323

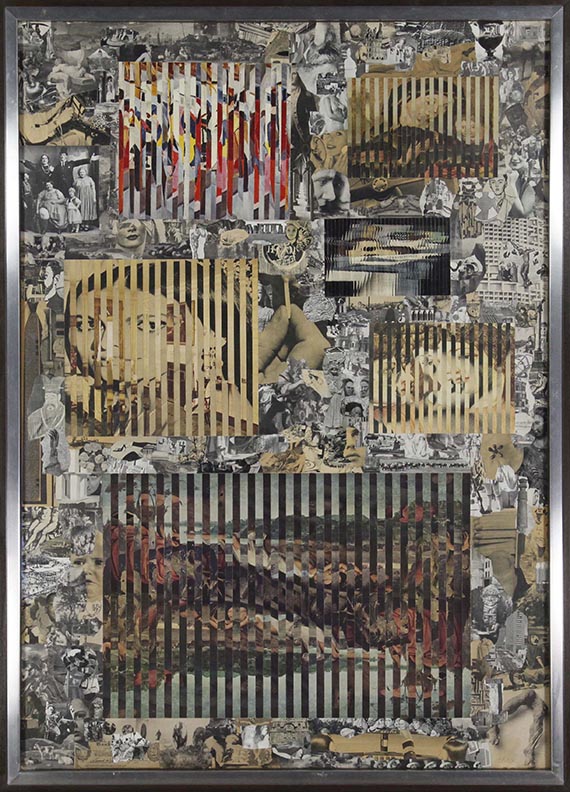

Jirí Kolár

Musterbuch III. / Die Versuchung des Hl. Antonius, 1964.

Collage and rollage of offset prints on cardboa...

Estimate:

€ 8,000 / $ 9,440 Sold:

€ 10,160 / $ 11,988 (incl. surcharge)

Musterbuch III. / Die Versuchung des Hl. Antonius. 1964.

Collage and rollage of offset prints on cardboard in different colors.

Monogrammed and dated lower right. 98.5 x 70 cm (38.7 x 27.5 in), the full sheet.

[KA].

• Jirí Kolár is one of the most acclaimed international representatives of the collage technique and one of the most famous Czech artists of the second half of the 20th century.

• In his unique visual poetic language, Kolár creates collages from color reproductions of well-known paintings and newspaper clippings, weaving a tapestry of memories, places, feelings, and eras.

• In the present work, Kolar creates a cross-section of history.

• In 1963, Kolár had his first solo exhibition at the Arthur Jeffress Gallery in London, and in 1975, he was honored with a retrospective at the Solomon R. Guggenheim Museum in New York.

PROVENANCE: Ursula Wentorf Collection, Düsseldorf.

Private collection, Cologne.

From a Swiss collection.

LITERATURE: Sturies Kunst & Auktionen, 11th auction, May 15, 2004, lot 112 (illustrated).

"Kolár's work reflects on the relationship between history and the present, on the development, differences and similarities between individual cultural epochs, on the discovery of hidden properties, on the unexpected juxtaposition of elements of reality and art, of fantasy and sober objectivity. It is characterized by both reverence for tradition and a yearning for new creative methods."

Jirí Machalický, 2014, quoted from: Jirí Kolár. 1914-2002 Collagen, Cologne 2014, p. 33

Collage and rollage of offset prints on cardboard in different colors.

Monogrammed and dated lower right. 98.5 x 70 cm (38.7 x 27.5 in), the full sheet.

[KA].

• Jirí Kolár is one of the most acclaimed international representatives of the collage technique and one of the most famous Czech artists of the second half of the 20th century.

• In his unique visual poetic language, Kolár creates collages from color reproductions of well-known paintings and newspaper clippings, weaving a tapestry of memories, places, feelings, and eras.

• In the present work, Kolar creates a cross-section of history.

• In 1963, Kolár had his first solo exhibition at the Arthur Jeffress Gallery in London, and in 1975, he was honored with a retrospective at the Solomon R. Guggenheim Museum in New York.

PROVENANCE: Ursula Wentorf Collection, Düsseldorf.

Private collection, Cologne.

From a Swiss collection.

LITERATURE: Sturies Kunst & Auktionen, 11th auction, May 15, 2004, lot 112 (illustrated).

"Kolár's work reflects on the relationship between history and the present, on the development, differences and similarities between individual cultural epochs, on the discovery of hidden properties, on the unexpected juxtaposition of elements of reality and art, of fantasy and sober objectivity. It is characterized by both reverence for tradition and a yearning for new creative methods."

Jirí Machalický, 2014, quoted from: Jirí Kolár. 1914-2002 Collagen, Cologne 2014, p. 33

323

Jirí Kolár

Musterbuch III. / Die Versuchung des Hl. Antonius, 1964.

Collage and rollage of offset prints on cardboa...

Estimate:

€ 8,000 / $ 9,440 Sold:

€ 10,160 / $ 11,988 (incl. surcharge)

Headquarters

Joseph-Wild-Str. 18

81829 Munich

Phone: +49 89 55 244-0

Fax: +49 89 55 244-177

info@kettererkunst.de

Louisa von Saucken / Undine Schleifer

Holstenwall 5

20355 Hamburg

Phone: +49 40 37 49 61-0

Fax: +49 40 37 49 61-66

infohamburg@kettererkunst.de

Dr. Simone Wiechers / Nane Schlage

Fasanenstr. 70

10719 Berlin

Phone: +49 30 88 67 53-63

Fax: +49 30 88 67 56-43

infoberlin@kettererkunst.de

Cordula Lichtenberg

Gertrudenstraße 24-28

50667 Cologne

Phone: +49 221 510 908-15

infokoeln@kettererkunst.de

Hessen

Rhineland-Palatinate

Miriam Heß

Phone: +49 62 21 58 80-038

Fax: +49 62 21 58 80-595

infoheidelberg@kettererkunst.de

We will inform you in time.

Lot 323

Lot 323