109

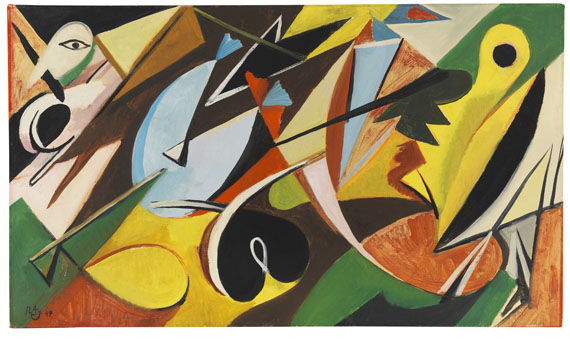

Ernst Wilhelm Nay

Lampe, 1949.

Oil on canvas

Post auction sale: € 60,000 / $ 63,000

Lampe. 1949.

Oil on canvas.

Signed and dated in the lower left. Signed, dated, titled and inscribed “XIX 9.” on the stretcher. Inscribed “495” by a hand other than that of the artist on the reverse. 59 x 71 cm (23.2 x 27.9 in). [CH].

• The catalogue raisonné mentions this work as the first in the series of the “Fugal Paintings”.

• With this colorful work and the subsequent work group, Nay achieved rhythmic balance between figuration and abstraction, order and movement.

• Formerly part of the collection of the Berlin gallerist Eberhard Seel, 1950-1972 managing director of the Deutscher Künstlerbund, collector and close friend of the artist.

• In 1952 the work was part of the early retrospective at Haus am Waldsee, Berlin.

• The same year he created a color lithograph and a gouache of the same subject, albeit in different colors.

• Early professional highlights: One year before and one year after this work was made, E. W. Nay participated in the Biennale di Venezia (1948 and 1950).

PROVENANCE: Eberhard Seel Collection (1900-1978), Berlin/Cologne (presumably directly from the artist).

Private collection, Cologne (acquired from the above, presumably in 1974, Lempertz, Cologne).

Galerie Orangerie-Reinz, Cologne (1995).

Private collection Hesse (acquired from the above, presumably in 1995).

Ever since family-owned.

EXHIBITION: E. W. Nay. Arbeiten der Jahre 1924-1952. Retrospektive, Haus am Waldsee, Berlin, May 17 - June 15, 1952, cat. no. 114 (illu.).

LITERATURE: Aurel Scheibler, Siegfried Gohr, Ernst Wilhelm Nay. Catalogue raisonné of oil paintings, vol. 1 (1922-1951), Cologne 1990, no. 456 (illu. in colors).

- -

Kunsthaus Lempertz, Cologne, 542nd auction, December 4, 1974, p. 99, lot 499 ( illu. in color on p. 65, plate III).

Karlheinz Gabler, Bericht über die Zeichnungen, in: exhib. cat. Nay. Zeichnungen, Jahrhunderthalle, Höchst 1976, pp. 8f.

Friedrich Weltzien, E. W. Nay. Figur und Körperbild. Kunst und Kunsttheorie der vierziger Jahre, Berlin 2003, p. 275.

Oil on canvas.

Signed and dated in the lower left. Signed, dated, titled and inscribed “XIX 9.” on the stretcher. Inscribed “495” by a hand other than that of the artist on the reverse. 59 x 71 cm (23.2 x 27.9 in). [CH].

• The catalogue raisonné mentions this work as the first in the series of the “Fugal Paintings”.

• With this colorful work and the subsequent work group, Nay achieved rhythmic balance between figuration and abstraction, order and movement.

• Formerly part of the collection of the Berlin gallerist Eberhard Seel, 1950-1972 managing director of the Deutscher Künstlerbund, collector and close friend of the artist.

• In 1952 the work was part of the early retrospective at Haus am Waldsee, Berlin.

• The same year he created a color lithograph and a gouache of the same subject, albeit in different colors.

• Early professional highlights: One year before and one year after this work was made, E. W. Nay participated in the Biennale di Venezia (1948 and 1950).

PROVENANCE: Eberhard Seel Collection (1900-1978), Berlin/Cologne (presumably directly from the artist).

Private collection, Cologne (acquired from the above, presumably in 1974, Lempertz, Cologne).

Galerie Orangerie-Reinz, Cologne (1995).

Private collection Hesse (acquired from the above, presumably in 1995).

Ever since family-owned.

EXHIBITION: E. W. Nay. Arbeiten der Jahre 1924-1952. Retrospektive, Haus am Waldsee, Berlin, May 17 - June 15, 1952, cat. no. 114 (illu.).

LITERATURE: Aurel Scheibler, Siegfried Gohr, Ernst Wilhelm Nay. Catalogue raisonné of oil paintings, vol. 1 (1922-1951), Cologne 1990, no. 456 (illu. in colors).

- -

Kunsthaus Lempertz, Cologne, 542nd auction, December 4, 1974, p. 99, lot 499 ( illu. in color on p. 65, plate III).

Karlheinz Gabler, Bericht über die Zeichnungen, in: exhib. cat. Nay. Zeichnungen, Jahrhunderthalle, Höchst 1976, pp. 8f.

Friedrich Weltzien, E. W. Nay. Figur und Körperbild. Kunst und Kunsttheorie der vierziger Jahre, Berlin 2003, p. 275.

109

Ernst Wilhelm Nay

Lampe, 1949.

Oil on canvas

Post auction sale: € 60,000 / $ 63,000

Buyer's premium, taxation and resale right compensation for Ernst Wilhelm Nay "Lampe"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 109

Lot 109