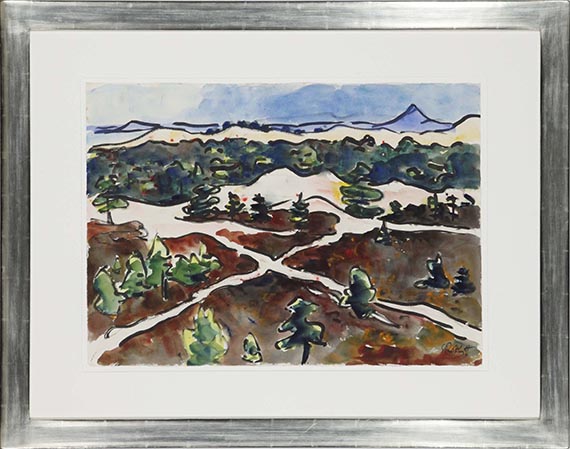

Frame image

246

Karl Schmidt-Rottluff

Pfade im Dünengelände, 1938.

Watercolor

Estimate:

€ 18,000 - 24,000

$ 19,800 - 26,400

Pfade im Dünengelände. 1938.

Watercolor.

Signed and inscribed with the work number "3856" lower right. On P.M.Fabriano wove paper (with the watermark). 50.5 x 69.5 cm (19.8 x 27.3 in), the full sheet. [EH].

• Atmospheric view of Lake Leba in Pomerania , where Karl and Emy Schmidt-Rottluff spent many summers in the 1930s and 1940s.

• Following his stays in Jershöft, Schmidt-Rottluff discovered the area around Lake Leba as a new source of artistic inspiration.

• In private North German ownership for over 30 years.

• A new interpretation of the landscape in striking clarity.

The work is documented in the archive of the Karl and Emy Schmidt-Rottluff Foundation, Berlin.

PROVENANCE: Private collection, Northern Germany.

LITERATURE: Grisebach, Berlin, Kunst des 19.und 20. Jahrhunderts, auction 60, November 29, 1997, lot 208 (illu. in color).

Called up: December 7, 2024 - ca. 15.21 h +/- 20 min.

Watercolor.

Signed and inscribed with the work number "3856" lower right. On P.M.Fabriano wove paper (with the watermark). 50.5 x 69.5 cm (19.8 x 27.3 in), the full sheet. [EH].

• Atmospheric view of Lake Leba in Pomerania , where Karl and Emy Schmidt-Rottluff spent many summers in the 1930s and 1940s.

• Following his stays in Jershöft, Schmidt-Rottluff discovered the area around Lake Leba as a new source of artistic inspiration.

• In private North German ownership for over 30 years.

• A new interpretation of the landscape in striking clarity.

The work is documented in the archive of the Karl and Emy Schmidt-Rottluff Foundation, Berlin.

PROVENANCE: Private collection, Northern Germany.

LITERATURE: Grisebach, Berlin, Kunst des 19.und 20. Jahrhunderts, auction 60, November 29, 1997, lot 208 (illu. in color).

Called up: December 7, 2024 - ca. 15.21 h +/- 20 min.

246

Karl Schmidt-Rottluff

Pfade im Dünengelände, 1938.

Watercolor

Estimate:

€ 18,000 - 24,000

$ 19,800 - 26,400

Buyer's premium, taxation and resale right compensation for Karl Schmidt-Rottluff "Pfade im Dünengelände"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 246

Lot 246