325

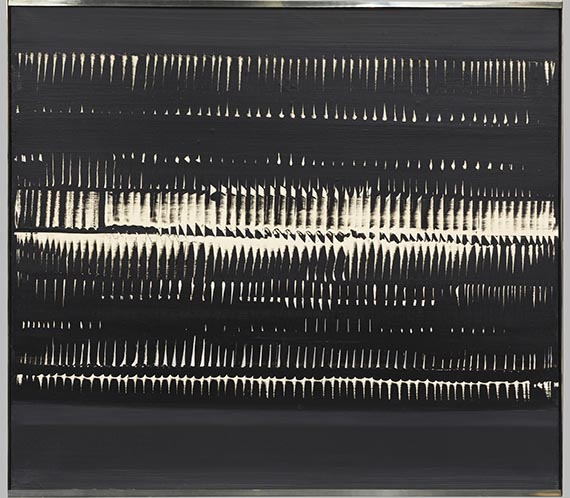

Heinz Mack

Dynamische Struktur Schwarz-Weiß, 1962.

Synthetic resin and Oil on coarse cotton cloth

Estimate:

€ 80,000 / $ 92,800 Sold:

€ 127,000 / $ 147,320 (incl. surcharge)

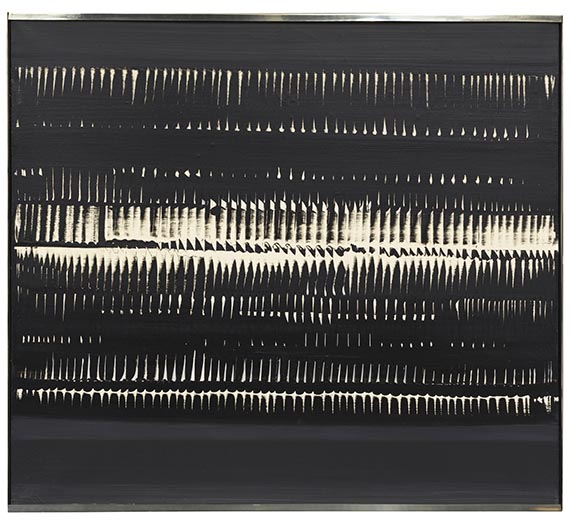

325

Heinz Mack

Dynamische Struktur Schwarz-Weiß, 1962.

Synthetic resin and Oil on coarse cotton cloth

Estimate:

€ 80,000 / $ 92,800 Sold:

€ 127,000 / $ 147,320 (incl. surcharge)

Dynamische Struktur Schwarz-Weiß. 1962.

Synthetic resin and Oil on coarse cotton cloth.

Signed, dated and with a direction arrow on the reverse of the canvas. Titled on the stretcher. 90 x 100 cm (35.4 x 39.3 in).

In the original frame. [KT].

• From the significant group of the “Dynamic Structures” – The reduction to a pure monochrome with maximum motion and dynamics.

• Vibration as an expression of continuous motion is a distinguishing feature of works from the heyday of ZERO.

• In 1958, Mack participated in Documenta II, and together with Piene and Uecker in Documenta III in 1964.

• Mack's works are in the most important international collections, including the Guggenheim Museum in New York, the Tate Gallery in London, and the Pinakothek der Moderne in Munich.

Accompanied by a certificate of authenticity issued by the Heinz Mack Studio, Mönchengladbach, dated October 2024. The work will be included into the catalogue raisonné “ZERO-Malerei von Heinz Mack” under the number 1962/44.

PROVENANCE: Private collection, Southern Germany (gifted from the artist, and family-owned since).

"Lines, surfaces and space are to merge seamlessly, mutually 'canceling' each other out in the dialectical sense that our language allows. If this integration remains visible, the image will vibrate so that our eyes find the calm of restlessness."

(Quoted from: Ute Mack, Heinz Mack. Druckgraphik und Multiples, Stuttgart 1990, p. 10).

Synthetic resin and Oil on coarse cotton cloth.

Signed, dated and with a direction arrow on the reverse of the canvas. Titled on the stretcher. 90 x 100 cm (35.4 x 39.3 in).

In the original frame. [KT].

• From the significant group of the “Dynamic Structures” – The reduction to a pure monochrome with maximum motion and dynamics.

• Vibration as an expression of continuous motion is a distinguishing feature of works from the heyday of ZERO.

• In 1958, Mack participated in Documenta II, and together with Piene and Uecker in Documenta III in 1964.

• Mack's works are in the most important international collections, including the Guggenheim Museum in New York, the Tate Gallery in London, and the Pinakothek der Moderne in Munich.

Accompanied by a certificate of authenticity issued by the Heinz Mack Studio, Mönchengladbach, dated October 2024. The work will be included into the catalogue raisonné “ZERO-Malerei von Heinz Mack” under the number 1962/44.

PROVENANCE: Private collection, Southern Germany (gifted from the artist, and family-owned since).

"Lines, surfaces and space are to merge seamlessly, mutually 'canceling' each other out in the dialectical sense that our language allows. If this integration remains visible, the image will vibrate so that our eyes find the calm of restlessness."

(Quoted from: Ute Mack, Heinz Mack. Druckgraphik und Multiples, Stuttgart 1990, p. 10).

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.