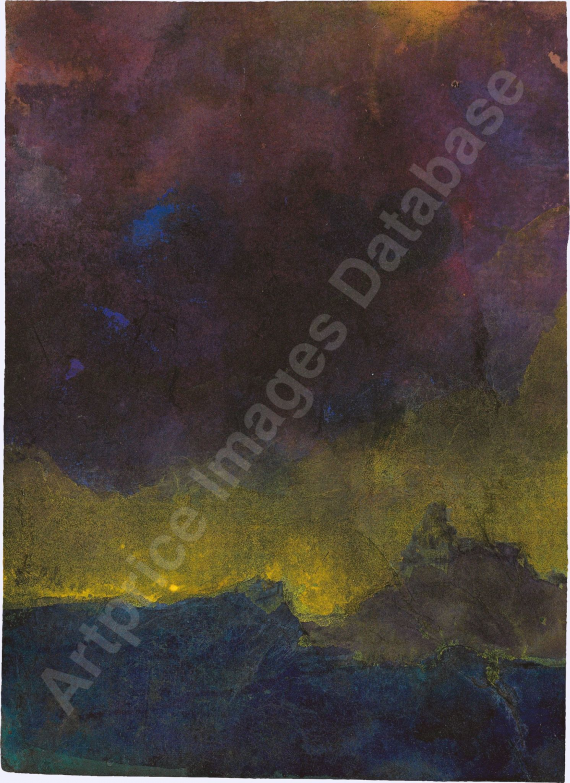

Emil Nolde

Am Meer, Um 1930/50.

Watercolor and ink pen

Estimate:

€ 30,000 - 40,000

$ 33,000 - 44,000

Am Meer. Um 1930/50.

Watercolor and ink pen.

Signed lower right. Titled on the accompanying backing board. On fine Japanese paper. 15.4 x 13.3 cm (6 x 5.2 in), the full sheet. [CH].

• Depictions of the sea and Northern German landscapes, in particular of his native Seebüll in Holstein, are found throughout Emil Nolde's entire oeuvre.

• In the present work, the artist breaks up the flat blue-gray color scheme with fine hatched lines and the motifs of small steamships emitting dark smoke.

• Atmospheric composition: the sloping dunes allow only a glimpse of the vast sea and the cloudy sky, seeming to offer the painter protection from wind and storms.

Accompanied by a written confirmation issued by Prof. Dr. Manfred Reuther, then Director of the Seebüll Ada and Emil Nolde Foundation, dated September 4, 2007.

The Academic Advisory Board of the Seebüll Ada and Emil Nolde Foundation has confirmed the inclusion of the work in a future catalogue raisonné of the watercolors and drawings of Emil Nolde (1867–1956) in writing.

PROVENANCE: Presumably Commetersche Kunsthandlung, Hamburg (with the label on the reverse).

Private collection, Northern Germany.

Called up: December 7, 2024 - ca. 15.30 h +/- 20 min.

Watercolor and ink pen.

Signed lower right. Titled on the accompanying backing board. On fine Japanese paper. 15.4 x 13.3 cm (6 x 5.2 in), the full sheet. [CH].

• Depictions of the sea and Northern German landscapes, in particular of his native Seebüll in Holstein, are found throughout Emil Nolde's entire oeuvre.

• In the present work, the artist breaks up the flat blue-gray color scheme with fine hatched lines and the motifs of small steamships emitting dark smoke.

• Atmospheric composition: the sloping dunes allow only a glimpse of the vast sea and the cloudy sky, seeming to offer the painter protection from wind and storms.

Accompanied by a written confirmation issued by Prof. Dr. Manfred Reuther, then Director of the Seebüll Ada and Emil Nolde Foundation, dated September 4, 2007.

The Academic Advisory Board of the Seebüll Ada and Emil Nolde Foundation has confirmed the inclusion of the work in a future catalogue raisonné of the watercolors and drawings of Emil Nolde (1867–1956) in writing.

PROVENANCE: Presumably Commetersche Kunsthandlung, Hamburg (with the label on the reverse).

Private collection, Northern Germany.

Called up: December 7, 2024 - ca. 15.30 h +/- 20 min.

253

Emil Nolde

Am Meer, Um 1930/50.

Watercolor and ink pen

Estimate:

€ 30,000 - 40,000

$ 33,000 - 44,000

Buyer's premium, taxation and resale right compensation for Emil Nolde "Am Meer"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 253

Lot 253