Frame image

404

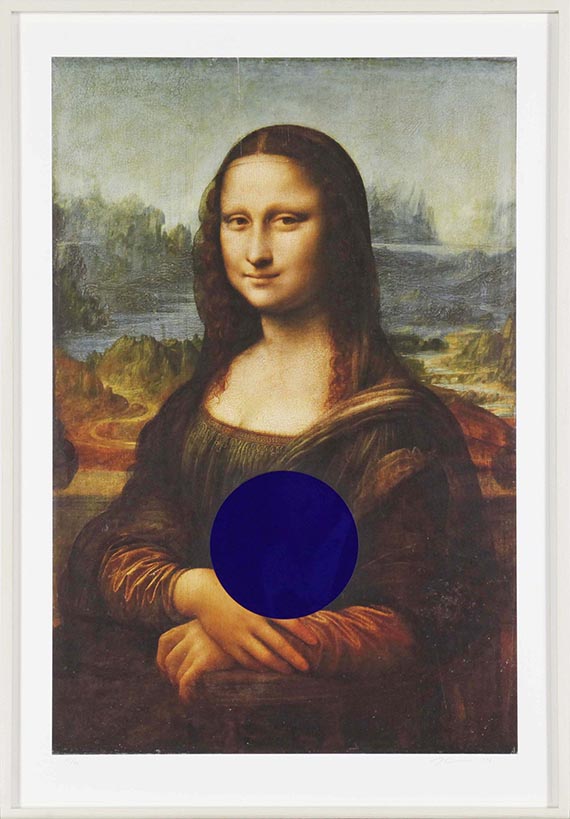

Jeff Koons

Gazing Ball (da Vinci Mona Lisa), 2016.

Mixed media. Inkjet print with mirrored acrylic...

Estimate:

€ 30,000 - 40,000

$ 33,000 - 44,000

Gazing Ball (da Vinci Mona Lisa). 2016.

Mixed media. Inkjet print with mirrored acrylic pane.

Signed, dated and numbered. From an edition of 40 copies aside from 10 artist proofs. On wove paper by Innova Art. 92.5 x 61.5 cm (36.4 x 24.2 in). 103 x 70,540,5 x 27,7

Published by Two Palms, New York. [KT].

• Probably the most famous smile in art - revamped by Koons as an icon of pop culture.

• Koons himself is a media darling and star of the art world.

• He playfully explores the boundaries of art, commerce and consumerism.

• His works have been exhibited in the most prestigious art capitals of the world

• He holds the record for the most expensive work sold by a living artist on the auction market with “Rabbit”.

PROVENANCE: Private collection, USA.

Private collection, Northern Germany (acquired in 2020).

Called up: December 7, 2024 - ca. 18.03 h +/- 20 min.

Mixed media. Inkjet print with mirrored acrylic pane.

Signed, dated and numbered. From an edition of 40 copies aside from 10 artist proofs. On wove paper by Innova Art. 92.5 x 61.5 cm (36.4 x 24.2 in). 103 x 70,540,5 x 27,7

Published by Two Palms, New York. [KT].

• Probably the most famous smile in art - revamped by Koons as an icon of pop culture.

• Koons himself is a media darling and star of the art world.

• He playfully explores the boundaries of art, commerce and consumerism.

• His works have been exhibited in the most prestigious art capitals of the world

• He holds the record for the most expensive work sold by a living artist on the auction market with “Rabbit”.

PROVENANCE: Private collection, USA.

Private collection, Northern Germany (acquired in 2020).

Called up: December 7, 2024 - ca. 18.03 h +/- 20 min.

404

Jeff Koons

Gazing Ball (da Vinci Mona Lisa), 2016.

Mixed media. Inkjet print with mirrored acrylic...

Estimate:

€ 30,000 - 40,000

$ 33,000 - 44,000

Buyer's premium, taxation and resale right compensation for Jeff Koons "Gazing Ball (da Vinci Mona Lisa)"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 404

Lot 404