261

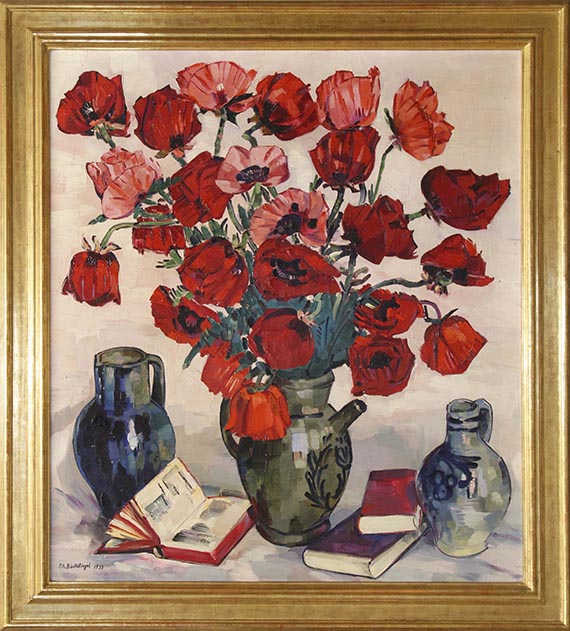

Peter August Böckstiegel

Stillleben mit Mohnblumen, 1933.

Oil on canvas

Estimate:

€ 20,000 - 30,000

$ 22,000 - 33,000

Stillleben mit Mohnblumen. 1933.

Oil on canvas.

Signed and dated lower left. 100.5 x 90.5 cm (39.5 x 35.6 in).

[KT].

• Large-format staging of the many shades of the color red in the delicate poppy blossoms.

• Böckstiegel's work attained a new sense of harmony in the 1930s.

• The ardent admirer of Vincent van Gogh is considered one of the most important representatives of Westphalian Expressionism.

PROVENANCE: Private collection, Bavaria (acquired in 1936, family-owned ever since).

EXHIBITION: Kunstausstellung Dresden, Sächsischer Kunstverein/Städtische Kunsthalle, Dresden, May 1936, cat no. 29: "Türkischer Mohn".

LITERATURE: David Riedel, Peter August Böckstiegel: Die Gemälde 1910-1951, Munich 2014, catalogue raisonné no. 281 (illustrated).

Called up: December 7, 2024 - ca. 15.41 h +/- 20 min.

Oil on canvas.

Signed and dated lower left. 100.5 x 90.5 cm (39.5 x 35.6 in).

[KT].

• Large-format staging of the many shades of the color red in the delicate poppy blossoms.

• Böckstiegel's work attained a new sense of harmony in the 1930s.

• The ardent admirer of Vincent van Gogh is considered one of the most important representatives of Westphalian Expressionism.

PROVENANCE: Private collection, Bavaria (acquired in 1936, family-owned ever since).

EXHIBITION: Kunstausstellung Dresden, Sächsischer Kunstverein/Städtische Kunsthalle, Dresden, May 1936, cat no. 29: "Türkischer Mohn".

LITERATURE: David Riedel, Peter August Böckstiegel: Die Gemälde 1910-1951, Munich 2014, catalogue raisonné no. 281 (illustrated).

Called up: December 7, 2024 - ca. 15.41 h +/- 20 min.

261

Peter August Böckstiegel

Stillleben mit Mohnblumen, 1933.

Oil on canvas

Estimate:

€ 20,000 - 30,000

$ 22,000 - 33,000

Buyer's premium and taxation for Peter August Böckstiegel "Stillleben mit Mohnblumen"

This lot can be purchased subject to differential or regular taxation.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Lot 261

Lot 261