Frame image

152

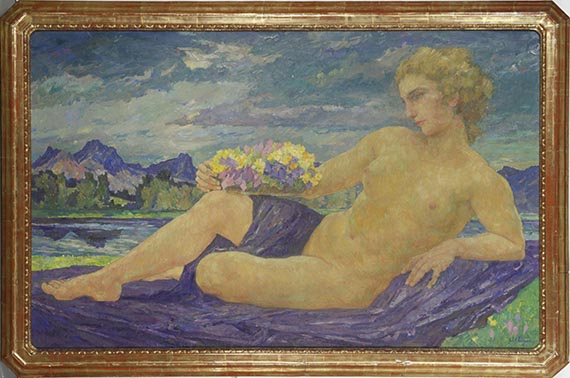

Hans Unger

Liegender weiblicher Akt, Wohl um 1906.

Oil on canvas

Estimate:

€ 5,000 - 7,000

$ 5,500 - 7,700

Liegender weiblicher Akt. Likely c. 1906.

Oil on canvas.

Signed lower right. Numbered and inscribed on the reverse, as well as with an old exhibition label and the stamp "Hans Unger 97". 101 x 160 cm (39.7 x 62.9 in).

• Hans Unger is considered one of the central representatives of Symbolism and Art Nouveau in Germany.

• A dreamy and pensive female figure in the tradition of French Symbolism à la Pierre Puvis de Chavannes and Gustave Moreau.

• An impasto, illuminated female figure in Unger's typically enigmatic pictorial language.

PROVENANCE: John Knittel Collection (1891-1970), Switzerland (ever since family-owned).

EXHIBITION: Mannheimer Kunstverein, no. 95 (with the label).

Called up: December 7, 2024 - ca. 14.08 h +/- 20 min.

Oil on canvas.

Signed lower right. Numbered and inscribed on the reverse, as well as with an old exhibition label and the stamp "Hans Unger 97". 101 x 160 cm (39.7 x 62.9 in).

• Hans Unger is considered one of the central representatives of Symbolism and Art Nouveau in Germany.

• A dreamy and pensive female figure in the tradition of French Symbolism à la Pierre Puvis de Chavannes and Gustave Moreau.

• An impasto, illuminated female figure in Unger's typically enigmatic pictorial language.

PROVENANCE: John Knittel Collection (1891-1970), Switzerland (ever since family-owned).

EXHIBITION: Mannheimer Kunstverein, no. 95 (with the label).

Called up: December 7, 2024 - ca. 14.08 h +/- 20 min.

152

Hans Unger

Liegender weiblicher Akt, Wohl um 1906.

Oil on canvas

Estimate:

€ 5,000 - 7,000

$ 5,500 - 7,700

Buyer's premium and taxation for Hans Unger "Liegender weiblicher Akt"

This lot can be subjected to differential taxation plus a 7% import tax levy (saving approx. 5 % compared to regular taxation) or regular taxation.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Lot 152

Lot 152