232

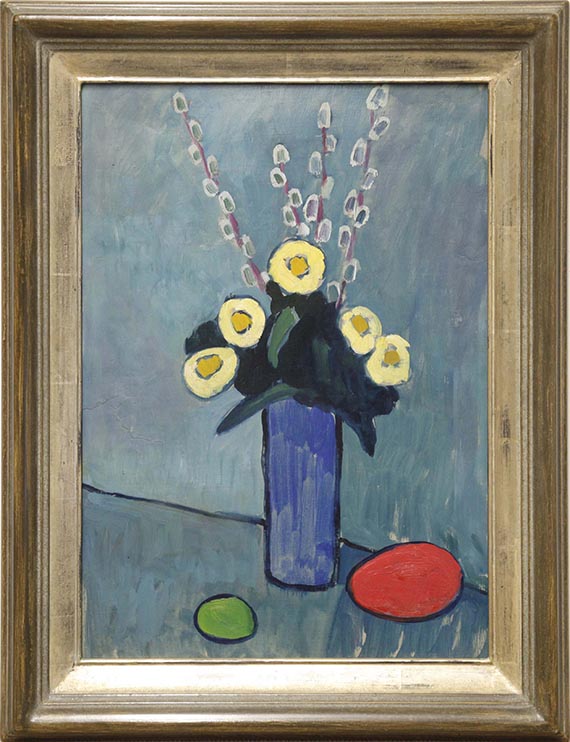

Gabriele Münter

Blumenstillleben, Um 1950.

Oil on cardboard, laid on artist board by Mün

Estimate:

€ 50,000 / $ 55,000 Sold:

€ 63,500 / $ 69,850 (incl. surcharge)

Blumenstillleben. Around 1950.

Oil on cardboard, laid on artist board by Münter.

Inscribed “Liste 14 Nr. 21” on the reverse. With a label bearing the number “B 263” (partly by hand, partly stamped) on the reverse. 47.3 x 33.7 cm (18.6 x 13.2 in). [CH].

• Gabriele Münter's use of reduced formal language, bold and clear colors, and strong contrasts allows her to create a still life of great expressiveness.

• The still life is one of the most relevant subjects in her entire oeuvre – from the pioneering days of the “Blauer Reiter” to the late work of the 1950s.

• In 1955, Gabriele was represented at the first documenta in Kassel with, among other works, a still life.

• This year, Gabriele Münter is honored internationally with numerous museum exhibitions (Vienna, Madrid, London and Bern).

PROVENANCE: Private collection, Hamburg.

Ivan Ristic, Leopold Museum Vienna, in: ex. cat. Gabriele Münter. Retrospektive, Leopold Museum, Vienna, p. 218.

Oil on cardboard, laid on artist board by Münter.

Inscribed “Liste 14 Nr. 21” on the reverse. With a label bearing the number “B 263” (partly by hand, partly stamped) on the reverse. 47.3 x 33.7 cm (18.6 x 13.2 in). [CH].

• Gabriele Münter's use of reduced formal language, bold and clear colors, and strong contrasts allows her to create a still life of great expressiveness.

• The still life is one of the most relevant subjects in her entire oeuvre – from the pioneering days of the “Blauer Reiter” to the late work of the 1950s.

• In 1955, Gabriele was represented at the first documenta in Kassel with, among other works, a still life.

• This year, Gabriele Münter is honored internationally with numerous museum exhibitions (Vienna, Madrid, London and Bern).

PROVENANCE: Private collection, Hamburg.

Ivan Ristic, Leopold Museum Vienna, in: ex. cat. Gabriele Münter. Retrospektive, Leopold Museum, Vienna, p. 218.

232

Gabriele Münter

Blumenstillleben, Um 1950.

Oil on cardboard, laid on artist board by Mün

Estimate:

€ 50,000 / $ 55,000 Sold:

€ 63,500 / $ 69,850 (incl. surcharge)

Lot 232

Lot 232