216

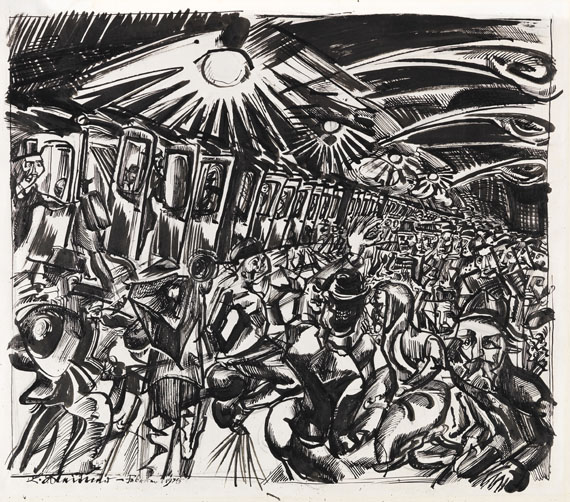

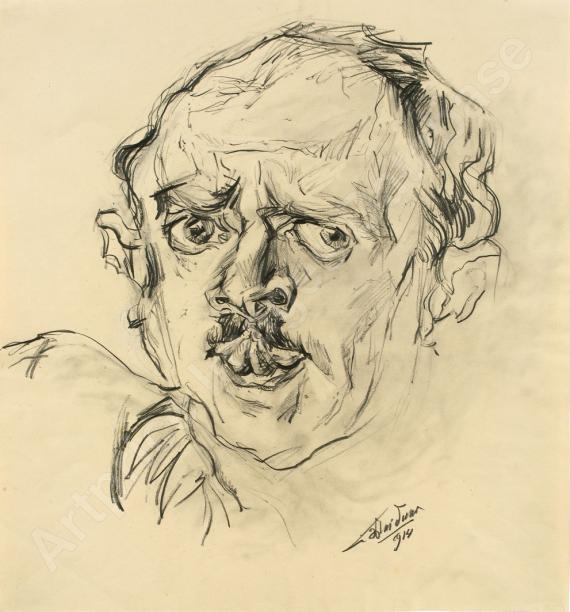

Ludwig Meidner

Selbstbildnis, 1912.

Pencil

Estimate:

€ 15,000 - 20,000

$ 16,500 - 22,000

Selbstbildnis. 1912.

Pencil.

Monogrammed and dated lower left. With the estate stamp (not in Lugt) and the handwritten inventory number “II/83” on the reverse. On wove paper. 37 x 33 cm (14.5 x 12.9 in), size of sheet. [AW].

• Dynamic self-portrait with rigorous lines.

• In 1912, the year it was painted, exhibited at Herwarth Walden's famous gallery “Der Sturm”.

• Featured in the major retrospective of the artist's work at Mathildenhöhe Darmstadt in 1991 and at the Stiftung Schleswig-Holsteinische Landesmuseen, Schloss Gottdorf, in 2009.

• The portrait as a genre is a central motif in Meidner's oeuvre.

• Meidner's works are part of renowned international collections, including the Museo Thyssen Bornemisza, Madrid, the Art Institute of Chicago, the Los Angeles County Museum of Art, and the Neue Nationalgalerie, Berlin.

PROVENANCE: From the artist's estate (1966).

Wilhelm Loth Collection, Darmstadt.

From a Swiss collection.

EXHIBITION: Ludwig Meidner. Zeichner, Maler, Literat 1884-1966, Mathildenhöhe Darmstadt, September 15 - December 1, 1991, vol. II, p. 44 (illustrated).

Ludwig Meidner. Zeichnungen, Radierungen, Galerie Schlichtenmaier, Grafenau, 1994, cat. no. 5, p. 19 (illustrated).

Fixsterne. 100 Jahre Kunst auf Papier. Adolph Menzel bis Kiki Smith, Stiftung Schleswig Holsteinische Landesmuseen, Schloss Gottdorf, May 31 - Sept. 20, 2009, p. 33 (illustrated).

Called up: December 7, 2024 - ca. 14.41 h +/- 20 min.

Pencil.

Monogrammed and dated lower left. With the estate stamp (not in Lugt) and the handwritten inventory number “II/83” on the reverse. On wove paper. 37 x 33 cm (14.5 x 12.9 in), size of sheet. [AW].

• Dynamic self-portrait with rigorous lines.

• In 1912, the year it was painted, exhibited at Herwarth Walden's famous gallery “Der Sturm”.

• Featured in the major retrospective of the artist's work at Mathildenhöhe Darmstadt in 1991 and at the Stiftung Schleswig-Holsteinische Landesmuseen, Schloss Gottdorf, in 2009.

• The portrait as a genre is a central motif in Meidner's oeuvre.

• Meidner's works are part of renowned international collections, including the Museo Thyssen Bornemisza, Madrid, the Art Institute of Chicago, the Los Angeles County Museum of Art, and the Neue Nationalgalerie, Berlin.

PROVENANCE: From the artist's estate (1966).

Wilhelm Loth Collection, Darmstadt.

From a Swiss collection.

EXHIBITION: Ludwig Meidner. Zeichner, Maler, Literat 1884-1966, Mathildenhöhe Darmstadt, September 15 - December 1, 1991, vol. II, p. 44 (illustrated).

Ludwig Meidner. Zeichnungen, Radierungen, Galerie Schlichtenmaier, Grafenau, 1994, cat. no. 5, p. 19 (illustrated).

Fixsterne. 100 Jahre Kunst auf Papier. Adolph Menzel bis Kiki Smith, Stiftung Schleswig Holsteinische Landesmuseen, Schloss Gottdorf, May 31 - Sept. 20, 2009, p. 33 (illustrated).

Called up: December 7, 2024 - ca. 14.41 h +/- 20 min.

216

Ludwig Meidner

Selbstbildnis, 1912.

Pencil

Estimate:

€ 15,000 - 20,000

$ 16,500 - 22,000

Buyer's premium, taxation and resale right compensation for Ludwig Meidner "Selbstbildnis"

This lot can be subjected to differential taxation plus a 7% import tax levy (saving approx. 5 % compared to regular taxation) or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 216

Lot 216