313

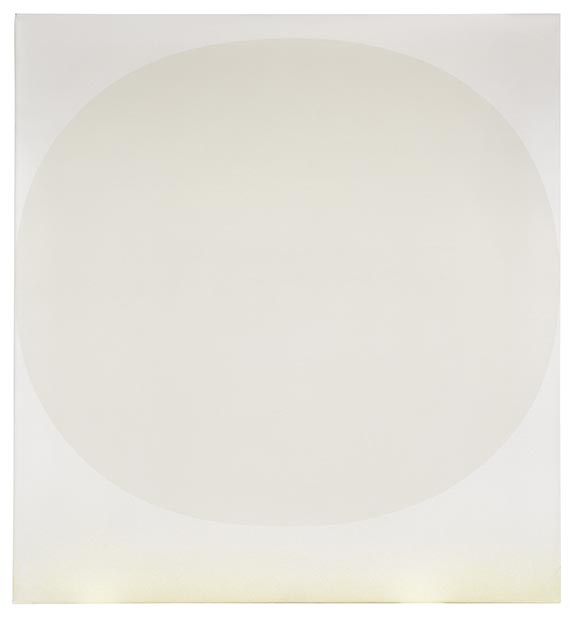

Rupprecht Geiger

523/68, 1968.

Acrylic on canvas

Post auction sale: € 40,000 / $ 44,000

523/68. 1968.

Acrylic on canvas.

Signed, dated and titled “523/68” on the stretcher, also inscribed with the dimensions, direction indicator. 120 x 110 cm (47.2 x 43.3 in). [CH].

• Geiger's works derive their extraordinary effect from the fine modulation of the color fields.

• The reduction and concentration of color and form peaked in the late 1960s.

• Geiger elevates the circle to a meditative color space.

• The work has been part of the same private collection since 1969.

• In the year it was created, Geiger took part in the 4th documenta in Kassel.

• Similar paintings are in numerous important collections, among them the Nationalgalerie Berlin, the Museum Folkwang, Essen, and the Städtische Galerie im Lenbachhaus, Munich.

We are grateful to Julia Geiger, Geiger Archive, Munich, for the kind supportr in cataloging this lot.

PROVENANCE: Private collection North Rhine-Westphalia (acquired from the artist in 1969).

Ever since family-owned.

LITERATURE: Rupprecht-Geiger-Gesellschaft, Städtische Galerie im Lenbachhaus, München (ed.), edited by Pia Dornacher and Julia Geiger, Rupprecht Geiger. Catalogue Raisonné 1942-2002. Gemälde und Objekte, architekturbezogene Kunst, München 2003, no. 498, p. 190.

Acrylic on canvas.

Signed, dated and titled “523/68” on the stretcher, also inscribed with the dimensions, direction indicator. 120 x 110 cm (47.2 x 43.3 in). [CH].

• Geiger's works derive their extraordinary effect from the fine modulation of the color fields.

• The reduction and concentration of color and form peaked in the late 1960s.

• Geiger elevates the circle to a meditative color space.

• The work has been part of the same private collection since 1969.

• In the year it was created, Geiger took part in the 4th documenta in Kassel.

• Similar paintings are in numerous important collections, among them the Nationalgalerie Berlin, the Museum Folkwang, Essen, and the Städtische Galerie im Lenbachhaus, Munich.

We are grateful to Julia Geiger, Geiger Archive, Munich, for the kind supportr in cataloging this lot.

PROVENANCE: Private collection North Rhine-Westphalia (acquired from the artist in 1969).

Ever since family-owned.

LITERATURE: Rupprecht-Geiger-Gesellschaft, Städtische Galerie im Lenbachhaus, München (ed.), edited by Pia Dornacher and Julia Geiger, Rupprecht Geiger. Catalogue Raisonné 1942-2002. Gemälde und Objekte, architekturbezogene Kunst, München 2003, no. 498, p. 190.

313

Rupprecht Geiger

523/68, 1968.

Acrylic on canvas

Post auction sale: € 40,000 / $ 44,000

Buyer's premium, taxation and resale right compensation for Rupprecht Geiger "523/68"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 313

Lot 313