407

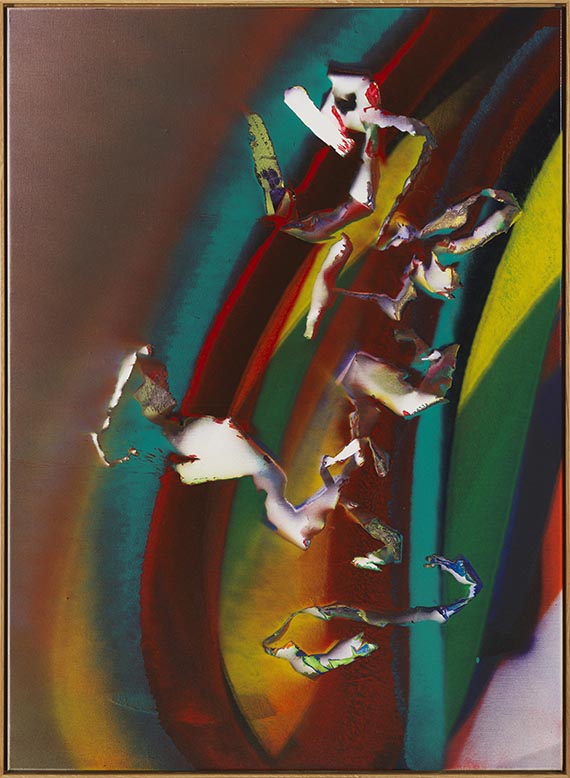

Katharina Grosse

Ohne Titel, 2021.

Acrylic on canvas

Estimate:

€ 70,000 - 90,000

$ 77,000 - 99,000

Ohne Titel. 2021.

Acrylic on canvas.

Signed and dated on the reverse of the canvas, as well as inscribed with the dimensions and the work number “2021/1063”. 160 x 114 cm (62.9 x 44.8 in).

[AR].

• Striking interplay between monochrome and colored surfaces.

• With her innovative technique, Katharina Grosse changed the face of painting and repeatedly pushed its boundaries.

• “Studio Painting” from one of the most successful recent work groups.

• This year, the Kunstmuseum Bonn dedicated a comprehensive retrospective to this central group of works (“Katharina Grosse. Studio Paintings 1988–2023”).

The work is registered at Studio Katharina Grosse, Berlin, under archive number “2021/1063”. We are grateful for the kind support in cataloging this lot.

PROVENANCE: König Galerie, Seoul.

Private collection, London.

Called up: December 7, 2024 - ca. 18.07 h +/- 20 min.

Acrylic on canvas.

Signed and dated on the reverse of the canvas, as well as inscribed with the dimensions and the work number “2021/1063”. 160 x 114 cm (62.9 x 44.8 in).

[AR].

• Striking interplay between monochrome and colored surfaces.

• With her innovative technique, Katharina Grosse changed the face of painting and repeatedly pushed its boundaries.

• “Studio Painting” from one of the most successful recent work groups.

• This year, the Kunstmuseum Bonn dedicated a comprehensive retrospective to this central group of works (“Katharina Grosse. Studio Paintings 1988–2023”).

The work is registered at Studio Katharina Grosse, Berlin, under archive number “2021/1063”. We are grateful for the kind support in cataloging this lot.

PROVENANCE: König Galerie, Seoul.

Private collection, London.

Called up: December 7, 2024 - ca. 18.07 h +/- 20 min.

Katharina Grosse's large-format “Studio Paintings” are created in her Berlin and New Zealand studios. They constitute an equally important part of her work as her successful large-scale projects in public spaces. The artist experiments with different techniques and materials in the studio. She has been increasingly using stencils and other utensils she occasionally finds near her studios. Among other things, she attaches branches or strings to the canvas. She integrates them into the painting, creating new effects and levels of perspective, foreground and background, composition, and pictorial hierarchy that challenge our traditional understanding of painting. Through her innovative use of color, she has fundamentally changed our contemporary perception of painting.

She used these devices in the present work from 2021, applying them to cover parts of the canvas during the painting process, resulting in a compelling interplay between colored and uncolored areas. In Grosse's work, the apparent flaw of the blank canvas is a stylistic device. It seems like a visual obstacle in the artist's otherwise colorful paintings, a strong counterpoint that makes the exuberant presence of the colors even more pronounced. In 2024, the Kunstmuseum in Bonn dedicated a comprehensive retrospective to the significant group of the “Studio Paintings.” It traced the artist's development from the 1980s to the present day and illustrated her rise to become one of the world's most successful artists. Large studio works on white canvas form the basis for an almost infinite range of possibilities to create a color stage and repeatedly redefine the boundaries of painting. [AR]

She used these devices in the present work from 2021, applying them to cover parts of the canvas during the painting process, resulting in a compelling interplay between colored and uncolored areas. In Grosse's work, the apparent flaw of the blank canvas is a stylistic device. It seems like a visual obstacle in the artist's otherwise colorful paintings, a strong counterpoint that makes the exuberant presence of the colors even more pronounced. In 2024, the Kunstmuseum in Bonn dedicated a comprehensive retrospective to the significant group of the “Studio Paintings.” It traced the artist's development from the 1980s to the present day and illustrated her rise to become one of the world's most successful artists. Large studio works on white canvas form the basis for an almost infinite range of possibilities to create a color stage and repeatedly redefine the boundaries of painting. [AR]

407

Katharina Grosse

Ohne Titel, 2021.

Acrylic on canvas

Estimate:

€ 70,000 - 90,000

$ 77,000 - 99,000

Buyer's premium, taxation and resale right compensation for Katharina Grosse "Ohne Titel"

This lot can be subjected to differential taxation plus a 7% import tax levy (saving approx. 5 % compared to regular taxation) or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 407

Lot 407