Frame image

383

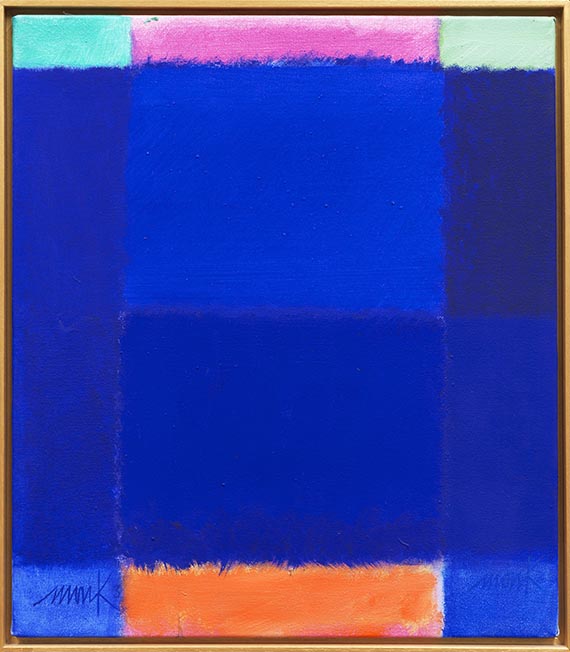

Heinz Mack

Kleiner Farb-Dialog (Chromatische Konstellation), 2003.

Acrylic on canvas

Estimate:

€ 20,000 / $ 23,200 Sold:

€ 69,850 / $ 81,026 (incl. surcharge)

Kleiner Farb-Dialog (Chromatische Konstellation). 2003.

Acrylic on canvas.

Signed and dated "3" lower left, also signed lower right. Signed, dated “3” and titled on the reverse of the canvas. 54.5 x 48 cm (21.4 x 18.8 in).

[KA].

• Vibrant “Chromatic Constellation”.

• An expressive example of Mack's multifaceted exploration of rhythm and color.

• At a young age, Mack, one of the "ZERO" protagonists, broke away from the traditional concept of art with innovative creative principles by making light and movement the central theme of his work.

• Heinz Mack exhibited at documenta II and III in 1959 and 1964. In 1970, he represented the Federal Republic of Germany at the XXXV Venice Biennale.

With a certificate from Atelier Heinz Mack dated October 2024.

PROVENANCE: Galerie Neher (with a label on the reverse of the stretcher).

Private collection, Germany.

Private collection, Southern Germany.

Acrylic on canvas.

Signed and dated "3" lower left, also signed lower right. Signed, dated “3” and titled on the reverse of the canvas. 54.5 x 48 cm (21.4 x 18.8 in).

[KA].

• Vibrant “Chromatic Constellation”.

• An expressive example of Mack's multifaceted exploration of rhythm and color.

• At a young age, Mack, one of the "ZERO" protagonists, broke away from the traditional concept of art with innovative creative principles by making light and movement the central theme of his work.

• Heinz Mack exhibited at documenta II and III in 1959 and 1964. In 1970, he represented the Federal Republic of Germany at the XXXV Venice Biennale.

With a certificate from Atelier Heinz Mack dated October 2024.

PROVENANCE: Galerie Neher (with a label on the reverse of the stretcher).

Private collection, Germany.

Private collection, Southern Germany.

383

Heinz Mack

Kleiner Farb-Dialog (Chromatische Konstellation), 2003.

Acrylic on canvas

Estimate:

€ 20,000 / $ 23,200 Sold:

€ 69,850 / $ 81,026 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 383

Lot 383