Frame image

147

Otto Modersohn

Birken am Moorgraben, 1904.

Oil on cardboard

Estimate:

€ 10,000 / $ 11,800 Sold:

€ 24,130 / $ 28,473 (incl. surcharge)

147

Otto Modersohn

Birken am Moorgraben, 1904.

Oil on cardboard

Estimate:

€ 10,000 / $ 11,800 Sold:

€ 24,130 / $ 28,473 (incl. surcharge)

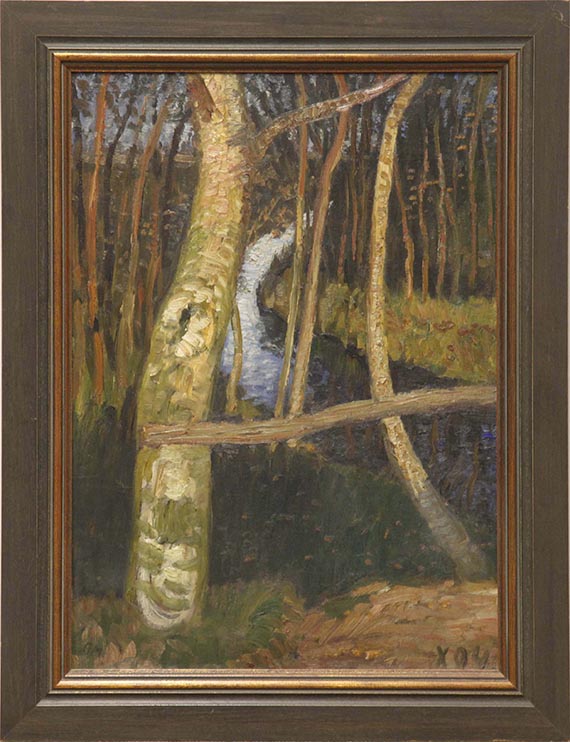

Birken am Moorgraben. 1904.

Oil on cardboard.

Monogrammed "OM" lower left, monogrammed "X 04" lower right. 56.7 x 40.5 cm (22.3 x 15.9 in).

• Birch trees are the most important motif in the Worpswede landscapes of Otto Modersohn and his wife, Paula Modersohn-Becker.

• A mysterious world of moor landscape in dark tonality.

• The immediate and intimate impression of nature is the hallmark of the Worpswede style.

We are grateful to Mr. Rainer Noeres, Otto-Modersohn-Museum, Fischerhude, for his kind expert advice.

PROVENANCE: From the estate of Otto Modersohn, Fischerhude.

Mathilde Modersohn.

Galerie Wolfgang Werner, Bremen.

Private collection, Northern Germany.

Private collection, Bavaria (acquired in 2014).

LITERATURE: Hauswedell & Nolte, Hamburg, auction on June 13, 2014, lot 14 (illustrated).

Oil on cardboard.

Monogrammed "OM" lower left, monogrammed "X 04" lower right. 56.7 x 40.5 cm (22.3 x 15.9 in).

• Birch trees are the most important motif in the Worpswede landscapes of Otto Modersohn and his wife, Paula Modersohn-Becker.

• A mysterious world of moor landscape in dark tonality.

• The immediate and intimate impression of nature is the hallmark of the Worpswede style.

We are grateful to Mr. Rainer Noeres, Otto-Modersohn-Museum, Fischerhude, for his kind expert advice.

PROVENANCE: From the estate of Otto Modersohn, Fischerhude.

Mathilde Modersohn.

Galerie Wolfgang Werner, Bremen.

Private collection, Northern Germany.

Private collection, Bavaria (acquired in 2014).

LITERATURE: Hauswedell & Nolte, Hamburg, auction on June 13, 2014, lot 14 (illustrated).

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.