Frame image

315

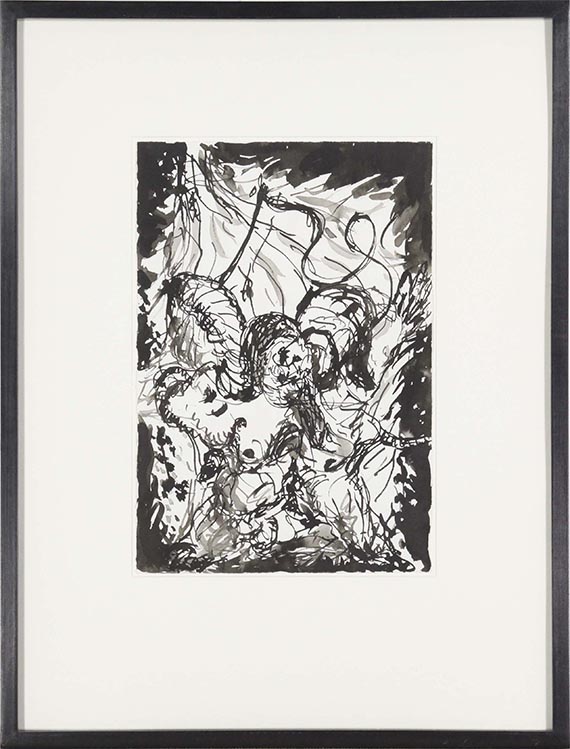

Georg Baselitz

Ohne Titel (Fahne), 1965.

Pen and India ink drawing, with wash

Estimate:

€ 50,000 - 70,000

$ 54,500 - 76,300

Ohne Titel (Fahne). 1965.

Pen and India ink drawing, with wash.

On Fabriano paper (with the wwatermark "C. M. Fabriano"). 48.3 x 33 cm (19 x 12.9 in), the full sheet. [KA].

• Very dense and elaborate drawing.

• Early testimony to Baselitz's masterly play with art-historical traditions, provocation, and association.

• Such vibrant works from his early days are scarce on the international auction market.

• In 2022/23, the Morgan Library & Museum New York, and the Albertina in Vienna presented a major retrospective of Baselitz's drawings from 1963 to 2018.

PROVENANCE: Helmut and Margot Kraetz, Dreieich (acquired directly from the artist).

Ruth Miles Pite Collection, New York (acquired from the above in 1992, Sotheby's, New York).

Acquired by the current owner from the above.

LITERATURE: Sotheby's, New York, 6290th auction, Contemporary Art, Part II, May 7, 1992, lot 102.

"Drawings are like antics; they amaze you and also terrify you. [..] It is like a language without reason and only makes sense once you have learned the vocabulary [..]."

Georg Baselitz, 1993, quoted from: Georg Baselitz. Gesammelte Schriften und Interviews, München 2011, p. 258.

Called up: December 7, 2024 - ca. 16.05 h +/- 20 min.

Pen and India ink drawing, with wash.

On Fabriano paper (with the wwatermark "C. M. Fabriano"). 48.3 x 33 cm (19 x 12.9 in), the full sheet. [KA].

• Very dense and elaborate drawing.

• Early testimony to Baselitz's masterly play with art-historical traditions, provocation, and association.

• Such vibrant works from his early days are scarce on the international auction market.

• In 2022/23, the Morgan Library & Museum New York, and the Albertina in Vienna presented a major retrospective of Baselitz's drawings from 1963 to 2018.

PROVENANCE: Helmut and Margot Kraetz, Dreieich (acquired directly from the artist).

Ruth Miles Pite Collection, New York (acquired from the above in 1992, Sotheby's, New York).

Acquired by the current owner from the above.

LITERATURE: Sotheby's, New York, 6290th auction, Contemporary Art, Part II, May 7, 1992, lot 102.

"Drawings are like antics; they amaze you and also terrify you. [..] It is like a language without reason and only makes sense once you have learned the vocabulary [..]."

Georg Baselitz, 1993, quoted from: Georg Baselitz. Gesammelte Schriften und Interviews, München 2011, p. 258.

Called up: December 7, 2024 - ca. 16.05 h +/- 20 min.

315

Georg Baselitz

Ohne Titel (Fahne), 1965.

Pen and India ink drawing, with wash

Estimate:

€ 50,000 - 70,000

$ 54,500 - 76,300

Buyer's premium, taxation and resale right compensation for Georg Baselitz "Ohne Titel (Fahne)"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 315

Lot 315