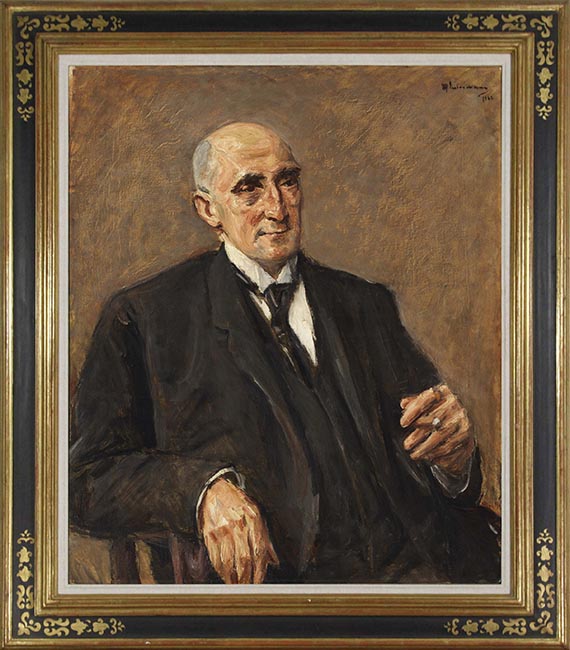

Frame image

215

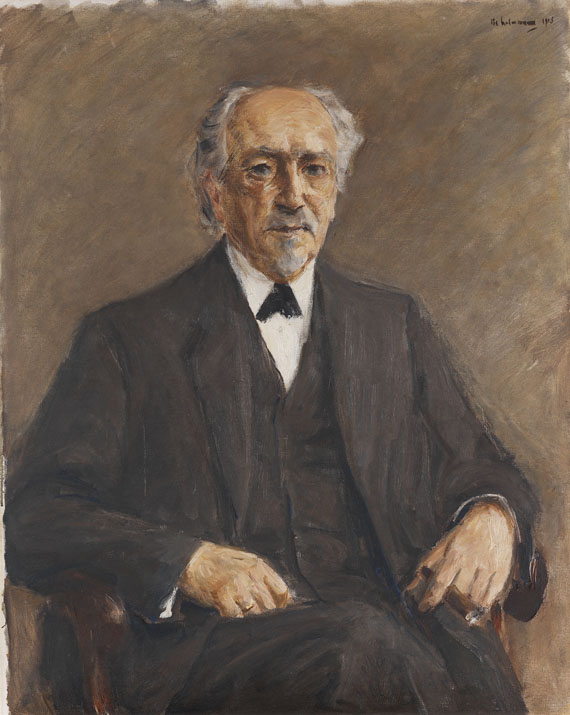

Max Liebermann

Bildnis des Textilfabrikanten Carl Lewin, 1922.

Oil on canvas

Estimate:

€ 20,000 - 30,000

$ 22,000 - 33,000

Bildnis des Textilfabrikanten Carl Lewin. 1922.

Oil on canvas.

Signed and dated upper right. 90 x 72.5 cm (35.4 x 28.5 in).

[AR].

• Made for one of the six children of the art-loving industrialist Carl Lewin from Breslau, who was also portrayed by Georg Kolbe.

• Initially criticized for a lack of idealization in his earlier portraits, Liebermann eventually became one of the most sought-after portraitists of his time. In 1927, he received a commission to paint the Reich President Paul von Hindenburg.

• Similar works can be found in numerous museum collections, including the Kunsthalle Hamburg, the Staatliche Museen Schwerin and the Alte Nationalgalerie in Berlin.

PROVENANCE: The work is free from restitution claims. The offer is made subject to an amicable agreement with the heirs of Cäcilie Beermann on the basis of a fair and just solution.

LITERATURE: Matthias Eberle, Max Liebermann. Werkverzeichnis der Gemälde und Ölstudien, vol. II: 1900-1935, Munich 1996, no. 1922/15 (illu. in black and white on p. 1058).

--

Galerie Rosen, auction 24, Berlin May 16 - 18, 1955, no. 1876.

Peter Günnemann, Hamburg, 18th auction, April 4, 1992, lot 15 (illu. in color).

Called up: December 7, 2024 - ca. 14.40 h +/- 20 min.

Oil on canvas.

Signed and dated upper right. 90 x 72.5 cm (35.4 x 28.5 in).

[AR].

• Made for one of the six children of the art-loving industrialist Carl Lewin from Breslau, who was also portrayed by Georg Kolbe.

• Initially criticized for a lack of idealization in his earlier portraits, Liebermann eventually became one of the most sought-after portraitists of his time. In 1927, he received a commission to paint the Reich President Paul von Hindenburg.

• Similar works can be found in numerous museum collections, including the Kunsthalle Hamburg, the Staatliche Museen Schwerin and the Alte Nationalgalerie in Berlin.

PROVENANCE: The work is free from restitution claims. The offer is made subject to an amicable agreement with the heirs of Cäcilie Beermann on the basis of a fair and just solution.

LITERATURE: Matthias Eberle, Max Liebermann. Werkverzeichnis der Gemälde und Ölstudien, vol. II: 1900-1935, Munich 1996, no. 1922/15 (illu. in black and white on p. 1058).

--

Galerie Rosen, auction 24, Berlin May 16 - 18, 1955, no. 1876.

Peter Günnemann, Hamburg, 18th auction, April 4, 1992, lot 15 (illu. in color).

Called up: December 7, 2024 - ca. 14.40 h +/- 20 min.

This portrait is one of four paintings that the textile manufacturer Carl Lewin commissioned his friend Max Liebermann with: a portrait for four of his six children - the others received his portrait bust by Georg Kolbe. The painting shown here was intended for his daughter Cäcilie, another for Leo Lewin, the important art collector (and her brother).

As a Jew, Cäcilie suffered persecution by the National Socialists soon after the Nazis came into power. Her two sons were able to flee to South Africa in time, but Cäcilie was not. Shortly before she was deported to Auschwitz, she gave her possessions, including her art collection, to a distant non-Jewish relative, Hermine Marie Lewin, née Radespiel. The portrait thus remained in Berlin and was saved from confiscation.

Cäcilie did not survive deportation and her sons never received the painting back. Instead, the painting was sold by the descendants of Hermine Marie Lewin in 1955. Today, the painting with its eventful history can be offered free from restitution claims based on a fair and just solution. [CFN]

As a Jew, Cäcilie suffered persecution by the National Socialists soon after the Nazis came into power. Her two sons were able to flee to South Africa in time, but Cäcilie was not. Shortly before she was deported to Auschwitz, she gave her possessions, including her art collection, to a distant non-Jewish relative, Hermine Marie Lewin, née Radespiel. The portrait thus remained in Berlin and was saved from confiscation.

Cäcilie did not survive deportation and her sons never received the painting back. Instead, the painting was sold by the descendants of Hermine Marie Lewin in 1955. Today, the painting with its eventful history can be offered free from restitution claims based on a fair and just solution. [CFN]

215

Max Liebermann

Bildnis des Textilfabrikanten Carl Lewin, 1922.

Oil on canvas

Estimate:

€ 20,000 - 30,000

$ 22,000 - 33,000

Buyer's premium and taxation for Max Liebermann "Bildnis des Textilfabrikanten Carl Lewin"

This lot can be purchased subject to differential or regular taxation.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Lot 215

Lot 215