205

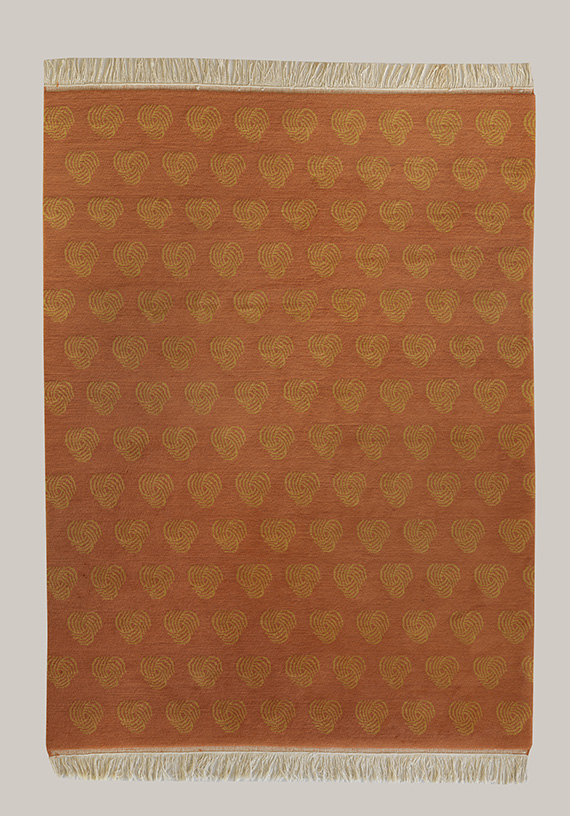

Rosemarie Trockel

Woolmark, 1991.

Carpet

Post auction sale: € 45,000 / $ 47,250

Woolmark. 1991.

Carpet.

Signed, numbered and inscribed “WOOL” on an accompanying piece of fabric. From an edition of 15 copies. 260 x 182 cm (102.3 x 71.6 in).

[AR].

• Woolmark, the repeated presentation of a commercial seal of quality.

• Rosemarie Trockel's use of wool is a commentary on the male-dominated art world: She uses the material with a traditional female connotation to create machine-produced art and not needlework.

• She made first wool works that would earn her international acclaim as early as in 1984.

• The Museum of Modern Art in New York devoted an exhibition to her as early as in 1988, while the museum's collection includes one of her “knitted pictures” from 1987.

• To this day, Trockel is one of the most important conceptual artists.

PROVENANCE: Private collection Baden-Württemberg.

Private collection Southern Germany.

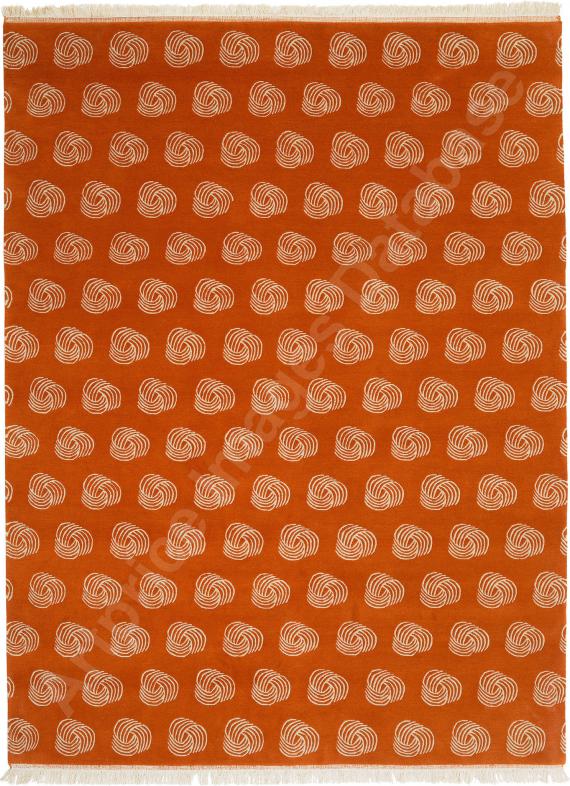

Carpet.

Signed, numbered and inscribed “WOOL” on an accompanying piece of fabric. From an edition of 15 copies. 260 x 182 cm (102.3 x 71.6 in).

[AR].

• Woolmark, the repeated presentation of a commercial seal of quality.

• Rosemarie Trockel's use of wool is a commentary on the male-dominated art world: She uses the material with a traditional female connotation to create machine-produced art and not needlework.

• She made first wool works that would earn her international acclaim as early as in 1984.

• The Museum of Modern Art in New York devoted an exhibition to her as early as in 1988, while the museum's collection includes one of her “knitted pictures” from 1987.

• To this day, Trockel is one of the most important conceptual artists.

PROVENANCE: Private collection Baden-Württemberg.

Private collection Southern Germany.

205

Rosemarie Trockel

Woolmark, 1991.

Carpet

Post auction sale: € 45,000 / $ 47,250

Buyer's premium, taxation and resale right compensation for Rosemarie Trockel "Woolmark"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 205

Lot 205