Frame image

401

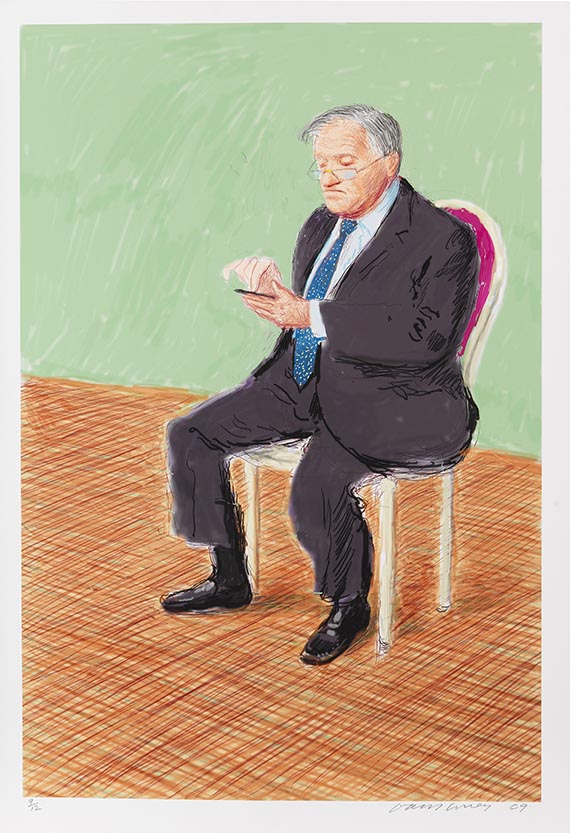

David Hockney

iPad Drawing 'Untitled, 329', 2010.

Inkjet print in color

Estimate:

€ 18,000 - 24,000

$ 19,800 - 26,400

iPad Drawing 'Untitled, 329'. 2010.

Inkjet print in color.

Signed and numbered, and with the artist's blindstamp. From an edition of 250 copies. On firm wove paper. 44 x 33 cm (17.3 x 12.9 in). Sheet: 55,8 x 43,2 cm (21,9 x 17 in).

Published by the artist in collaboration with Taschen, Berlin, as an addition to his publication “David Hockney. A Bigger Book”. [AR].

• David Hockney's art is experimental and oscillates between techniques, subjects, and media.

• From computer art to iPhone and iPad drawings: The artist has repeatedly demonstrated the relevance of his painting even at an old age.

• New media allows him to realize a pictorial idea quickly, and his works bear witness to a great immediacy with a seemingly artificial appearance.

• David Hockney is a co-founder of British Pop Art and rose to international fame with his pool pictures after relocating to the United States in the 1960s.

PROVENANCE: Privae collection, North Rhine-Westphalia.

Called up: December 7, 2024 - ca. 17.59 h +/- 20 min.

Inkjet print in color.

Signed and numbered, and with the artist's blindstamp. From an edition of 250 copies. On firm wove paper. 44 x 33 cm (17.3 x 12.9 in). Sheet: 55,8 x 43,2 cm (21,9 x 17 in).

Published by the artist in collaboration with Taschen, Berlin, as an addition to his publication “David Hockney. A Bigger Book”. [AR].

• David Hockney's art is experimental and oscillates between techniques, subjects, and media.

• From computer art to iPhone and iPad drawings: The artist has repeatedly demonstrated the relevance of his painting even at an old age.

• New media allows him to realize a pictorial idea quickly, and his works bear witness to a great immediacy with a seemingly artificial appearance.

• David Hockney is a co-founder of British Pop Art and rose to international fame with his pool pictures after relocating to the United States in the 1960s.

PROVENANCE: Privae collection, North Rhine-Westphalia.

Called up: December 7, 2024 - ca. 17.59 h +/- 20 min.

401

David Hockney

iPad Drawing 'Untitled, 329', 2010.

Inkjet print in color

Estimate:

€ 18,000 - 24,000

$ 19,800 - 26,400

Buyer's premium, taxation and resale right compensation for David Hockney "iPad Drawing 'Untitled, 329'"

This lot can be purchased subject to differential or regular taxation, artist‘s resale right compensation is due.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Differential taxation:

Hammer price up to 800,000 €: herefrom 32 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 27 % and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 22 % and is added to the premium of the share of the hammer price up to 4,000,000 €.

The buyer's premium contains VAT, however, it is not shown.

Regular taxation:

Hammer price up to 800,000 €: herefrom 27 % premium.

The share of the hammer price exceeding 800,000 € is subject to a premium of 21% and is added to the premium of the share of the hammer price up to 800,000 €.

The share of the hammer price exceeding 4,000,000 € is subject to a premium of 15% and is added to the premium of the share of the hammer price up to 4,000,000 €.

The statutory VAT of currently 19 % is levied to the sum of hammer price and premium. As an exception, the reduced VAT of 7 % is added for printed books.

We kindly ask you to notify us before invoicing if you wish to be subject to regular taxation.

Calculation of artist‘s resale right compensation:

For works by living artists, or by artists who died less than 70 years ago, a artist‘s resale right compensation is levied in accordance with Section 26 UrhG:

4 % of hammer price from 400.00 euros up to 50,000 euros,

another 3 % of the hammer price from 50,000.01 to 200,000 euros,

another 1 % for the part of the sales proceeds from 200,000.01 to 350,000 euros,

another 0.5 % for the part of the sale proceeds from 350,000.01 to 500,000 euros and

another 0.25 % of the hammer price over 500,000 euros.

The maximum total of the resale right fee is EUR 12,500.

The artist‘s resale right compensation is VAT-exempt.

Lot 401

Lot 401