124

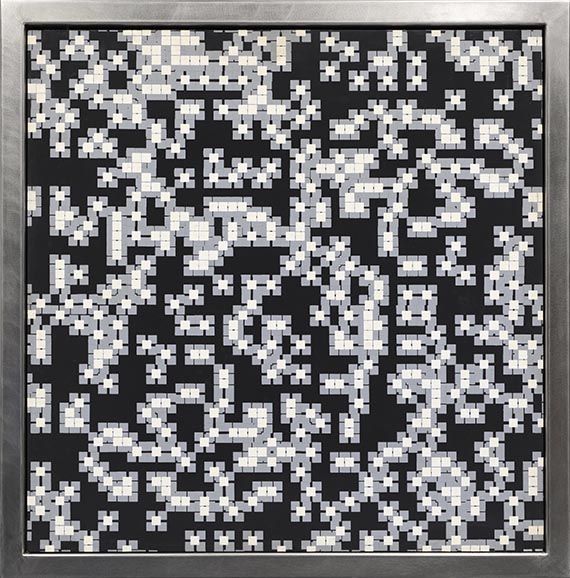

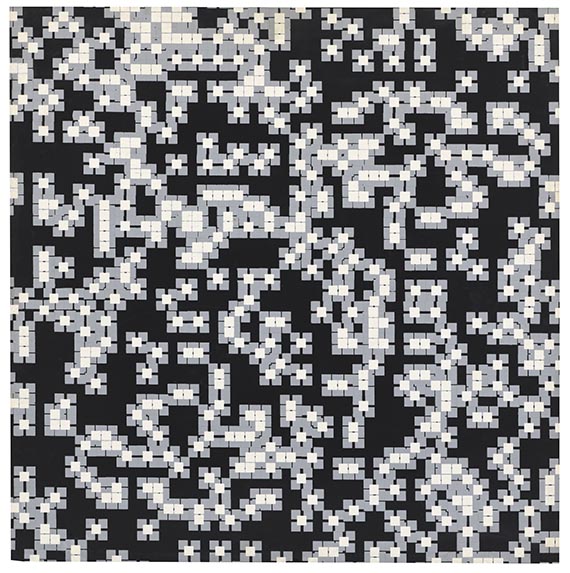

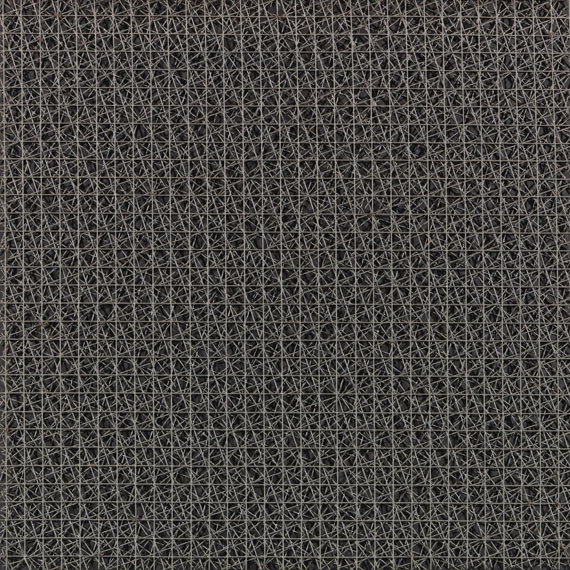

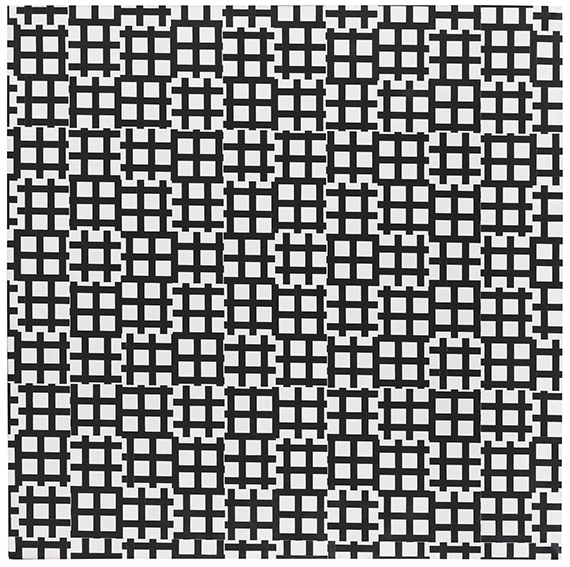

François Morellet

Superposition d'une répartition aléatoire de 20% de carrés, 1971.

Silkscreen on panel

Estimate:

€ 40,000 - 60,000

$ 42,800 - 64,200

Superposition d'une répartition aléatoire de 20% de carrés. 1971.

Silkscreen on panel.

Signed, dated, titled, numbered and inscribed on the reverse. From an edition of three copies. 80 x 80 cm (31.4 x 31.4 in).

Mounted in a stainless steel frame. [AW].

• The pioneer of geomentric abstraction.

• The combination of geometric calculation and joie de vivre is characteristic of Morellet's work.

• As one of the founding fathers of the "Groupe de Recherche d'Art Visuel" ("GRAV, 1960-1968), Morellet has been at the center of Op Art and Kinetic Art from the very beginning.

• Family-owned since it was made.

PROVENANCE: Private collection North Rhine-Westphalia (acquired from the artist in 1972, with a dedication on the reverse).

Called up: June 7, 2024 - ca. 14.03 h +/- 20 min.

Silkscreen on panel.

Signed, dated, titled, numbered and inscribed on the reverse. From an edition of three copies. 80 x 80 cm (31.4 x 31.4 in).

Mounted in a stainless steel frame. [AW].

• The pioneer of geomentric abstraction.

• The combination of geometric calculation and joie de vivre is characteristic of Morellet's work.

• As one of the founding fathers of the "Groupe de Recherche d'Art Visuel" ("GRAV, 1960-1968), Morellet has been at the center of Op Art and Kinetic Art from the very beginning.

• Family-owned since it was made.

PROVENANCE: Private collection North Rhine-Westphalia (acquired from the artist in 1972, with a dedication on the reverse).

Called up: June 7, 2024 - ca. 14.03 h +/- 20 min.

124

François Morellet

Superposition d'une répartition aléatoire de 20% de carrés, 1971.

Silkscreen on panel

Estimate:

€ 40,000 - 60,000

$ 42,800 - 64,200

Buyer's premium, taxation and resale right compensation for François Morellet "Superposition d'une répartition aléatoire de 20% de carrés"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 124

Lot 124