Frame image

130

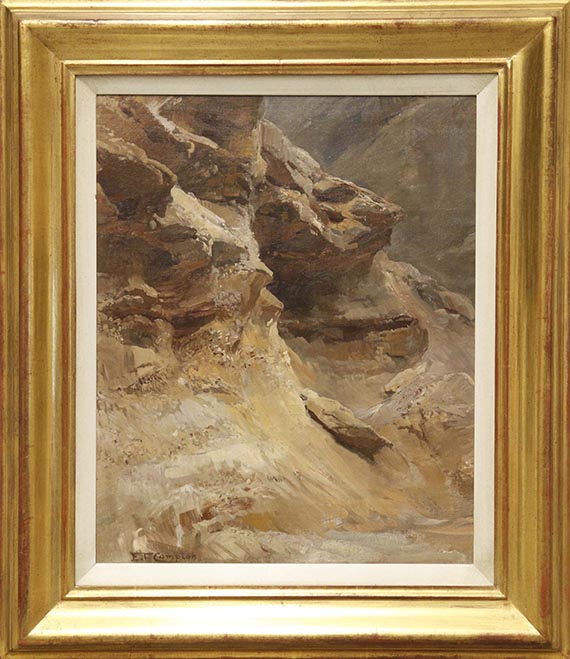

Edward Theodore Compton

Felsenstudie, Wohl um 1870.

Oil on canvas

Estimate:

€ 2,000 - 3,000

$ 2,200 - 3,300

Felsenstudie. Likely c. 1870.

Oil on canvas.

Signed lower left. 50.5 x 40.5 cm (19.8 x 15.9 in).

• A fascinating, vivid rock study showing highly nuanced colors.

• A perfect combination of painting and geological observation.

• Compton, an enthusiastic mountaineer in the early days of Alpinism, is considered the most important painter of the mountain world.

We are grateful to Mrs. Sibylle Brandes, Tutzing, for her kind support in cataloging this lot.

PROVENANCE: Private collection, Austria.

Called up: December 7, 2024 - ca. 13.38 h +/- 20 min.

Oil on canvas.

Signed lower left. 50.5 x 40.5 cm (19.8 x 15.9 in).

• A fascinating, vivid rock study showing highly nuanced colors.

• A perfect combination of painting and geological observation.

• Compton, an enthusiastic mountaineer in the early days of Alpinism, is considered the most important painter of the mountain world.

We are grateful to Mrs. Sibylle Brandes, Tutzing, for her kind support in cataloging this lot.

PROVENANCE: Private collection, Austria.

Called up: December 7, 2024 - ca. 13.38 h +/- 20 min.

130

Edward Theodore Compton

Felsenstudie, Wohl um 1870.

Oil on canvas

Estimate:

€ 2,000 - 3,000

$ 2,200 - 3,300

Buyer's premium and taxation for Edward Theodore Compton "Felsenstudie"

This lot can be purchased subject to differential or regular taxation.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Lot 130

Lot 130