Frame image

372

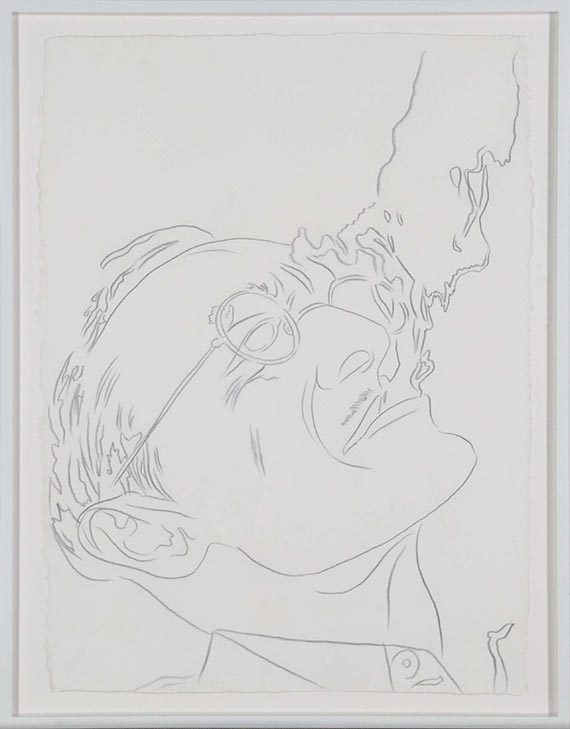

Andy Warhol

Hesse, 1984.

Pencil drawing

Estimate:

€ 18,000 - 24,000

$ 19,620 - 26,160

Hesse. 1984.

Pencil drawing.

With the estate stamp and the handwritten number “115.186”, as well as with the handwritten inscription “VF” and the stamp of the Andy Warhol Foundation for the Visual Arts on the reverse. 80 x 58.5 cm (31.4 x 23 in), the full sheet. [EH].

• Andy Warhol, the icon of Pop Art, is a brilliant draftsman with an unerring and at times ornamental stroke.

• The screen print of the same name was made after this drawing (Feldmann/Schellmann IIIC.71).

• The present work was inspired by the photograph “Hermann Hesse smoking in the library, 1935”.

• In 2020/21, Tate Modern, London, and Museum Ludwig, Cologne, dedicated the special exhibition “Andy Warhol Now” to Warhol's artistic contribution to more social diversity.

PROVENANCE: From the artist's estate.

Andy Warhol Foundation for the Visual Arts, New York.

Private collection, Germany.

From a German owner (acquired from the above).

Called up: December 7, 2024 - ca. 17.21 h +/- 20 min.

Pencil drawing.

With the estate stamp and the handwritten number “115.186”, as well as with the handwritten inscription “VF” and the stamp of the Andy Warhol Foundation for the Visual Arts on the reverse. 80 x 58.5 cm (31.4 x 23 in), the full sheet. [EH].

• Andy Warhol, the icon of Pop Art, is a brilliant draftsman with an unerring and at times ornamental stroke.

• The screen print of the same name was made after this drawing (Feldmann/Schellmann IIIC.71).

• The present work was inspired by the photograph “Hermann Hesse smoking in the library, 1935”.

• In 2020/21, Tate Modern, London, and Museum Ludwig, Cologne, dedicated the special exhibition “Andy Warhol Now” to Warhol's artistic contribution to more social diversity.

PROVENANCE: From the artist's estate.

Andy Warhol Foundation for the Visual Arts, New York.

Private collection, Germany.

From a German owner (acquired from the above).

Called up: December 7, 2024 - ca. 17.21 h +/- 20 min.

372

Andy Warhol

Hesse, 1984.

Pencil drawing

Estimate:

€ 18,000 - 24,000

$ 19,620 - 26,160

Buyer's premium, taxation and resale right compensation for Andy Warhol "Hesse"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 372

Lot 372