Video

260

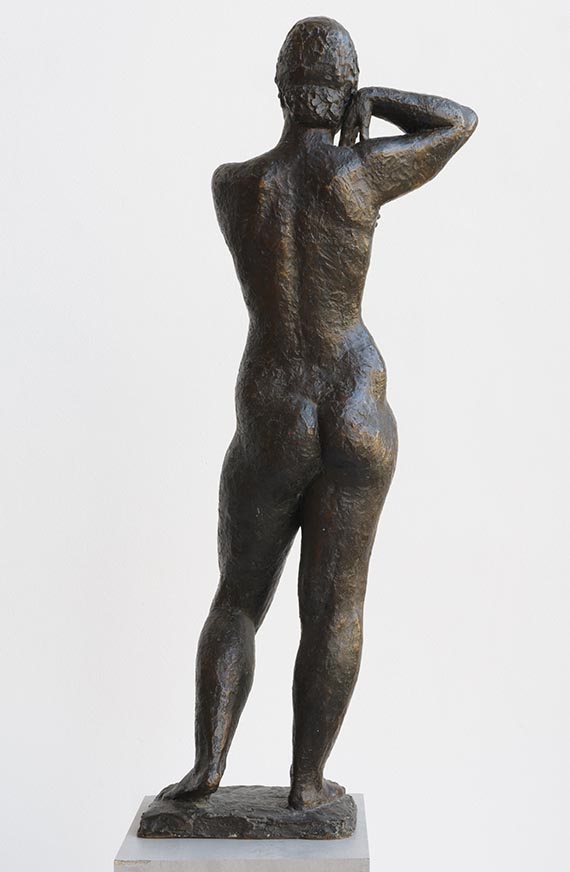

Gerhard Marcks

Die Gärtnerin, 1934.

Bronze with brown patina

Estimate:

€ 40,000 / $ 47,200 Sold:

€ 96,520 / $ 113,893 (incl. surcharge)

260

Gerhard Marcks

Die Gärtnerin, 1934.

Bronze with brown patina

Estimate:

€ 40,000 / $ 47,200 Sold:

€ 96,520 / $ 113,893 (incl. surcharge)

Die Gärtnerin. 1934.

Bronze with brown patina.

Monogrammed (ligature) on the plinth behind the left foot. Foundry mark “GUSS RICH. BARTH MARIENDORF” on the back of the base. Height: 101 cm (39.7 in).

• Scarce – no copy of this bronze has been offered on the international auction market in the last 40 years (source: artprice.com).

• The catalogue raisonné mentions only three copies of this bronze.

• The diversity of his oeuvre makes Gerhard Marcks, along with Barlach, Lehmbruck, and Kolbe, one of the most important German sculptors of the last century.

Bronze with brown patina.

Monogrammed (ligature) on the plinth behind the left foot. Foundry mark “GUSS RICH. BARTH MARIENDORF” on the back of the base. Height: 101 cm (39.7 in).

• Scarce – no copy of this bronze has been offered on the international auction market in the last 40 years (source: artprice.com).

• The catalogue raisonné mentions only three copies of this bronze.

• The diversity of his oeuvre makes Gerhard Marcks, along with Barlach, Lehmbruck, and Kolbe, one of the most important German sculptors of the last century.

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.